[U.S. Markets] Rebound Just a Day After a Sharp Sell-off... Swayed by Trump’s Moves

- Input

- 2026-01-22 06:34:21

- Updated

- 2026-01-22 06:34:21

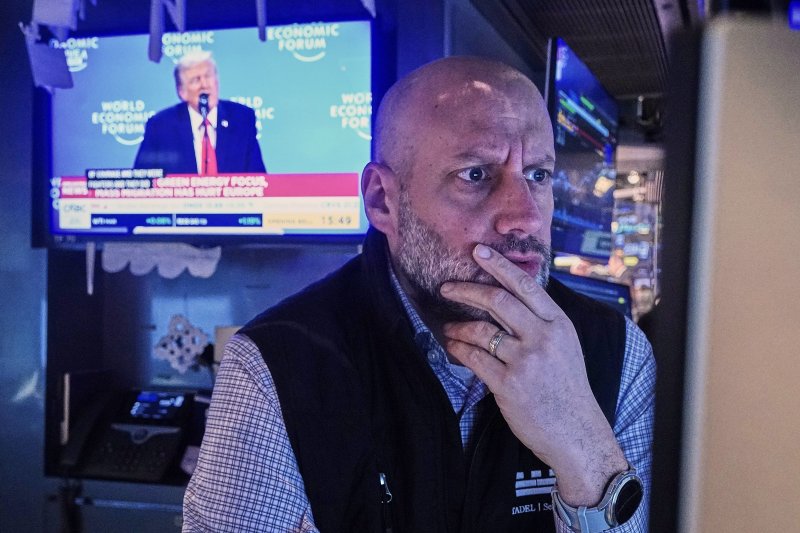

The New York stock market managed to rebound on the 21st (local time).

Donald Trump, the president of the United States, said he had reached an agreement with the North Atlantic Treaty Organization (NATO) and withdrew his plan to impose tariffs on European countries that had sent troops to Greenland, which became the main catalyst for the rally. In his WEF speech that day, President Donald Trump also added that he had no plans to subjugate Greenland by force.

Relief that Europe, NATO and the United States would not head toward an all-out confrontation encouraged investors to return to buying. Big tech stocks, which had been hit hard the previous day, posted strong gains this session.

Rebound in a Single Day... ‘Wall Street Fear Gauge’ Plunges

Major U.S. stock indices all rebounded.

The Dow Jones Industrial Average (DJIA), made up of 30 large blue chips, jumped 588.64 points, or 1.21%, to close at 49,077.23.

The Standard & Poor's (S&P) 500, which broadly reflects overall market conditions, rose 78.76 points (1.16%) to 6,875.62, while the tech-heavy Nasdaq Stock Market (Nasdaq) climbed 270.50 points (1.18%) to finish at 23,224.83.

The Russell 2000 Index, which tracks 2,000 small and mid-cap stocks, posted the biggest gain of the day and resumed its run of record highs. The Russell 2000 Index surged 52.81 points (2.00%) to close at 2,698.17.

The day’s moves once again confirmed that momentum in the New York stock market is shifting away from big tech toward value and small- and mid-cap stocks.

The Cboe Volatility Index (VIX), often called Wall Street’s “fear gauge,” plunged 3.19 points (15.88%) to 16.90. In just one day, it fell back below the psychologically important 20-point level.

Big Tech Rebound

Big tech stocks were generally strong. They shook off the sharp sell-off from the previous session in just one day.

Nvidia Corporation soared $5.25 (2.95%) to close at $183.32, while Alphabet Inc. jumped $6.22 (1.93%) to $328.38.

Tesla, Inc. climbed $12.19 (2.91%) to finish at $431.44, and Apple Inc. added $0.95 (0.39%) to end the day at $247.65.

However, Palantir Technologies slipped $3.20 (1.90%) to $165.33, and Microsoft Corporation (MS) tumbled $10.41 (2.29%) to $444.11.

Semiconductors Rally

With Nvidia Corporation rebounding, semiconductor stocks as a group showed solid strength.

Intel Corporation, which was set to release its quarterly earnings after the close, skyrocketed $5.69 (11.72%) to $54.25. A decision by Seaport Research Partners to upgrade its rating from neutral to buy and to set a price target of $65 also fueled the surge.

Investors were on edge over what Intel Corporation would say about yield rates for its 18 (1.8-nanometer) process in this earnings announcement.

Advanced Micro Devices (AMD) soared $17.88 (7.71%) to $249.80, and Micron Technology, Inc. jumped $24.11 (6.61%) to $389.11.

By contrast, Broadcom Inc. slipped $3.80 (1.14%) to close at $328.80.

dympna@fnnews.com Song Kyung-jae Reporter