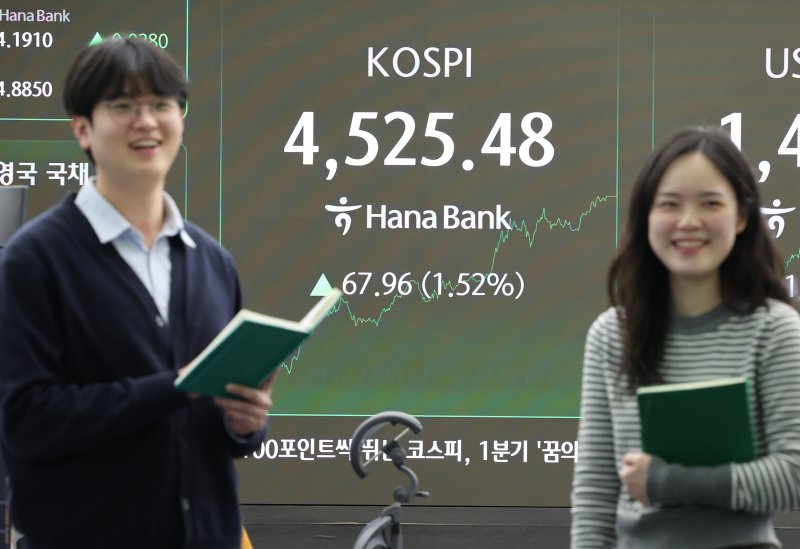

KOSPI Surpasses 4,500 for the First Time Ever... “Further Gains Possible on Semiconductor Earnings”

- Input

- 2026-01-06 16:40:22

- Updated

- 2026-01-06 16:40:22

According to the Korea Exchange (KRX), the KOSPI closed at a record high of 4,525.48, up 67.96 points (1.52%) from the previous session. Previously, the KOSPI touched an intraday high of 4,313.55 on January 2, the first trading day of the year, and continued its rally, closing at 4,457.52 the previous day to set another record.

Individual investors were the main drivers of the index's rise today. In the KOSPI Market, while foreigners and institutions were net sellers, individuals made net purchases totaling 595.4 billion won. Foreign investors had been net buyers almost every day since December 22, except for December 30, but today they turned to net selling, offloading 629.4 billion won to realize profits.

Expectations for a semiconductor super rally are building ahead of earnings announcements. The market anticipates that major semiconductor companies will begin releasing preliminary earnings starting with Samsung Electronics on the 8th. In fact, Samsung Electronics' share price, which stood at 119,900 won on December 30 last year, reached a record high of 138,900 won today, marking a 15.8% increase in just three trading days. SK Hynix has also risen by 10.7% since the beginning of the year.

Lee Jae-won, a researcher at Shinhan Securities, stated, “Following the preliminary earnings announcement from Samsung Electronics on the 8th, we will be able to confirm results from SK Hynix and others through the end of this month. The impact of earnings momentum and guidance was already evident a few weeks ago with Micron Technology. January is shaping up to be a month of strong earnings momentum.”

The securities industry believes that the KOSPI rally led by semiconductors will not be short-lived. With global AI semiconductor demand on the rise, both Samsung Electronics and SK Hynix have notified major clients of DRAM price increases. In addition, the expected passage or implementation of Commercial Act amendments aimed at enhancing shareholder rights is also seen as a positive for the stock market.

Kim Yong-gu, a researcher at Yuanta Securities Korea, observed, “There are unwavering expectations for a global AI and semiconductor supercycle, and we are witnessing an acute semiconductor shortage. Not only are shareholder-friendly financial policy changes such as Commercial Act amendments on the horizon, but the normalization of export momentum based on the semiconductor supercycle is also expected to drive the KOSPI toward the 5,000 mark.”

However, there are also concerns about potential risks in the medium to long term. Kim added, “Risks include the possibility of the Federal Reserve System (Fed) raising rates due to economic and inflationary overheating, and the risk of a lame-duck period for U.S. President Donald Trump if the Republican Party (GOP) suffers a defeat in the November midterm elections. Additionally, we must be wary of a surge in credit risk and deteriorating profitability among global Big Tech companies due to overheated AI investment.”

yimsh0214@fnnews.com Im Sang-hyuk Reporter