National Tax Delinquency Management Unit to Hire 500 Fixed-Term Workers to Meet All Delinquent Taxpayers in Person

- Input

- 2026-01-12 12:00:00

- Updated

- 2026-01-12 12:00:00

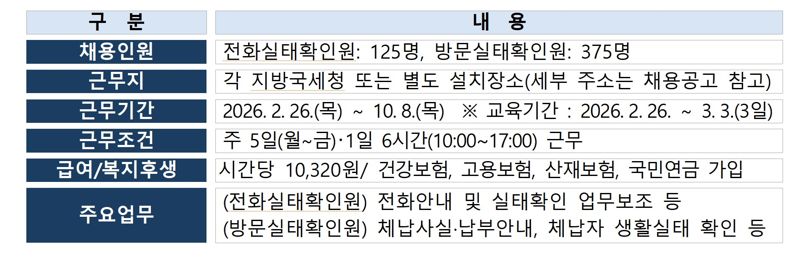

[Financial News] The National Tax Service (NTS) is recruiting 500 fixed-term workers to serve in the National Tax Delinquency Management Unit. Specifically, 125 will work as telephone survey officers and 375 as on-site survey officers. Through this initiative, the NTS plans to meet all delinquent taxpayers face-to-face, verify their actual economic capacity, and establish a customized delinquency management system tailored to different types of delinquent taxpayers.

According to the National Tax Service (NTS) on the 12th, a recruitment notice for fixed-term workers to serve in the National Tax Delinquency Management Unit will be posted starting today. Those hired will be assigned to the National Tax Delinquency Management Unit at each Regional Tax Office in metropolitan cities and provinces, and will work from March through October.

Survey officers at the National Tax Delinquency Management Unit will first provide prior notice to delinquent taxpayers by phone, then visit their registered address or place of business in person to closely examine their living conditions and ability to pay. These officers will not carry out administrative actions such as dunning, seizure, or search. Instead, they will perform simple fact-finding tasks, such as informing taxpayers of their delinquency status and checking their living situation.

The hired fixed-term workers will receive three days of training from the 26th to March 3 on topics such as compliance with personal data protection, job procedures, work rules, and safety, all necessary for performing their duties. The training venue will be announced separately at a later date. Working conditions are five days a week, six hours per day, with an hourly wage of 10,320 won, plus separate payments for meal allowances, paid leave, and other benefits.

Applicants must be at least 18 years old, hold South Korean nationality, and there are no restrictions on education or work experience. They must be able to devote themselves fully to the assigned duties during the employment period and working hours. The NTS plans to hire a balanced pool of young people, women returning to the workforce, retirees, persons with disabilities, and national merit recipients, while giving preference to those with prior experience in police, firefighting, social welfare, tax administration, or statistical surveys.

However, individuals who have been sentenced to imprisonment or a heavier punishment and for whom five years have not yet elapsed, sex offenders, and those who have been dismissed or removed from office through disciplinary action, as well as others who fall under the grounds for disqualification set out in Article 33 of the State Public Officials Act, will be excluded from recruitment.

The recruitment notice can be found from today on the National Tax Service website and on Employment 24. Application documents may be submitted either by email to the contact person at the Regional Tax Office in the desired area or by visiting the Regional Tax Office in person. The application period runs from the 14th to the 20th. After a document screening and interviews, the final successful candidates will be announced on February 23. Details such as the number of hires and recruitment schedule by region can be found in the recruitment announcement.

Park Hae-young, Director General for Tax Collection and Legal Affairs at the NTS, stated, “In the first year of implementation, we will prioritize high-amount and long-term delinquent taxpayers, as well as those applying for extinction of their tax payment obligations, and then gradually expand the program. Going forward, the NTS will continue to strengthen field-oriented activities such as the National Tax Delinquency Management Unit to help financially distressed taxpayers regain their economic footing, while responding strictly to those who deliberately evade payment, thereby actively supporting the livelihood economy and realizing tax justice.”

syj@fnnews.com Seo Young-jun Reporter