Who Is the Retail Investor Behind SK Hynix’s 4 Billion Won Windfall? “There Is a Legend Among Us”

- Input

- 2026-01-07 07:24:23

- Updated

- 2026-01-07 07:24:23

[Financial News] As SK Hynix’s stock price hit an all-time high, fueled by the Artificial Intelligence (AI) boom, attention has returned to an employee who reportedly purchased a large volume of company shares at less than 10,000 won per share and is now estimated to have made tens of billions of won in unrealized gains.

On the 6th, SK Hynix closed at 726,000 won, up 30,000 won (4.31%) from the previous day. The intraday high reached 727,000 won, setting new records for both the highest intraday and closing prices. Based on the closing price, the company’s market capitalization reached 528.5297 trillion won, surpassing the total market cap of all Korea Securities Dealers Automated Quotations (KOSDAQ) listed companies and even overtaking Toyota Motor Corporation, Japan’s top company by market value.

From the 22nd of last month through this day, SK Hynix recorded nine consecutive days of gains. During this period, it was the most heavily bought stock by foreign investors, with net purchases reaching 2.0318 trillion won—far outpacing Samsung Electronics, which came in second at 1.091 trillion won.

Purchased 5,700 Shares of SK Hynix at 7,800 Won Each

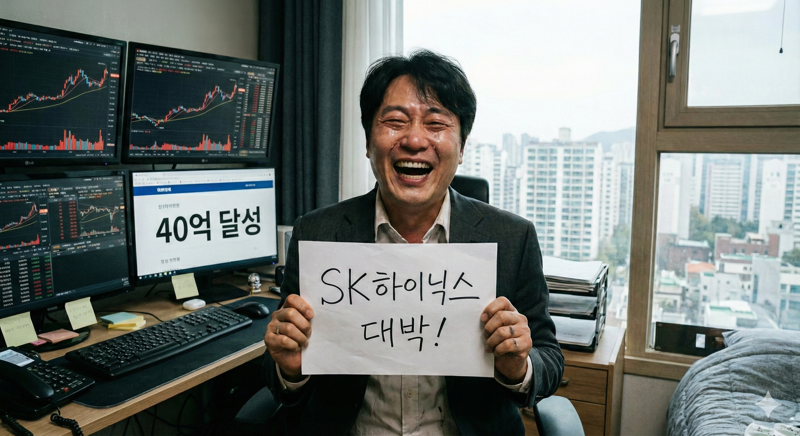

As the stock price surged, online stock communities were filled with posts sharing investment returns. On this day, an SK Hynix shareholder posted on the anonymous workplace community app Blind, saying, “I don’t know who it is, but there is a legend in our company,” along with a screenshot from a Mobile Trading System (MTS). The screenshot showed an investor who had purchased 5,700 shares of SK Hynix at 7,800 won per share.

The 'legend' mentioned by the user is believed to be Investor A, who became famous online in 2020. At the time, Investor A explained the reason for buying 5,700 shares of SK Hynix: “Back then, people in the company said you’d have to be crazy to buy company stock. But driven by company loyalty and the belief that the stock was undervalued, I went all in. It was my first-ever stock investment.”

Investor A also provided an update in May 2024. In response to a post by another user, A commented, “I still haven’t found the right time to sell,” and shared a screenshot from the MTS showing continued ownership of 5,700 shares. The return, which was 1,367.63% in 2020, had risen to 2,424.86%. Given that SK Hynix’s share price surpassed 8,000 won after February 2009, it appears that A invested even earlier.

If Investor A still holds these shares, their value would now be 4.1382 billion won. The return rate would be close to 9,669.23%, and with an initial investment of 44.46 million won, the unrealized profit would be approximately 4.09374 billion won.

SK Hynix’s Stock Rally Expected to Continue

Experts predict that SK Hynix’s upward momentum will continue for the time being. The AI boom has shifted the memory semiconductor market in favor of suppliers. The previous day, SK Hynix announced through its newsroom, “The amount of Dynamic random-access memory (DRAM) and High Bandwidth Memory (HBM) installed per server for AI training and inference continues to rise,” adding, “The proportion of memory and storage within the overall AI infrastructure is structurally increasing.”

As a result, memory prices are expected to rise, leading to improved earnings. Recently, Daishin Securities projected SK Hynix’s annual operating profit for this year at 10.0776 trillion won. Hyungkeun Ryu, a researcher at Daishin Securities, stated, “This year, HBM shipments are expected to reach 19 billion gigabytes (GB), a 54% increase from last year. Supported by aggressive price hikes, profits are expected to grow significantly.”

hsg@fnnews.com Han Seung-gon Reporter