Alphabet Inc. surpasses $4 trillion in market capitalization...expands Gemini user base through partnership with Apple Inc.

- Input

- 2026-01-13 02:58:39

- Updated

- 2026-01-13 02:58:39

Alphabet Inc.’s market capitalization exceeded $4 trillion (about 5,872 trillion won) for the first time ever on the 12th (local time). It is the fourth company to break through the $4 trillion mark, following Apple Inc., Microsoft Corporation (MS), and Nvidia Corporation.

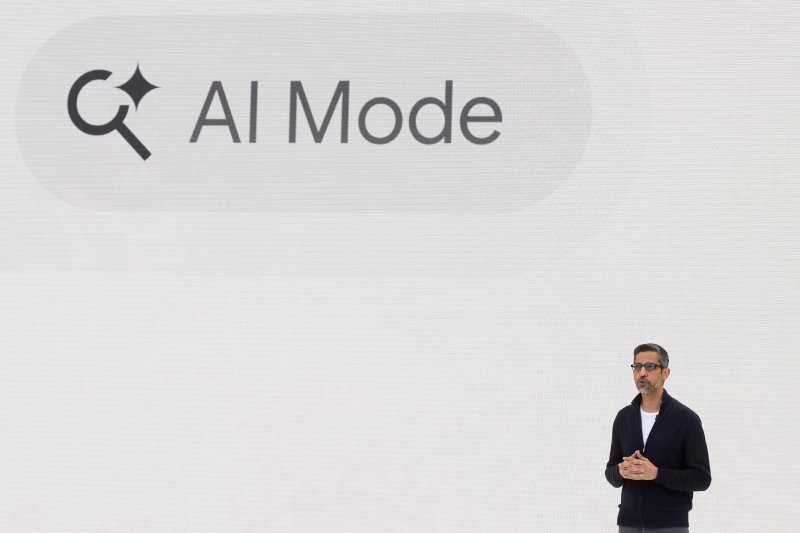

Alphabet Inc. is attracting investors as it uses its artificial intelligence (AI) model Gemini 3 as a springboard to expand its share of the AI market, while its in-house Tensor Processing Unit (TPU) is emerging as a powerful rival to Nvidia Corporation’s ultra-expensive general-purpose Graphics Processing Unit (GPU).

Alphabet Inc.’s share price rose more than 1.5% from the previous session in morning trading that day, briefly pushing its market capitalization above the $4 trillion threshold.

Apple Inc.’s Siri to be revamped on Gemini

The direct trigger for Alphabet Inc. breaking through the $4 trillion market-cap barrier was a report that Apple Inc. had adopted Google’s Gemini 3.

Apple Inc. will continue to develop its own Small Language Model (SLM) AI, while partnering with Google to make up for its shortfall in Large Language Model (LLM) AI.

In the latter half of this year, Apple Inc. plans to launch a voice-recognition AI assistant Siri powered by Google’s Gemini 3.

To that end, Apple Inc. has signed a multi-year licensing agreement with Google.

Through this deal, Google will gain access to a user base of more than 1 billion highly loyal Apple Inc. iPhone and Mac computer customers.

Gemini, which has already emerged as a strong competitor to OpenAI’s ChatGPT and lifted its AI market share above 20%, will now be able to intensify competition with OpenAI, which has so far dominated among Apple Inc. users. Apple Inc. is already partnered with OpenAI as well.

Some forecasts suggest that if Gemini expands its influence among Apple Inc. users, its market share could rise above 40%.

At the same time, Google is expected to generate substantial revenue from licensing fees for Gemini technology.

More than doubled since April last year

As recently as early last year, Alphabet Inc.’s share price performance was sluggish.

There were growing concerns that Alphabet Inc.’s search engine business, its main cash cow, could see its earnings plunge as it lost ground to AI services such as ChatGPT and Perplexity AI.

In addition, U.S. regulators’ efforts to break up Alphabet Inc., citing concerns over market monopoly by the increasingly large company, were another negative factor.

However, the mood has since shifted.

Demis Hassabis, co-founder of Google DeepMind, Google’s AI subsidiary, took the lead in efforts to develop a rival to ChatGPT, and those efforts have begun to bear fruit.

Google in particular unveiled Gemini 3 and subsequently released tools such as the image-generation tool Nano Banana, driving competitors including OpenAI into a corner in the AI race. As a result, its share price has more than doubled since April last year.

By contrast, OpenAI CEO Sam Altman last month issued a “code red” internal alert, saying that the company urgently needs product innovation.

Building its own ecosystem

Just as Nvidia Corporation has built its own GPU ecosystem and outpaced rivals through its Compute Unified Device Architecture (CUDA) software platform for running its GPUs, Alphabet Inc. is securing an edge in competition by building its own AI ecosystem.

According to the Financial Times (FT), HSBC Holdings plc (HSBC) assesses that Google has developed its own AI chips and, based on these chips, built AI systems that run within a proprietary ecosystem spanning Google data centers as well as consumer and enterprise applications. This is on top of operating the world’s largest search engine.

By contrast, OpenAI, Anthropic, and others mainly rely on third-party data centers and applications, and are therefore gradually losing ground to Google, HSBC noted.

dympna@fnnews.com Song Kyung-jae Reporter