"Atlas backflips, the game has changed"... Hyundai Motor Company smashes through 500,000 won, target prices revised sharply higher

- Input

- 2026-01-23 06:00:00

- Updated

- 2026-01-23 06:00:00

[Financial News] Since Hyundai Motor Company unveiled its humanoid robot, the company has been re-evaluated as a physical artificial intelligence (AI) player, and its share price has already surged 78% this year alone. In response, securities firms are steadily raising their target prices, reflecting expectations for Hyundai Motor Company’s growth potential.

According to the Korea Exchange (KRX) on the 23rd, Hyundai Motor Company shares closed at 529,000 won the previous day, down 20,000 won, or 3.64%, from the prior session. During early trading, the stock touched 590,000 won, hitting an all-time high, but it reversed course as profit-taking orders poured in.

Hyundai Motor Company’s share price has jumped 78.41% so far this year. At the end of last year, the stock was trading around 296,500 won.

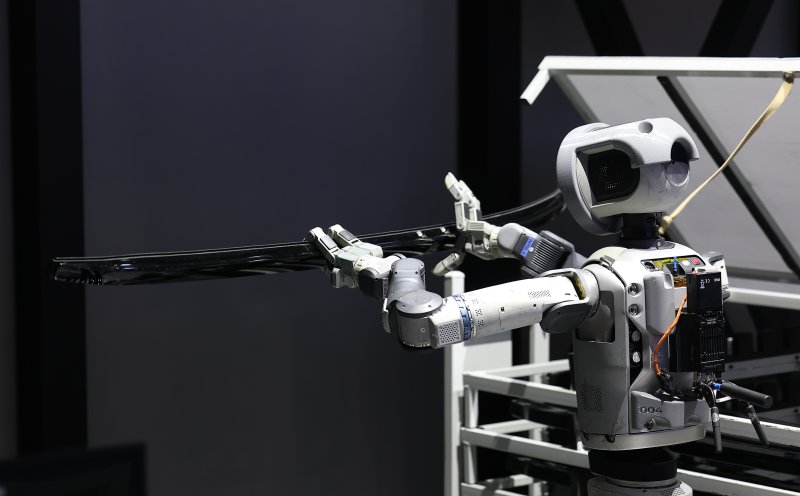

The humanoid robot unveiled at the world’s largest consumer electronics and IT trade show, Consumer Electronics Show 2026 (CES 2026), at the start of the year acted as the catalyst for the rally. As its subsidiary Boston Dynamics introduced the Atlas humanoid robot, Hyundai Motor Company is moving beyond a mobility company to establish itself as an AI-based robotics company.

Brokerages are also in a trend of raising their target prices. As of last month, the upper end of analysts’ target price range was 470,000 won, but as the stock price blew past that level, firms have been steadily revising their targets upward.

The current top-end target price is 850,000 won, suggested by Samsung Securities. On the 14th, Samsung Securities raised its target from 400,000 won to 650,000 won, and then revised it again just a week later.

Lim Eun-young, an analyst at Samsung Securities, stated, "We have raised our target price for the second time since CES," adding, "We have verified the training of Hyundai Motor Company’s humanoid robot AI model and confirmed its role in producing humanoid robots."

She continued, "This year marks the beginning of physical AI services, starting with the commercialization of robotaxis," and added, "As long as current earnings are not so shocking as to delay the build-out of the physical AI ecosystem, investors should not miss the visible growth trajectory and should stay with the story."

Recently, KB Securities also sharply raised its target price for Hyundai Motor Company from 310,000 won to 800,000 won.

Kang Seong-jin, an analyst at KB Securities, said, "Boston Dynamics is expected to become the decisive turning point for productivity innovation at Hyundai Motor Company," and predicted, "Going forward, Hyundai Motor Company could even enter the final stage of completing an autonomous driving foundry based on this productivity innovation."

He went on to stress, "In particular, considering the acquisition of a ‘brain’ through strategic collaboration with Google Gemini Robotics AI, the vast trove of factory data within Hyundai Motor Group, the management’s rapid decision-making structure, and its mass-production capabilities, only companies with such strengths in the physical AI market are Hyundai Motor Group and Tesla."

jisseo@fnnews.com Seo Min-ji Reporter