Economists Are Worried Too: Exchange Rate Seen as Top Risk

- Input

- 2026-01-23 12:00:00

- Updated

- 2026-01-23 12:00:00

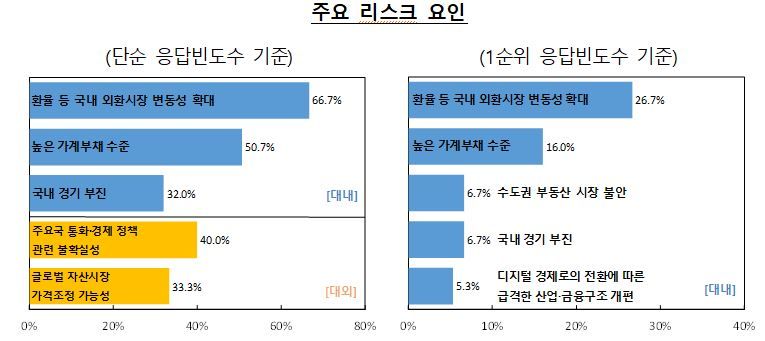

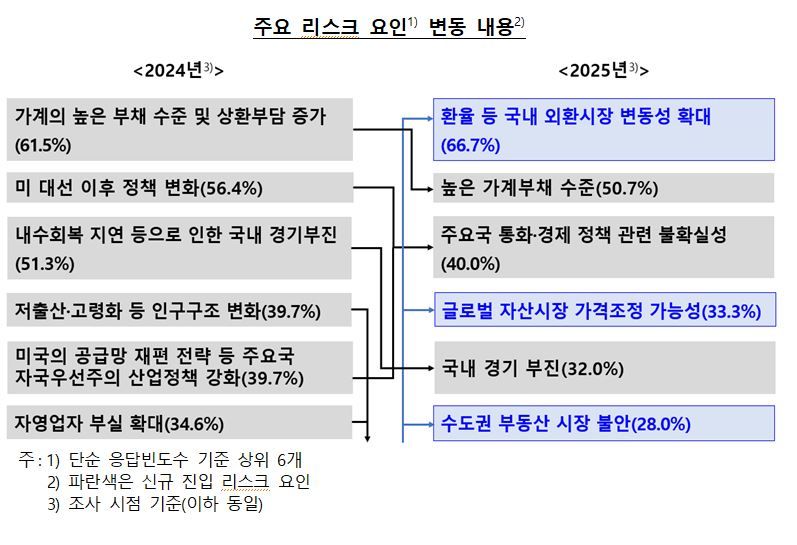

According to the Systemic Risk Survey conducted and released by the Bank of Korea (BOK) on the 23rd, respondents were asked to select five risk factors regardless of priority. When these responses were simply tallied, the most frequently cited domestic risk factor was the "widening volatility in the domestic foreign exchange market, including the exchange rate" at 66.7%.

This was followed by the "high level of household debt" at 50.7% and "domestic economic slowdown" at 32.0%. As for external risk factors, respondents pointed to "uncertainty over major countries’ monetary and economic policies" at 40.0% and the "possibility of price corrections in global asset markets" at 33.3%.

The survey was carried out in November and December last year among a total of 80 people, including employees of domestic and overseas financial institutions and leading economic experts. Of these, 75 submitted responses.

A separate tally was made of the risk factors that respondents chose as their number-one concern. Here too, the "widening volatility in the domestic foreign exchange market, including the exchange rate" ranked first at 26.7%. It was followed by the "high level of household debt" at 16.0%, "instability in the real estate market in the Seoul metropolitan area" at 6.7%, "domestic economic slowdown" at 6.7%, and the "rapid restructuring of industry and finance driven by the transition to a digital economy" at 5.3%.

The BOK also conducted a survey on when these risks are likely to materialize. Respondents judged that the "widening volatility in the domestic foreign exchange market, including the exchange rate," "uncertainty over major countries’ monetary and economic policies," and the "possibility of price corrections in global asset markets" are highly likely to surface in the short term, within one year.

By contrast, risks related to the "high level of household debt," "domestic economic slowdown," and "instability in the real estate market in the Seoul metropolitan area" were expected to be more likely to emerge in the medium term, within one to three years.

The factor expected to have the greatest impact on the financial system was the "high level of household debt." As risk factors with a high probability of occurrence, respondents pointed to the "widening volatility in the domestic foreign exchange market, including the exchange rate," "uncertainty over major countries’ monetary and economic policies," and the "possibility of price corrections in global asset markets."

The widening volatility in the domestic foreign exchange market, including the exchange rate, the possibility of price corrections in global asset markets, and instability in the real estate market in the Seoul metropolitan area all entered the list as newly identified risk factors in this survey.

However, confidence in the stability of South Korea’s financial system over the next three years has improved compared with the previous survey. The share of respondents who rated financial system stability as "very low" or "low" fell from 5.1% to 4.0%. In contrast, the proportion answering "very high" or "high" rose from 50.0% to 54.7%.

A BOK official said, "Respondents called for stronger risk management and enhanced policy credibility and predictability as ways to improve the stability of our financial system amid domestic and external uncertainty." The official added, "They also highlighted the need to stabilize and more closely monitor foreign exchange and asset markets, and for policymakers to communicate clearly and transparently."

taeil0808@fnnews.com Kim Tae-il Reporter