U.S. ‘Clarity Act’ Controversy Spreads to Tighter RWA Regulation [Crypto Briefing]

- Input

- 2026-01-19 14:14:32

- Updated

- 2026-01-19 14:14:32

\r\n

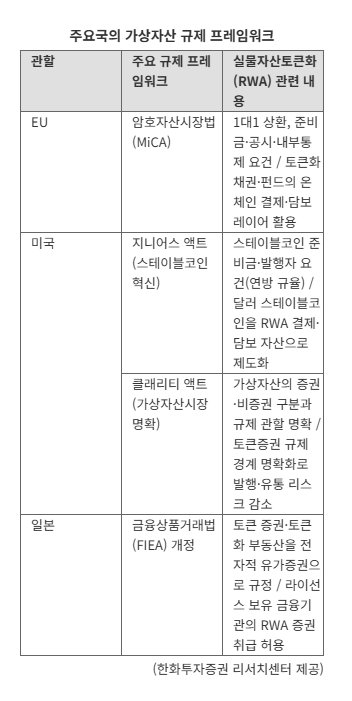

[The Financial News] The legislative timetable for the “Digital Asset Market Structure Bill,” also known as the “Digital Asset Market Clarity Act of 2025,” being pursued by the United States Congress, has hit a snag. As disagreements have widened between the White House and cryptocurrency exchange Coinbase over the permissible scope of “stablecoin interest income,” it has become increasingly likely that the United States Senate will delay its scheduled review of the bill this month. The dispute is rapidly escalating into a proxy battle between traditional financial institutions such as banks and the crypto industry over leadership in the Real-World Asset (RWA) tokenization space.

According to foreign media and the virtual asset industry on the 19th, the United States Senate Committee on Banking, Housing, and Urban Affairs is now expected to postpone the markup session it had planned this month for the Digital Asset Market Clarity Act of 2025. The core issue is whether stablecoin issuers may distribute to users the interest income generated from reserve assets such as government bonds.

Coinbase CEO Brian Armstrong has publicly withdrawn his support for the draft bill in the United States Senate. This is because the revised text would, in principle, restrict the payment of interest and similar returns to stablecoin holders.

Traditional financial institutions, by contrast, are taking a hard line. They are increasingly concerned about systems that operate outside the banking regulatory perimeter while performing bank-like functions and paying out returns. The move is widely seen as an attempt to raise regulatory barriers against stablecoins that encroach on banks’ core “interest margin” model—the spread between deposit and lending rates.

Hong Sung-uk, a researcher at NH Investment & Securities, said, “Coinbase’s pushback is a matter of survival for future stablecoin business models,” adding, “At the same time, it shows that a single company like Coinbase has become such a key player that it can influence the legislative timetable.” However, some in the industry note that Coinbase’s opposition may be part of the negotiation process, and they still see a possibility that the bill will be passed within the first half of the year, before the U.S. midterm elections.

The industry’s concern is that the latest revisions could dampen not only stablecoins but the broader markets for real-world asset tokenization (RWA) and decentralized finance (DeFi). The amended Digital Asset Market Clarity Act of 2025 would bring the issuance and distribution of tokenized securities (such as stocks, bonds, and funds) under the existing securities law framework, and require that claims on underlying real-world assets and legal ownership be recorded in separate off-chain ledgers rather than on the blockchain. As a result, critics argue, the regulation would effectively strip tokenization of its real benefits, such as 24/7 global trading on public, on-chain networks and on-chain transfers of ownership.

In addition, provisions granting broad authority to the United States Securities and Exchange Commission (SEC) to classify tokens are cited as the biggest risk for the RWA market. A crypto industry official said, “If all RWAs are brought under the traditional SEC-centered securities law regime, the advantages of blockchain—24/7 trading and disintermediated distribution—will no longer be possible,” arguing, “This bill is not about clarity; it is an all-encompassing regulatory approach that will shrink the market.”

The delay in U.S. legislation is also expected to affect the policy timetable of South Korea’s financial authorities. This is because the Financial Services Commission (FSC) and the Financial Supervisory Service (FSS) are likely to reference the U.S. regulatory framework when designing guidelines for tokenized securities (STO) and other RWAs.

In particular, if the United States firmly adopts a “securities regulation first” stance on RWAs, industry observers believe South Korea is also likely to shift in a more conservative direction by tightening restrictions on over-the-counter trading of tokenized securities. This, they warn, could become a factor constraining liquidity in the domestic tokenized securities market, which is set to fully take off early next year.

A representative from Xangle Research said, “As CEO Brian Armstrong withdrew his support for the Digital Asset Market Clarity Act of 2025, citing reasons such as restrictions on tokenized stocks, privacy concerns stemming from expanded DeFi access requirements, and the potential reduction of stablecoin rewards, the case for delaying the markup has gained momentum,” adding, “Given that consensus is still lacking on provisions related to ethics and conflicts of interest, the ongoing debate is likely to become a watershed moment for the direction of crypto regulation.”

elikim@fnnews.com Kim Mi-hee Reporter