Export and Import Prices Rise for Six Consecutive Months...“Excluding Exchange Rate Effects, They Actually Fell”

- Input

- 2026-01-14 06:00:00

- Updated

- 2026-01-14 06:00:00

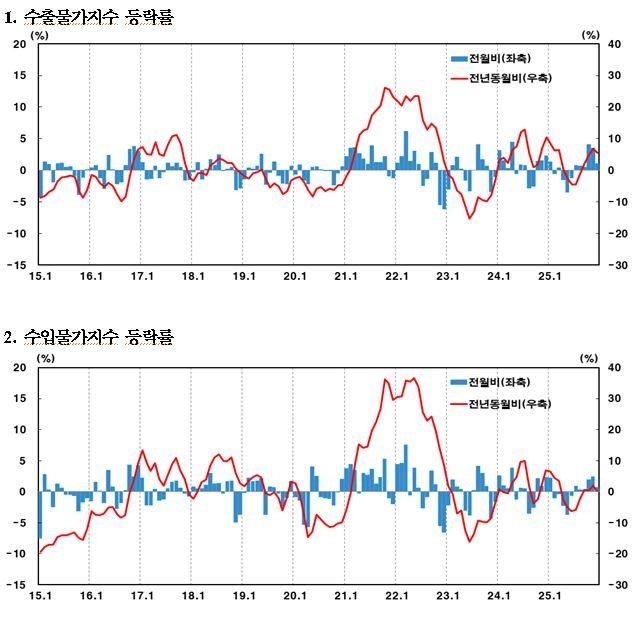

According to the ‘Export and Import Price Index and Trade Index for December 2025’ released by the Bank of Korea (BOK) on the 14th, the export price index in won terms for December last year rose 1.1% from the previous month. This marked six straight months of increases, following July (0.8%), August (0.6%), September (0.5%), October (4.1%), and November (3.5%) of the same year.

Year-on-year, the index climbed 5.5%. The figure for the previous month was 6.8%.

Prices of agricultural, forestry and marine products fell 0.4% from the previous month, while manufactured goods rose 1.1% over the same period. Among manufactured goods, the increase was particularly pronounced in computers, electronic and optical equipment (2.7%), which include semiconductors, and in basic metal products (5.3%).

In contract currency terms, export prices in December rose only 0.4% month-on-month. Year-on-year, they were up 2.7%. This indicates that the contribution of the exchange rate to the rise in the price index was substantial.

Regarding the price level after January this year, Moon-hee Lee, head of the Price Statistics Team at Economic Statistics Department 1 of the BOK, explained, “Since the beginning of the year, the US Dollar–South Korean Won exchange rate and the price of Dubai Crude Oil have fallen compared with their monthly averages,” but added, “However, given the high level of uncertainty in domestic and external conditions, we need to continue to monitor developments.”

For 2025 as a whole, export prices rose 2.3% year-on-year, but in contract currency terms they actually fell 2.1%.

Supported by the upward trend in the exchange rate, the import price index last month also rose 0.7% from the previous month, extending its gains for the sixth consecutive month. This is the longest such streak since the six-month rise from May to October 2021. Year-on-year, the index was up 0.3%.

Although the international price of Dubai Crude Oil fell from 64.47 dollars per barrel in November to 62.05 dollars in December, the increase in the exchange rate more than offset this decline.

For raw materials, crude oil prices fell but liquefied natural gas (LNG) prices rose, pushing up prices of mining products and resulting in a 0.1% month-on-month increase. Intermediate goods rose 1.0%, driven by higher prices of basic metal products (3.8%). Capital goods and consumer goods climbed 0.7% and 0.4%, respectively.

In contract currency terms, import prices were flat compared with the previous month and fell 2.4% year-on-year. For all of 2025, import prices declined 0.4% from a year earlier, and in contract currency terms they dropped 4.6%.

In December last year, the export volume index rose 11.9% year-on-year, driven by increases in computers, electronic and optical equipment, and chemical products. This was the highest level in three months since September (14.5%). The export value index jumped 14.8% over the same period, matching the level last seen in July 2024 (14.8%) and marking a 17‐month high.

The import volume index rose 8.7% year-on-year, led by increases in basic metal products and mining products. The import value index climbed 5.9%.

For 2025 as a whole, the export volume index and export value index rose 5.0% and 3.2% year-on-year, respectively. The import volume index increased 4.6%, while the import value index edged down 0.3%.

The net barter terms of trade index, which measures the quantity of goods that can be imported per unit of exports, rose 5.4% year-on-year as export prices increased 2.6% and import prices fell 2.6%. Month-on-month, it was up 0.1%. For 2025 as a whole, the index rose 3.0% from the previous year.

The income terms of trade index, which reflects both the net barter terms of trade index (up 5.4%) and the export volume index (up 11.9%) over the same period, surged 17.9% year-on-year. For 2025, the index jumped 8.2% from a year earlier.

The income terms of trade index is an indicator that measures the capacity to increase imports based on export earnings. A rise in this index means that the ability (in quantity terms) to import goods with a given total value of exports has improved.

taeil0808@fnnews.com Kim Tae-il Reporter