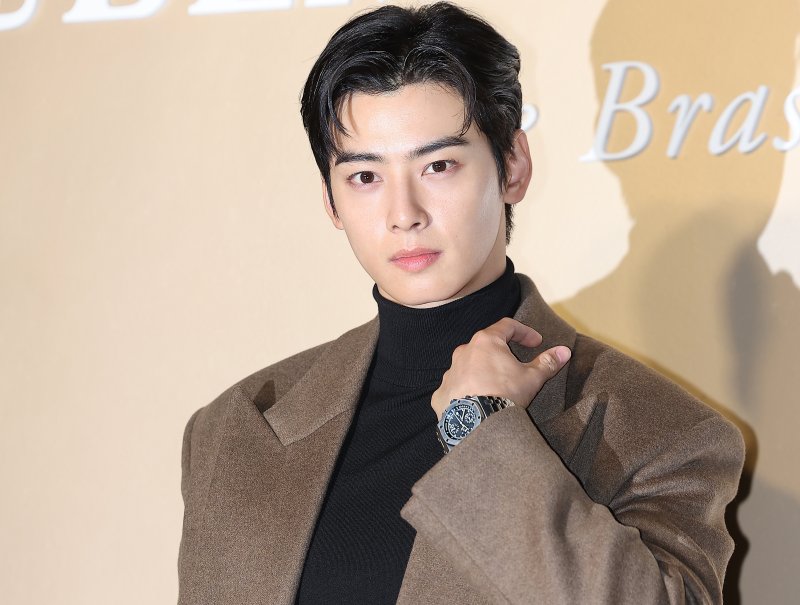

Cha Eun-woo faces allegations of 20 billion won tax evasion via mother’s company: "Nothing has been finalized, we will actively clarify"

- Input

- 2026-01-22 17:54:48

- Updated

- 2026-01-22 17:54:48

[Financial News] Cha Eun-woo, a singer and actor currently serving in the military, has become embroiled in allegations of tax evasion worth hundreds of billions of won, and his agency has announced it will actively clarify the matter.

On the 22nd, one media outlet reported that Cha Eun-woo had received a notice from the National Tax Service (NTS) for an additional income tax assessment exceeding 20 billion won. The core of the allegation is that Cha Eun-woo signed a management service contract with a company established by his mother and thereby benefited from the lower corporate tax rate instead of the higher personal income tax rate.

In Korea, income tax is progressive, so the tax rate rises as income increases. For income over 1 billion won, the rate is 45 percent, and when a 10 percent local income tax is added, the maximum effective rate reaches 49.5 percent. In contrast, the top corporate tax rate is lower than the income tax rate: for taxable income over 300 billion won, the rate is 24 percent, and including the 10 percent local income tax, the maximum effective rate is about 26.4 percent.

"Whether Cha Eun-woo’s mother’s company is subject to taxation is the key issue"

Responding to the report on the 22nd, Cha Eun-woo’s agency Fantagio stated, "The main point of contention in this case is whether the company established by Cha Eun-woo’s mother falls under the actual scope of tax liability." The agency added, "Nothing has been finally determined or officially notified at this stage, and we plan to actively present our case through the proper procedures regarding the issues of legal interpretation and application."

The agency continued, "The artist and his tax representative will fully cooperate so that the relevant procedures can be concluded as quickly as possible," adding, "As a citizen, Cha Eun-woo also promises to faithfully fulfill his legal obligations, including tax filings, going forward."

jashin@fnnews.com Shin Jin-ah Reporter