First 30 Trillion-Won Stock Tycoon Emerges in Korea: Lee Jae-yong’s Equity Wealth Jumps 2.5 Times in a Year

- Input

- 2026-01-22 08:12:09

- Updated

- 2026-01-22 08:12:09

[Financial News] As the Korea Composite Stock Price Index (KOSPI) nears the 5,000 mark, Samsung Electronics Chairman Lee Jae-yong’s stock holdings have surpassed 30 trillion won.

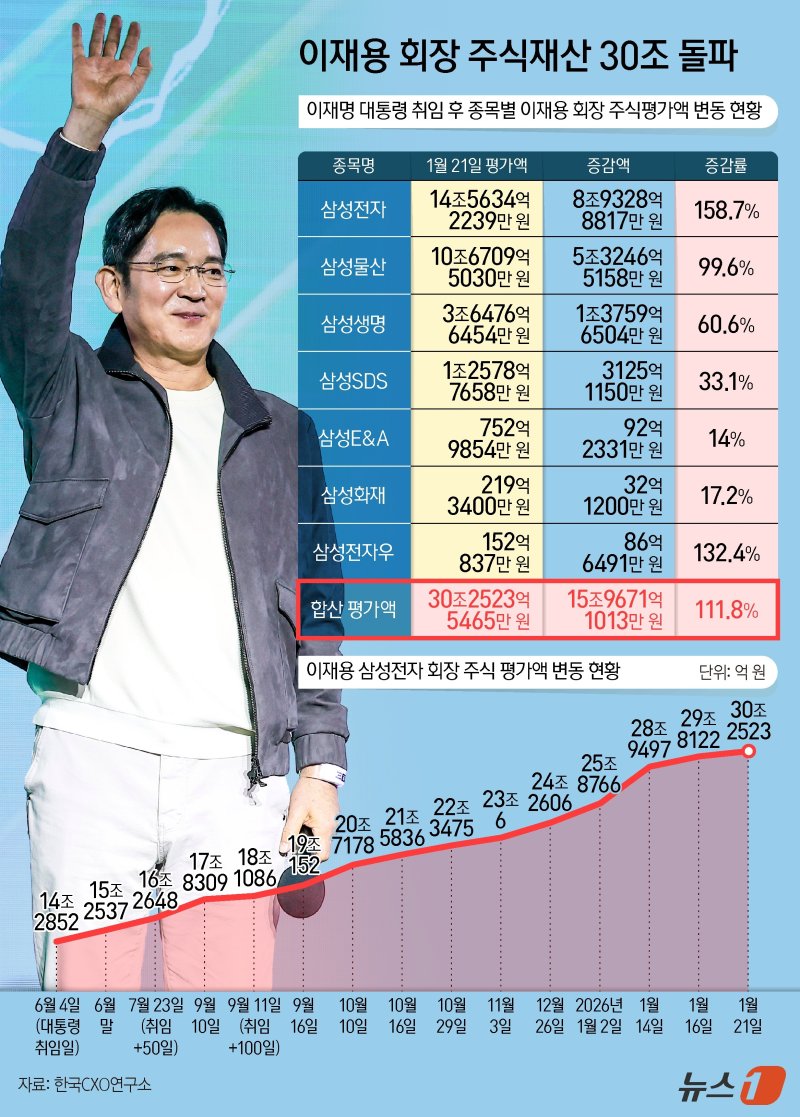

According to corporate analysis firm Korea CXO Institute on the 22nd, Lee’s equity holdings are now valued at 30.2523 trillion won.

This is more than 2.5 times higher than the 11.9099 trillion won recorded on January 2 last year, meaning his stock wealth has ballooned in roughly one year.

The Korea CXO Institute found that Lee Jae-yong currently holds shares in seven listed companies: Samsung Electronics, Samsung C&T, Samsung Life Insurance, Samsung SDS, Samsung E&A, Samsung Fire & Marine Insurance, and Samsung Electronics preferred shares.

Lee’s stock wealth first exceeded 20 trillion won on October 10 last year. Just three months later, it moved into the 30 trillion-won range. Compared with the more than four years it took for his holdings to reach 20 trillion won after inheritance, the pace of growth has accelerated sharply.

The main drivers were the share price rallies of Samsung Electronics and Samsung C&T. Samsung Electronics climbed from 57,800 won in early June last year to 149,500 won on the 21st of this month. As a result, the value of Lee’s stake in Samsung Electronics jumped from 5.6305 trillion won to 14.5634 trillion won.

Samsung C&T shares also rose over the same period, from 157,800 won to 299,000 won, pushing up the value of Lee’s holdings from 5.3462 trillion won to 10.6709 trillion won.

In addition, the fact that Hong Ra-hee, honorary director of the Leeum Museum of Art, gifted him 1,808,577 Samsung C&T shares in February this year also helped bring forward the point at which his equity wealth crossed 30 trillion won. As of the 21st of this month, the Samsung C&T shares donated by Hong were worth more than 500 billion won.

Beyond that, the valuation of his other holdings also rose across the board: Samsung Life Insurance by 60.6% (from 2.2716 trillion won on June 4, 2025 to 3.6476 trillion won on January 21, 2026), Samsung SDS by 33.1% (from 945.3 billion won to 1.2578 trillion won), Samsung E&A by 14% (from 66 billion won to 75.2 billion won), Samsung Fire & Marine Insurance by 17.2% (from 18.7 billion won to 21.9 billion won), and Samsung Electronics preferred shares by 132.4% (from 6.5 billion won to 15.2 billion won).

Oh Ilseon, head of the Korea CXO Institute, assessed, "Since the launch of the Lee Jae-myung administration, a range of institutional reforms have been pursued to enhance transparency and trust in companies and the stock market, and this has coincided with strong expectations for the AI and semiconductor industries, driving a steep rise in share prices in recent months."

He went on to say, "This year is a crucial time to prove those expectations through actual earnings. In particular, depending on first-quarter business results, this will be the turning point that determines whether the upward momentum in the share prices of market heavyweights, including Samsung Electronics, continues or shifts into a phase of moderation."

moon@fnnews.com Moon Young-jin Reporter