[Editorial] Mounting compound risks from exchange rates, oil prices and inflation call for preemptive action

- Input

- 2026-01-14 18:56:43

- Updated

- 2026-01-14 18:56:43

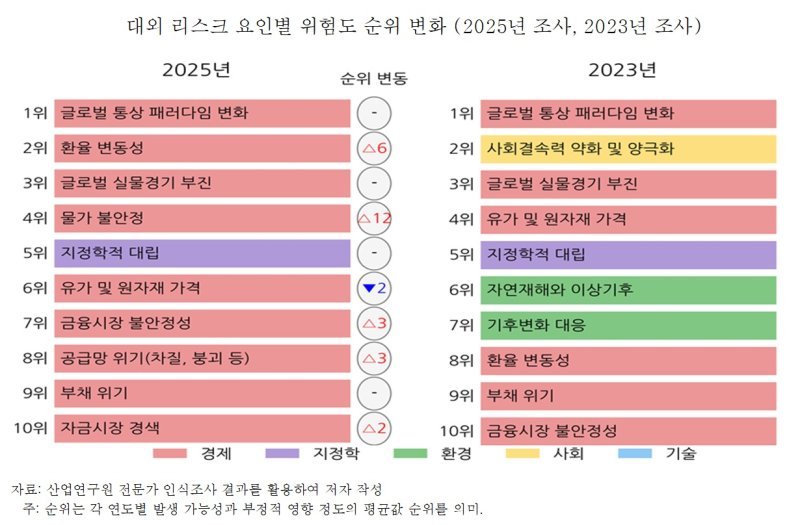

External economic risks are worrisome because they can deal a direct blow to the real economy. Stock prices may be hitting record highs day after day, but without support from the real economy, the stock market cannot maintain stability. If the real economy is hit by external risks, the stock market will not be able to avoid the shock either.

Exchange-rate volatility, which has emerged as the biggest source of instability for the domestic economy since the second half of last year, is a prime example. The government has taken drastic measures to keep the won–dollar exchange rate from exceeding 1,500 won, but it is proving difficult to defend this red line.

This is because the exchange rate is heavily influenced by factors beyond the government’s control, such as U.S. monetary policy, China’s economic conditions and global capital flows.

Oil prices are not showing a sharp spike at the moment, but they could swing sharply at any time. They are heavily affected by a complex set of variables that have been changing rapidly, including the situation in the Middle East, production decisions by the Organization of the Petroleum Exporting Countries (OPEC), and major countries’ energy-transition policies.

External variables such as exchange rates and oil prices impose direct cost burdens on our economy and deal a direct blow to corporate profitability and household purchasing power.

Inflation is currently being held around the stable 2% range, but whenever the global trade environment changes abruptly, there is a high risk that it could easily get out of control. Geopolitical crises trigger supply-chain disruptions, which in turn deliver cascading shocks to prices and production in each country.

What stands out in this report in particular is that the assessment of policy responses is very weak. In other words, when information infrastructure and networks fail or exchange-rate volatility increases, the ability of policy to cushion shocks is poor. In general, domestic risks can be sufficiently overcome if the government or companies respond properly on their own.

However, external risks go beyond the control of national governments and companies. Such compound risks, which lie outside the control of domestic governments or firms, are now emerging simultaneously on multiple fronts. One crisis can trigger another, and the channels through which shocks spread have become harder to predict. This means that new challenges have increased to a level that is difficult to manage with traditional policy-response approaches.

Ultimately, to overcome the economy’s compound risks, the way we respond must also change. Companies need to strengthen their own risk-management capabilities, and the government must build support systems that back them up. The government’s approach to external compound risks must also be different. If each ministry pursues performance-driven policies in isolation, external risks cannot be overcome. In an era when the economy and security are closely intertwined, a whole-of-government integrated response is essential. The government must find ways to maximize the synergy of the information and capabilities held by each ministry.

While upgrading growth to a more advanced level is the core of policy, it is equally important to respond wisely to external risks and minimize losses. At a time when self-centered nationalism is gaining ground and geopolitical risks are rising, the Korean economy must fasten its seat belt and navigate global risks with prudence and wisdom.