"What used to cost 30,000 won is now 50,000; we can’t even afford U.S. beef" – prices go crazy under a strong dollar [Weekend Digging]

- Input

- 2026-01-24 06:00:00

- Updated

- 2026-01-24 06:00:00

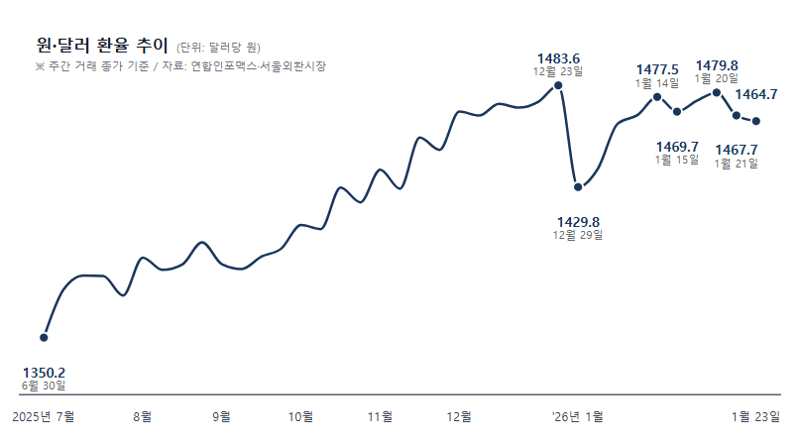

" There was a reason the exchange rate came up first. Since September last year, the strong-dollar, weak-won trend has persisted, fueling concerns that higher import prices and heavier burdens in servicing foreign debt would follow.

Anxiety has grown to the point that some are talking about a possible national default, warning of "a second IMF-style crisis" reminiscent of the 1997 IMF Crisis. Are these fears merely overblown? Experts say the current situation cannot be put on the same footing as 1997 and draw a line against excessive alarm.

Why the exchange rate falls, then climbs right back up The government has tried to defend the currency more than ten times over roughly three months, starting with verbal intervention last October, but the upward trend in the exchange rate has not been broken. At the end of December, the rate briefly plunged to the 1,420 won range after the government signaled a strong will to defend the won and it became known that the National Pension Service had begun hedging its foreign exchange exposure.

Just before the event began, the US Dollar–South Korean Won exchange rate broke through 1,480 won as soon as trading opened. It eased slightly to the high-1,460 won range only after Lee responded that, "according to the authorities, it is expected to fall to around 1,400 won in a month or two.

However, as overseas stock investment quickly picked up again and global uncertainties such as a weaker yen piled on, the rate returned to pre-intervention levels within about two weeks. The same thing happened when Scott Bessent, the United States of America’s Treasury Secretary, issued an unusually explicit message expressing concern about the weak Korean won.

Just before the event began, the US Dollar–South Korean Won exchange rate broke through 1,480 won as soon as trading opened. It eased slightly to the high-1,460 won range only after Lee responded that, "according to the authorities, it is expected to fall to around 1,400 won in a month or two.Just before the event began, the US Dollar–South Korean Won exchange rate broke through 1,480 won as soon as trading opened. It eased slightly to the high-1,460 won range only after Lee responded that, "according to the authorities, it is expected to fall to around 1,400 won in a month or two.

Right after Bessent’s remarks, the US Dollar–South Korean Won exchange rate dropped by more than 10 won into the 1,460 won range during trading, but the decline narrowed quickly, and the rate bounced back to the 1,470 won range the very next day. Experts say this shows the limits of market intervention when it runs up against entrenched expectations of a weaker won.

Jung Se-eun, a professor in the Department of Economics, Chungnam National University, noted, "Demand from domestic and foreign investors to buy dollars is intensifying upward pressure on the exchange rate, which in turn dilutes the short-term impact of government policy measures. " So what is driving the US Dollar–South Korean Won exchange rate higher? A report published last April by the Korea Development Institute (KDI), titled "The Impact of Recent Exchange Rate Fluctuations on Prices," explains that "the rise in the US Dollar–South Korean Won exchange rate can be divided into U.

S. dollar factors and domestic factors." According to the report, "Changes in the stance of U. S.monetary policy have altered the value of the dollar relative to other currencies," and, "unlike in the past, Korean individual and institutional investors are actively reallocating funds into overseas stocks and bonds. In particular, the sharp increase in U.

S. stock investment by domestic retail investors has boosted demand to sell won and buy dollars, " it explains.

Ordinary people feel the economy worsening by the day The strong-dollar environment is rapidly eroding how ordinary people feel about the economy. The photo shows U.S. beef on display at the meat section of a large supermarket in Seoul./News1 As the strong-dollar trend drags on, households’ perception of the economy is deteriorating quickly. Rising exchange rates are pushing up loan interest, overseas spending, and everyday living costs in succession, increasing the financial burden on households.

