Timeline for glass substrates is speeding up... SK targets this year as Samsung and LG also race ahead

- Input

- 2026-01-18 14:00:14

- Updated

- 2026-01-18 14:00:14

According to Financial News, SK Group, Samsung Group and LG Corporation are accelerating efforts to secure technology and talent for the commercialization of glass substrates, which are regarded as a key technology for next-generation semiconductor packaging. Among them, SK Group has set its commercialization target for this year, drawing attention to its potential to preempt the market.

According to industry sources on the 18th, SKC, an SK Group affiliate, strengthened its glass substrate business last month by appointing Kang Ji-ho, a vice president at SK hynix, as CEO of its semiconductor substrate subsidiary Absolics. SK Group Chairman Chey Tae-won even visited the company’s plant in the U.S. state of Georgia to personally review development progress, underscoring that the group views the glass substrate business as a future growth engine. Absolics is currently producing glass substrate prototypes with the goal of commercialization this year and is said to have launched qualification programs for major customers, including global big tech firms such as Advanced Micro Devices (AMD).

In its third-quarter earnings announcement last year, SKC stated, “At our plant in the U.S. state of Georgia, we produced mass-production samples of semiconductor glass substrates this quarter and have begun customer qualification procedures,” adding, “We have confirmed very positive simulation evaluation results and, in consultation with customers, are working toward a commercialization target of 2026.”

Samsung Electro-Mechanics and LG Innotek Co., Ltd. are also accelerating efforts to advance their technologies.

Samsung Electro-Mechanics is pushing to establish a joint venture within the year with Sumitomo Chemical Group of Japan to produce glass cores, a key material for glass substrates. The company has already built a pilot line at its Sejong Plant and begun prototype production, and it is reported to have supplied samples to customers last year for validation.

LG Innotek Co., Ltd. has likewise built a pilot glass substrate production line at the LG Innotek Gumi factory and is jointly developing prototypes with global big tech companies. Recently, the company signed a research and development collaboration agreement with UTI, a specialist in precision glass processing, to improve the strength of glass substrates.

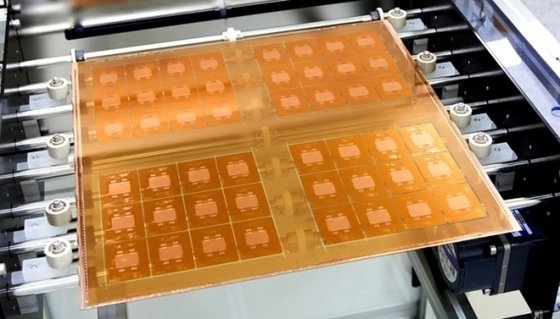

Glass substrates replace conventional plastic semiconductor package substrates with glass material. They are thin and have smooth surfaces, which helps minimize circuit distortion. Because they can improve data processing speed, power efficiency and heat dissipation, they are drawing attention as an alternative that can ease bottlenecks in artificial intelligence (AI) semiconductors. However, glass is inherently prone to cracking and breaking, and the process requires drilling thousands of microscopic holes and connecting circuits through them, making the manufacturing process highly challenging and a key hurdle to overcome.

Jonghwan Lee, Professor of System Semiconductor Engineering at Sangmyung University, explained, “The main reason glass substrates are attracting attention is that they can potentially offer far superior heat dissipation performance compared with existing organic substrates,” adding, “I view it as a technically feasible solution beyond the current technological hurdles, and the success or failure of commercialization will ultimately depend on achieving sufficient yield.”

Within the industry, there are also concerns about the level of completeness of the initial commercial products.

An industry insider said, “Even if glass substrates are introduced in the near term, the first-generation products will be close to a beta test, so their level of completeness may be somewhat lacking,” but added, “That alone does not mean commercialization is far off, and products incorporating glass substrates could begin to appear in earnest around 2027 to 2028.”

Not only domestic companies but also overseas players such as Intel Corporation, Taiwan Semiconductor Manufacturing Company (TSMC) and Rapidus Corporation have entered the glass substrate business. However, most companies are targeting mass production between 2027 and 2030, leading to the assessment that the company that first succeeds in commercialization is highly likely to seize control of the future glass substrate supply chain and packaging ecosystem.

solidkjy@fnnews.com Gu Ja-yoon, Jung Won-il Reporter