[Editorial] Foreign Investment Screening Is Too Lax, Becoming a Channel for Technology Leaks

- Input

- 2026-01-14 18:57:00

- Updated

- 2026-01-14 18:57:00

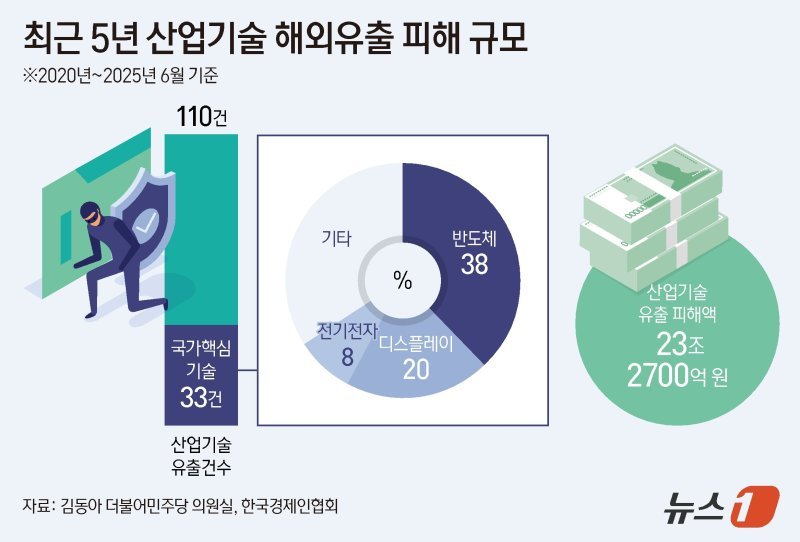

The leakage of advanced technologies is not only a direct blow to corporate survival but also an act of betrayal against the nation that threatens national security. Those responsible must be held fully accountable, both criminally and civilly, and punished to the fullest extent of the law. The scope of punishment should be broadly expanded to cover not only advanced technologies but also general industrial technology leaks. At the same time, it is urgent to overhaul systems that can prevent technology leaks in advance. The report recommends that strengthening FDI-related national security screening be actively considered from this perspective. This is an issue the government, which must put in place watertight safeguards against technology leaks, should examine from multiple angles.

The channels for technology leaks are becoming increasingly sophisticated. In the past, technology theft mainly took the form of poaching personnel, but it has now evolved into exploiting loopholes in investment structures, such as setting up a joint venture (JV), making minority equity investments, or establishing overseas research and development centers (R&D Centers). For example, a Chinese automobile company claimed it was entering the battery business, set up a local entity in Korea, and then used it as a conduit to siphon off technology before being caught. Similar cases are far from rare. The annual R&D spending of Korea’s top 1,000 companies exceeds 80 trillion won, supported in part by FDI. The concern is that strategic technologies are being developed through large-scale foreign investment and that a significant portion of these technologies could be leaked abroad, which calls for a thorough response.

Korea needs to pay close attention to the trend in major countries of placing greater emphasis on economic security in foreign investment screening. A prime example is the United States, which enacted the Foreign Investment Risk Review Modernization Act of 2018 (FIRRMA). In the United States, even the acquisition of minority stakes in companies handling core technologies and other sensitive information, as well as the purchase of real estate near military or critical infrastructure facilities, falls under the review of the Committee on Foreign Investment in the United States (CFIUS). Since last year, Japan has also been imposing separate regulations by designating investors engaged in malicious cyber activities or likely to engage in roundabout investments via third countries as specific foreign investors. It is reported that Korea is considering introducing a similar body modeled on the U.S. CFIUS.

It is time to re-examine our overly lax foreign investment screening regime. The categories exempt from screening also need a sweeping overhaul. These include cases where foreign ownership exceeds 50 percent or where a new plant is built through greenfield investment. As FKI suggests, it is necessary to expand the scope of screening to cover areas directly tied to national economic security—such as data, critical infrastructure, supply chains, and minerals—and to adjust the equity thresholds for screening to more realistic levels. It is true that FDI has served as a catalyst for invigorating private-sector companies. We must preserve its positive functions while rigorously preventing its abuse as a tool for technology leaks.