[Virtual Asset Year-End Review] The Dawn of Finance-Virtual Asset Integration... Urgent Discussions, but Legislation Delayed into Next Year

- Input

- 2025-12-29 13:22:54

- Updated

- 2025-12-29 13:22:54

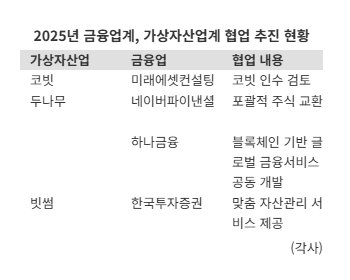

[Financial News] This year marked the beginning of collaboration between the financial and virtual asset industries. Dunamu Inc. formalized its partnership with NAVER Financial, and Mirae Asset Financial Group is currently considering acquiring the virtual asset exchange Korbit. The virtual asset sector is also actively seeking cooperation with traditional finance. However, the government's stance on the 'Separation of Finance and Virtual Assets' remains a significant hurdle. Legislative progress has stalled due to ongoing delays.

According to the virtual asset industry on the 29th, Mirae Asset Financial Group’s non-financial affiliate, Mirae Asset Consulting, recently signed a memorandum of understanding (MOU) regarding equity acquisition with Korbit’s major shareholders, NXC (60.5%) and SK Planet (31.5%). Established in July 2013, Korbit is Korea’s first virtual asset exchange and was acquired in 2017 by NXC, the holding company of game developer Nexon.

Earlier in October, Mirae Asset Financial Group unveiled its vision for financial innovation, 'Mirae Asset 3.0,' expressing its commitment to digital-based financial innovation. The group’s intention to acquire Korbit, one of the five major won-based exchanges, is seen as a move to realize this goal.

Dunamu Inc., the operator of the virtual asset exchange Upbit, is also pursuing a comprehensive stock swap with NAVER Financial. The aim is to expand its business as a subsidiary of NAVER Financial, encompassing both fintech and virtual assets. On November 27, Song Chi-hyung, Chairman of Dunamu Inc., emphasized, “We will design next-generation financial infrastructure by combining Artificial Intelligence (AI) and Blockchain, and present a new financial paradigm not only in Korea but also on the global stage.”

With the emergence of 'new finance' such as Stablecoins, collaboration between the financial and virtual asset industries is accelerating. In addition to NAVER Financial, Dunamu Inc. signed an MOU with Hana Financial Group on December 3 to jointly develop global financial services based on Blockchain technology. Bithumb also entered into an MOU with Korea Investment & Securities on December 24.

However, the financial authorities’ adherence to the principle of 'Separation of Finance and Virtual Assets' remains a variable. This principle calls for a clear distinction between the business domains of finance and virtual assets. While there is no explicit legal provision, the authorities enforce it through regulatory interpretations.

Due to the absence of codified regulations, the industry is entirely dependent on the authorities’ decisions. Although Mirae Asset Financial Group has positioned its non-financial affiliate as the acquiring entity, the authorities could still raise issues regarding the group during the review process. In Dunamu Inc.'s case, whether NAVER Financial should be classified as a 'financial business' is a key issue. As a result, even companies that have recently signed MOUs with traditional financial institutions face limitations on the scope of their business activities.

Industry voices are calling for the relaxation of the Separation of Finance and Virtual Assets principle through the second phase of virtual asset legislation, the Digital Asset Basic Act. However, with the government’s proposal delayed, passage within the year is now out of reach. A representative from the virtual asset industry stated, “The government proposal was originally scheduled for release in October, but it has yet to be disclosed. A forward-looking agreement at the regulatory level is needed.”

Experts predict that the authorities will gradually ease their stance in response to changing times. Ji Youl Jung, a professor at Hanyang University, noted, “While existing financial institutions are considering collaboration with the virtual asset industry, they have hesitated due to regulatory concerns. However, NAVER and Mirae Asset have pushed ahead as a breakthrough. Just as the government relaxed the separation of banking and commerce when KT successfully acquired K Bank, it is expected that the government will also apply a more flexible approach to the Separation of Finance and Virtual Assets.”

yimsh0214@fnnews.com Im Sang-hyuk Reporter