Dining wallets open only for 'Culinary Class Wars' chefs... Neighborhood eateries cling to survival with 'Dujjong-ku' cookies

- Input

- 2026-01-25 15:02:28

- Updated

- 2026-01-25 15:02:28

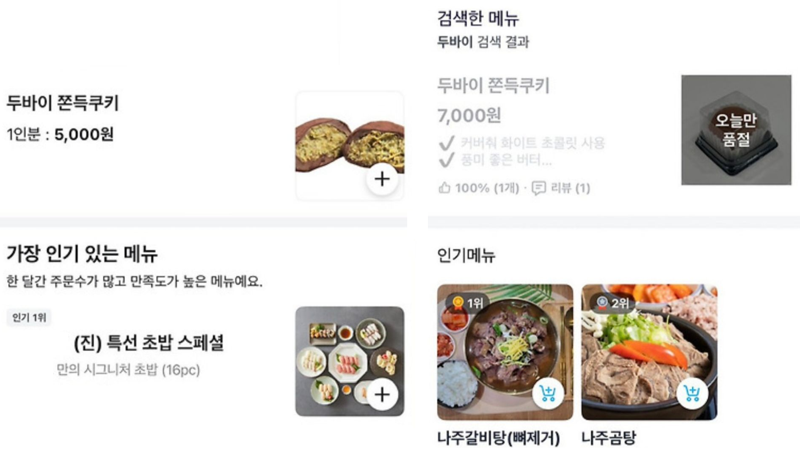

#. Recently, a restaurant owner A who runs a Japanese eatery in Seocho District, Seoul added a dessert section to one side of the menu. The new item is a "Dubai Chewy Cookie," which does not really go with sushi or rice bowls. In the midst of severe business difficulties, it is less about expecting a dramatic jump in sales and more a desperate attempt to draw in customers. A said, "This menu has nothing to do with my main business, but I bake cookies every morning with the mindset that I have to do something, anything, to survive."

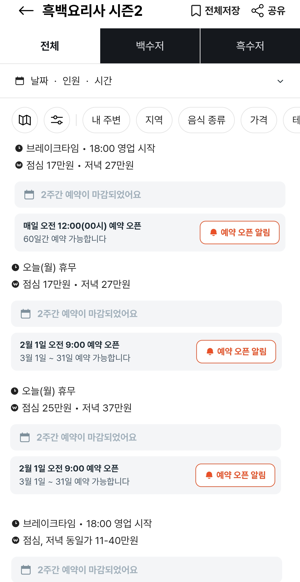

According to industry sources on the 25th, restaurants run by chefs who appear on the Netflix variety show "Culinary Class Wars 2" are already fully booked through next month. In reality, judge chef Sung Anh’s restaurant Mosu has no tables left until April, and Son Jong-won’s restaurants L'Amant Secret and Eatanic Garden are fully booked through February.

Overall indicators for the dining-out market tell a very different story. Data from the Food Service Statistics Inquiry System show that the number of dining-out payment transactions fell from 233.68 million in 2023 to 191.06 million in 2024, and further down to 184.99 million in 2025. Over the same period, dining-out sales shrank from 4.4462 trillion won to 4.2778 trillion won.

The scale of restaurant closures also remains high. According to the Korean Statistical Information Service (KOSIS), the number of food-service business closures rose from around 136,000 in 2022 to about 158,000 in 2023, and again exceeded 150,000 in 2024.

As the downturn drags on, restaurants are adopting trendy items as part of their operating strategy. With the "Dubai Chewy Cookie" (Dujjong-ku) spreading mainly through social networking services (SNS), more cafes and dessert shops—as well as places like soup-and-rice joints and sushi restaurants—are starting to make and sell it themselves.

According to food-delivery app Baedal Minjok, the number of takeout orders related to Dujjong-ku jumped 311% in January 2026 compared with November 2025. Observers point to the fact that it can be produced in small quantities without dedicated equipment and carries relatively low inventory risk as key reasons for its rapid spread.

Some establishments only allow customers to buy Dujjong-ku when they also order a meal, or they sell it exclusively as part of a set. Critics have labeled this practice "hostage selling," but owners counter that it is a way to attract new customers and prevent a drop in average spending per person.

Jeong Seeun, a professor of economics at Chungnam National University (CNU), noted, "In a recession, people do not necessarily stop spending altogether, but they tend to maintain only the types of consumption they perceive as having a low risk of failure," and went on, "Restaurants promoted through TV shows or on SNS are seen as relatively safe choices, which is intensifying the concentration of demand even within the dining-out market."

Analysts also say that changing consumer perceptions are reinforcing this trend. Professor Hwang Jin-joo of the Department of Consumer Science at Inha University said, "Recently, the meaning of food consumption has shifted from nutrition to experience," and added, "As people share their experiences on social media and seek a sense of belonging within their peer groups, attention keeps circling back to particular menus or content."

425_sama@fnnews.com Choi Seung-han Reporter