"A Loss of 350 Million Won, Leaving After Losing Everything"... Individual Investors Betting on Index Decline Sigh Amid KOSPI Rally

- Input

- 2026-01-07 05:36:12

- Updated

- 2026-01-07 05:36:12

[Financial News] As the Korea Composite Stock Price Index (KOSPI) hit an all-time high, surpassing the 4,500 mark, individual investors who anticipated a decline and invested in Inverse Exchange-Traded Funds (Inverse ETF) are facing mounting losses. Leading inverse products such as the KODEX 200 Futures Inverse 2X have plummeted to record lows.

According to the Korea Exchange (KRX) on the 6th, the KOSPI closed at 4,525.48, up 67.96 points (1.52%) from the previous trading day. This marks the first time the KOSPI has finished above the 4,500 level. Due to the sharp index surge, prices of inverse ETFs, which bet on a market downturn, have collectively dropped to historic lows.

The KODEX 200 Futures Inverse 2X, a representative leveraged inverse product, closed at 517 won, marking its lowest price since listing. It has fallen for nine consecutive trading days, with a decline of over 95% from its peak. The KODEX Inverse ETF also dropped to 2,235 won, reaching its lowest level since inception.

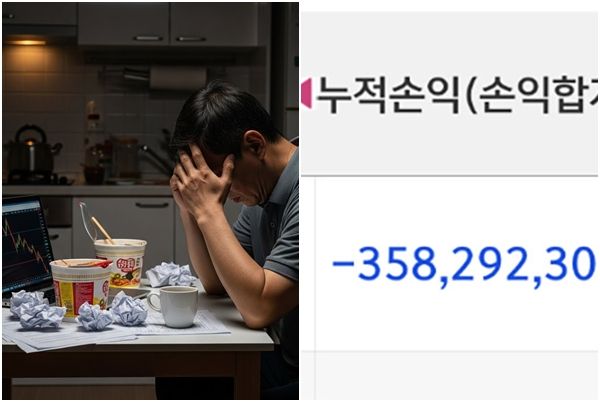

Cases of investors realizing losses continue to emerge. Numerous posts lamenting significant losses have appeared in stock discussion forums. One investor reported a loss exceeding 350 million won and announced a halt to further investing, while several others posted about losses in the millions of won.

This surge in Inverse ETF investments was led by individual investors. As the KOSPI reached new highs at the end of last month, many individuals purchased inverse products in anticipation of a correction. Over the past week, KODEX 200 Futures Inverse 2X ranked first in net purchases by individuals, accounting for a significant portion of total ETF net buying.

Despite the continued rise of the index, individuals continued to make additional purchases. The top three ETFs in net individual purchases the previous day were all inverse products, and some investors reportedly increased their inverse positions using margin loans.

The KOSPI rally has been driven by semiconductor stocks. Both Samsung Electronics Co., Ltd. and SK Hynix set new record highs, leading the index upward. Samsung Electronics Co., Ltd. is approaching the 140,000 won mark, while SK Hynix climbed as high as 727,000 won during trading, surpassing the 720,000 won level.

hsg@fnnews.com Han Seung-gon Reporter