Just before the event began, the US Dollar–South Korean Won exchange rate broke through 1,480 won as soon as trading opened. It eased slightly to the high-1,460 won range only after Lee responded that, "according to the authorities, it is expected to fall to around 1,400 won in a month or two.

Loan rates have risen first. 50% per year for five consecutive meetings, lending rates at commercial banks have climbed rapidly.

Just before the event began, the US Dollar–South Korean Won exchange rate broke through 1,480 won as soon as trading opened. It eased slightly to the high-1,460 won range only after Lee responded that, "according to the authorities, it is expected to fall to around 1,400 won in a month or two.

4% from the previous month, marking a fourth straight month of increases since September. 9%, respectively.

Prices of items heavily dependent on imports rose even more steeply. BOK data show that, in won terms, the import price of coffee has nearly quadrupled compared with 2020.

In dollar terms, coffee prices are up about fourfold. Beef prices have climbed about 30% in dollar terms, but once the exchange rate is factored in, they are up roughly 60% in won terms, and even wheat, whose international price has fallen, has seen its import price in won rise 22%.In other words, the higher exchange rate is amplifying inflationary pressure. Demand for overseas travel has also weakened.According to the Tour. go Tourism Knowledge & Information System, the number of outbound travelers between July and September last year was 7,093,383, down 79,928 from the same period a year earlier.

This was the first time since Coronavirus disease 2019 (COVID-19) that the number, which had been increasing by hundreds of thousands, actually declined.Analysts attribute this to the higher costs of staying abroad, airfare, and accommodation caused by the stronger dollar.The cost of studying abroad is also ballooning.Tuition for one semester at a top-tier private university in the United States of America is around 20,000 dollars.95 million won.

4 million won.

5 million won to a single semester’s tuition, and on an annual basis, the extra burden approaches 3 million won.As the strong dollar squeezes every aspect of daily life, anxiety is mounting.On online communities and social media, some users are even voicing fears that "if the strong dollar continues, we might face a second IMF Crisis.

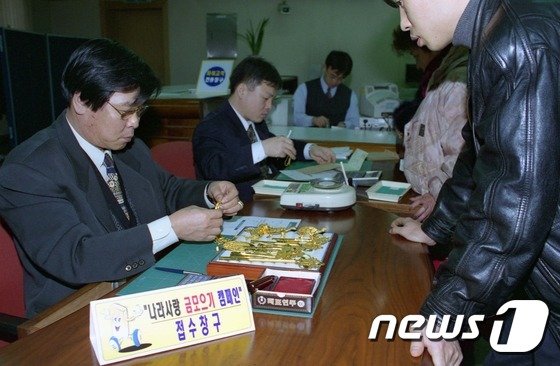

" Analysts say the national trauma from the 1997 IMF Crisis—when the exchange rate spiked and foreign currency ran short—is being reawakened.

Just before the event began, the US Dollar–South Korean Won exchange rate broke through 1,480 won as soon as trading opened. It eased slightly to the high-1,460 won range only after Lee responded that, "according to the authorities, it is expected to fall to around 1,400 won in a month or two.

"Talk of an IMF Crisis goes too far" The Bank of Korea has recently and officially dismissed speculation about a looming IMF Crisis linked to the rising US Dollar–South Korean Won exchange rate.

Just before the event began, the US Dollar–South Korean Won exchange rate broke through 1,480 won as soon as trading opened. It eased slightly to the high-1,460 won range only after Lee responded that, "according to the authorities, it is expected to fall to around 1,400 won in a month or two.

/News1 So, could the situation of the 1997 IMF Crisis really be replayed? The BOK has officially brushed aside talk of another IMF Crisis.Yoon Kyoungsoo, director general of the International Department of the Bank of Korea, wrote in a blog post on the 19th, "Fundamentally, foreign exchange and financial crises occur when a country’s external payment capacity weakens to the point that it becomes difficult to borrow dollar funds," and added, "Like Japan, our country is a net external creditor and holds ample foreign exchange reserves and large net external assets, so we are far from a typical crisis situation." Professor Donghyun Ahn of the Department of Economics, Seoul National University, likewise commented that "talk of an IMF Crisis goes too far," but also pointed out that "it is worrisome that the funds available in a crisis could prove insufficient.

" Professor Ahn added, "Our foreign exchange reserves currently stand at about 420 billion dollars, and viewed conservatively, 400 billion dollars is the minimum threshold.In reality, the amount of funds that can be mobilized immediately is around 20 billion dollars." He went on to predict that the exchange rate will fluctuate within a certain band before stabilizing.

"There will continue to be demand for dollars in the market, so the rate is likely to swing between the mid-1,400 won and low-1,500 won range for some time," he said."It may break into the 1,500 won range, but it will be hard for it to climb into the 1,600 won range.An automatic adjustment mechanism will kick in around the low-1,500 won level.

"

sms@fnnews.com Reporter Sung Min-seo Reporter