President Lee: "No consideration at all for extending tax break on capital gains for multiple-home owners"

- Input

- 2026-01-23 08:12:57

- Updated

- 2026-01-23 08:12:57

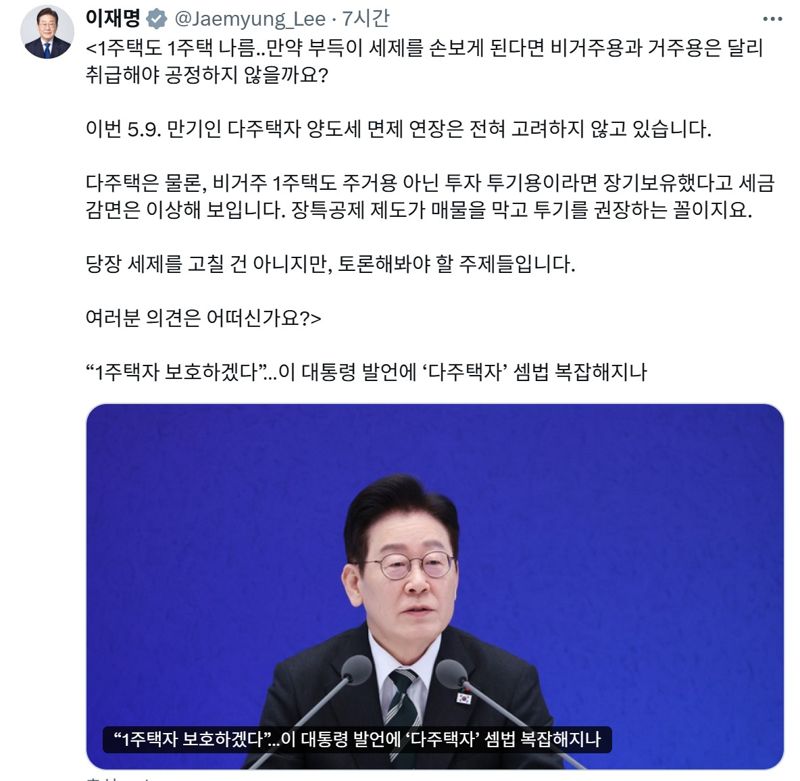

The Financial News reported that President Lee Jae-myung said on the 23rd, "We are not considering at all an extension of the temporary exemption from the additional capital gains tax on multiple-home owners, which expires on May 9."

Lee Jae-myung made this remark in relation to real estate policy through a social networking service (SNS) on the same day.

The measure was introduced under the previous administration to temporarily exempt multiple-home owners from the heavier portion of capital gains tax when selling residential properties, with the aim of revitalizing housing transactions. Some observers had focused on whether the government would extend it after it expires in May this year. Lee made it clear, however, that he will not grant another grace period and intends to end the measure.

Regarding the long-term holding special deduction (special deduction for long-term holding), the president also wrote, "Not only for multiple-home owners, but even for those with a single home, if the property is held for investment or speculative purposes rather than as a residence, it seems strange to reduce taxes just because it has been held for a long time." He added, "This measure effectively blocks properties from coming onto the market and ends up encouraging speculation."

He went on, "Even a single home is not all the same. If we are inevitably going to revise the tax system, wouldn't it be fair to treat non-residential properties differently from residential ones?" He emphasized, "We are not going to change the tax code immediately, but these are topics that deserve discussion."

Earlier, at a New Year's press conference on the 21st, Lee Jae-myung had also stressed the need to regulate multiple-home owners, while at the same time taking a cautious stance on overhauling real estate taxation.

At that time, when asked about the possibility of revising real estate taxes, he said, "If you ask whether taxes will be strengthened or not, the answer is that we may or may not do so." He added, "As much as possible, taxes are a tool for securing state finances, and it is not desirable to repurpose them as a means of regulation." However, he also noted, "If it becomes absolutely necessary, and if it is an effective tool in a situation where it is needed, there is no reason not to use it just because it is not ideal. I simply hope such a situation does not arise." In other words, while he does not plan to introduce stricter real estate tax measures immediately, he left open the possibility of using the tax system if conditions deteriorate and real estate becomes a serious social problem.

In particular, the president expressed a negative view of the fact that multiple-home owners also receive the special deduction for long-term holding on their capital gains. Single-home owners can receive a long-term holding special deduction of up to 80 percent of their capital gains, with 40 percent each based on the holding period and the period of residence. Multiple-home owners, when selling a property they have held for at least three years, receive a long-term holding special deduction of 2 percent per year, up to 30 percent over a maximum of 15 years. The same deduction rates apply even in designated adjustment areas until May 9, because the additional capital gains tax has been temporarily suspended there as well. Lee Jae-myung pointed out, "It seems a bit strange to reduce taxes just because someone has held undesirable investment or speculative real estate for a long time."

cjk@fnnews.com Reporter Choi Jong-geun Reporter