Only Certain Areas Saw Increases... Gangnam Home Prices Jumped While Outskirts Fell

- Input

- 2026-01-15 14:00:00

- Updated

- 2026-01-15 14:00:00

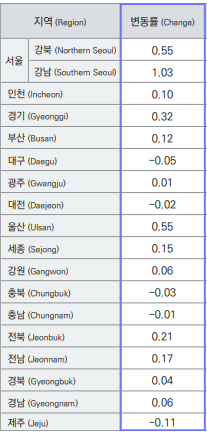

■Price increases centered on redevelopment zonesAccording to the Korea Real Estate Board (KREB) on the 15th, the areas that ranked at the top for home price increases in Seoul Metropolitan City were the so-called Han River Belt and the Gangnam 3 Districts.

In particular, Yongsan District (up 1.45%), Dongjak District in southwestern Seoul (up 1.38%), and Seongdong District (up 1.27%) each posted gains of more than 1%. These figures are four to five times higher than the nationwide increase of 0.26%.

Even compared with the Gangbuk average of 0.55%, the rise in the home sale price index in these three districts is markedly higher—more than double on a simple comparison. Within the Gangnam 3 Districts, Songpa District, which recorded a 1.72% increase, stood out. It climbed 0.69 percentage points more than Gangnam area in southern Seoul as a whole (up 1.03%), which already had the highest growth rate among all regions nationwide.

What these areas have in common is redevelopment. Yongsan District includes five redevelopment zones centered on Hannam-dong. In the case of the Hannam District 1 through Hannam Redevelopment District 5 in Yongsan-gu, Seoul projects, the construction cost for Hannam District 3 Redevelopment Zone alone, which is progressing the fastest, is well over 2 trillion won, making it a mega-project.

In Seongdong District, the Seongsu Strategic Redevelopment Zone project is in full swing. Divided into Seongsu District 1 through Seongsu District 4, the area will become a large-scale residential complex with more than 8,000 households once completed. Even the smallest of these, Seongsu District 4, is estimated to have construction costs of about 1.4 trillion won. In Dongjak District, redevelopment and maintenance zone designations centered on Sadang-dong are also gaining momentum.

Home prices in Bundang District of Seongnam City in Gyeonggi Province, where a wave of redevelopment is building through the designation of leading districts and similar measures, are also quietly trending upward. During this period, the home sale price index there rose 1.66%, more than five times the Gyeonggi Province average of 0.32%. A real estate industry official explained, “Seoul Metropolitan City is highly sought after, but within it, demand is even stronger in redevelopment zones from buyers hoping to secure association member status,” adding, “Even villas, which are generally considered less valuable than apartments, are changing hands at high prices.”

■Housing prices show negative growth in five provincial regionsBy contrast, it is not difficult to find areas in the provinces where housing prices are shrinking. Among regions nationwide, home prices in Daegu Metropolitan City, Daejeon Metropolitan City, North Chungcheong Province (Chungbuk), South Chungcheong Province, and Jeju Special Self-Governing Province declined compared with the previous month. That is five out of the 17 major regional jurisdictions.

In Daegu Metropolitan City, home prices fell month-on-month in Seo District and Dalseo District, while in Daejeon Metropolitan City, they declined in Seo District and Jung District, Daejeon. In Chungbuk, Eumseong County and Seowon District, Cheongju recorded drops, and in South Chungcheong Province, Asan-si and Dongnam District, Cheonan saw declines. On Jeju Island, prices fell mainly in Donghong-dong and Seongsan-eup in Seogwipo City, and in Ildo 2(i)-dong and Ido 2(i)-dong in Jeju City, where unsold new homes have been piling up. Ulsan Metropolitan City and Busan Metropolitan City, by contrast, held up relatively well, rising 0.55% and 0.12%, respectively, helped by the impact of new apartment complexes entering the market.

Common factors in areas where housing prices are falling include oversupply and a rise in unsold units, population decline, and the concentration of housing demand in the Greater Seoul area. The problem is that the polarization between Seoul Metropolitan City and the provinces is likely to persist. This is why calls continue for real estate policies that treat Seoul Metropolitan City and the rest of the country as separate markets and differentiate policy responses accordingly. A real estate industry official noted, “Even for a single home, apartment prices in Seoul Metropolitan City are far higher than in the provinces,” and predicted, “As long as the concentration of demand in the Greater Seoul area is not resolved, only certain areas will continue to see prices rise.”

Meanwhile, due to rising home prices and a decline in transaction volumes, the nationwide jeonse price index rose across the board except in Jeju Special Self-Governing Province. Sejong Special Self-Governing City, where jeonse supply is tight, saw an increase of 1.34%, followed by Gangnam at 0.68%. As jeonse supply has shrunk, the monthly rent price index has also risen in all regions except Jeju Special Self-Governing Province. For apartments, the home sale price index and jeonse price index increased mainly for units larger than 85 square meters and up to 102 square meters, while monthly rents rose mainly for units larger than 40 square meters and up to 60 square meters.

kjh0109@fnnews.com Kwon Jun-ho Reporter