Hedge Funds Scent Opportunity in the Donroe Doctrine... “Exploring Investment Opportunities in Latin America”

- Input

- 2026-01-12 09:54:57

- Updated

- 2026-01-12 09:54:57

On the 11th (local time), The Wall Street Journal (WSJ) reported that “several hedge funds and other investment firms are already planning business trips to Caracas, the capital of Venezuela, and some are examining ‘niche products’ such as defaulted sovereign bonds.”

According to the Journal, some investors are also turning their attention to sovereign bonds issued by the Republic of Colombia and Cuba, countries toward which President Trump has taken a dim view. The paper also noted that the share prices of small banks in Greenland, whose incorporation into the United States Trump has openly coveted, have recently surged.

For years, most U.S. fund managers had treated Venezuela as off‐limits for investment, citing U.S. sanctions, political repression under the Maduro regime, and severe economic mismanagement.

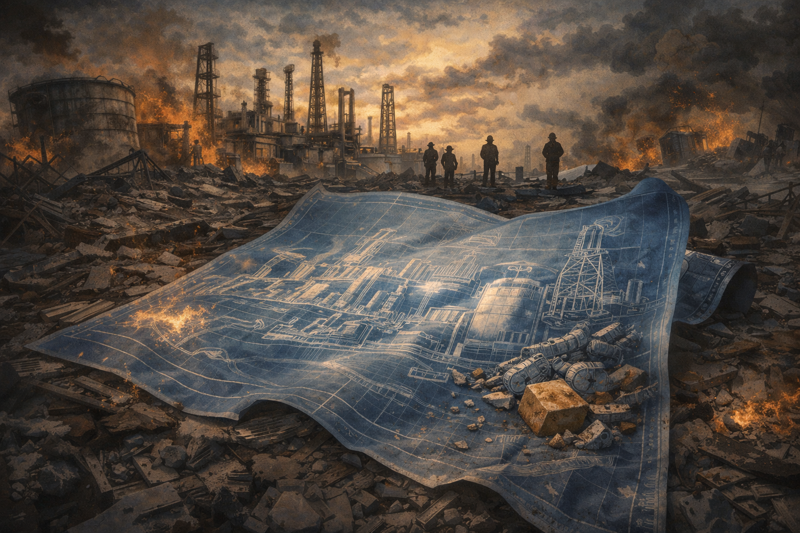

However, the Journal explained that investors now increasingly believe that a combination of political change following Maduro’s extradition to the United States, direct U.S. involvement, and American investment in Venezuela’s vast oil reserves could open the door to a restructuring of the country’s debt.

Charles Myers, chairman of New York City–based consulting firm Signum Global Advisors, said, “Our firm’s experts are planning a trip to Venezuela to assess the investment outlook, and we are being inundated with requests from clients who want to join us.”

Celestino Amore, co‐founder of Kanaima Capital Management, which has been investing in Venezuelan sovereign bonds for the past five years, commented, “For us, this is only the beginning,” adding that it marks “the start of much larger deals.”

Some investors also expect opportunities to emerge in other sectors of the Venezuelan economy that deteriorated under the Maduro regime.

Ben Cleary, a partner at Tribeca Investment Partners, headquartered in Sydney, said, “Our firm is interested in Venezuela’s undeveloped mineral resources, and we plan to send a team for several months to conduct on‐the‐ground assessments.”

At the same time, the Journal cautioned that investment risks remain substantial, noting that domestic instability in Venezuela and the potential for conflict with the United States could complicate reconstruction efforts, and that reviving the country’s aging oil infrastructure will be no easy task.

whywani@fnnews.com Hong Chae-wan Reporter