Upbit Faces Cracks Amid Plummeting 2025 Trading Volume... Prelude to Market Share Shifts [Crypto Briefing]

- Input

- 2026-01-05 12:32:54

- Updated

- 2026-01-05 12:32:54

[Financial News] Last year, Upbit's market share declined compared to previous years. As the overall crypto market slumped in the second half, trading volumes dropped across the board, while aggressive marketing by rival exchanges proved effective. In addition, with global exchanges and traditional financial institutions entering the scene, some predict a major shakeup to Upbit’s dominance this year.

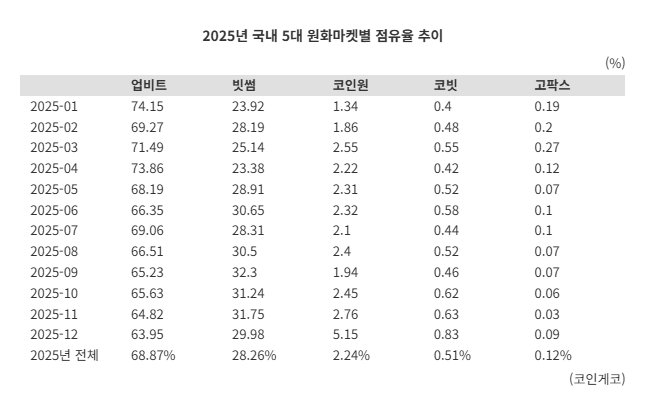

According to CoinGecko on the 5th, Upbit’s share among the top five domestic KRW exchanges (Upbit, Bithumb, Coinone, Korbit, GOPAX) stood at 68.87% last year. Specifically, Upbit held 68.87%, Bithumb 28.26%, Coinone 2.24%, Korbit 0.51%, and GOPAX 0.12%.

Upbit’s market share has been on a steady decline each year. According to data submitted by Democratic Party of Korea (DPK) lawmaker Kim Hyun-jung from the Financial Supervisory Service (FSS), Upbit’s share was 77.41% in 2021, 78.36% in 2022, 80.45% in 2023, and 70.84% in the first half of 2024.

Since trading volume data is considered sensitive in the industry and is only partially disclosed, figures may vary depending on the source. However, the overall downward trend in Upbit’s market share is consistently observed.

Since July last year, the overall crypto market downturn has coincided with Upbit’s declining market share. The combined trading volume of the top five KRW exchanges peaked at $219.7 billion in January, driven by the effects of martial law, and rose to $159.5 billion in July following the passage of the GENIUS Act. However, due to concerns over US-China tensions, volumes dropped to $99.8 billion in November and $56.6 billion in December. Upbit maintained around 70% market share through July, but this figure steadily declined, reaching 63.95% last month.

Analysts attribute the shift in market share to intensified marketing by competitors amid a general freeze in investor sentiment. Bithumb’s combined advertising and sales promotion expenses were 12.8 billion KRW and 16.1 billion KRW in 2022 and 2023, respectively. However, in 2024 and the first half of last year, these figures soared to 192.2 billion KRW and 134.6 billion KRW. As a result, the gap between Upbit and Bithumb narrowed from 50 percentage points in January last year to 33.97 percentage points in December.

Coinone also saw its market share rise from 1-2% between January and November last year to 5% last month. Coinone focused on marketing last month, launching services such as Coin Collection, the Coinone Mate Invite Challenge, and the Santa Rally event, which contributed positively to its market share increase.

Industry insiders believe Upbit’s overwhelming dominance could be shaken starting this year. Binance is set to acquire and operate GOPAX, while Mirae Asset Financial Group is actively considering acquiring Korbit. Meanwhile, Upbit’s operator Dunamu is seeking business diversification through collaboration with NAVER Financial, which could also impact the landscape.

A crypto industry official stated, “The historic rally in crypto assets since last July brought a surge in trading volume, but as the market entered a downturn and stagnation, volumes have also declined. Recently, the influx of large capital from outside the traditional domestic market is creating a sense that the competitive landscape may shift.”

yimsh0214@fnnews.com Im Sang-hyuk Reporter