Housing price outlook index hits highest level in 4 years and 3 months, while consumer sentiment improves slightly

- Input

- 2026-01-23 06:00:00

- Updated

- 2026-01-23 06:00:00

[Financial News] Consumers' expectations that housing prices will rise have surged to their highest level in four years and three months.

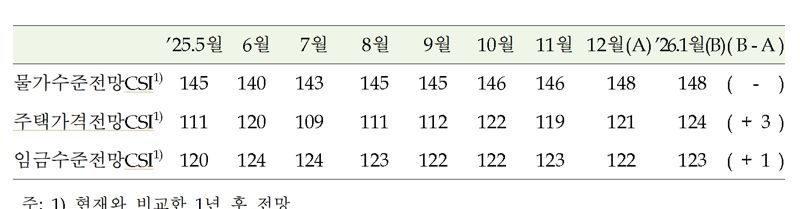

According to the "January 2026 Consumer Tendency Survey" released by the Bank of Korea (BOK) on the 23rd, the Housing Price Outlook Index stood at 124, up 3 points from the previous month. This is the highest reading since October 2021. The index is based on 100, and the more households that expect prices to rise rather than fall, the higher the index climbs.

An official at the Bank of Korea said, "The Housing Price Outlook Index is already at a fairly high level, and it rose further this month," adding, "After peaking at the end of 2020 and then trending downward, the index has turned upward again, which suggests expectations for higher housing prices have strengthened." The official added, "It is also considerably higher than the long-term average."

The Composite Consumer Sentiment Index (CCSI) came in at 110.8, up 1.0 point from the previous month. It rebounded just one month after a decline in December last year. A CCSI reading above 100 indicates that consumer sentiment is more optimistic than the long-term average for 2003–2025.

The Wage Level Outlook Index also rose 1 point from the previous month to 123, remaining at a high level.

By contrast, the Price Level Outlook Index was unchanged from the previous month at 148, indicating that perceived inflationary pressure remains heavy.

The Current Living Conditions Index rose 1 point to 96, while the Consumer Spending Outlook Index increased 1 point to 111. The Household Income Outlook Index and the Living Conditions Outlook Index were unchanged from the previous month at 103 and 100, respectively.

Perceptions of the overall economy showed mixed trends. The Current Economic Assessment Index climbed 1 point to 90, and the Future Economic Outlook Index rose 2 points to 98. However, the Employment Opportunity Outlook Index fell 1 point to 91.

The Interest Rate Outlook Index increased 2 points to 104, indicating a rise in responses expecting higher interest rates.

The expected inflation rate remained relatively stable. The one-year-ahead expected inflation rate was 2.6%, unchanged from the previous month. The three-year-ahead expected inflation rate edged down 0.1 percentage point to 2.5%.

imne@fnnews.com Hong Ye-ji Reporter