No Santa Rally for Bitcoin at Year-End... ‘Pessimism’ Emerges [Crypto Briefing]

- Input

- 2025-12-22 13:23:40

- Updated

- 2025-12-22 13:23:40

[Financial News] Bitcoin (BTC) is moving sideways without a Santa rally. Investor sentiment, which weakened due to U.S.-China tensions in October, has yet to recover even after two months. As pessimism grows in some corners of the market, the passage of new policies and the direction of benchmark interest rates are seen as key factors for next year.

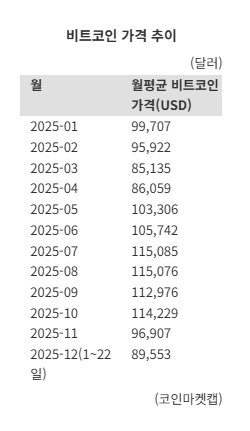

According to CoinMarketCap, a global digital asset information platform, as of 11 a.m. on the 22nd, BTC was trading at around $88,000, up 0.46% from the previous day (24-hour basis). Over the past week, BTC declined by 1.09%. Compared to its all-time high of $126,000 on October 7, the price has dropped by about 30.15%. It is also down approximately 5.37% from the year’s opening price of $93,000.

BTC maintained the $90,000–$100,000 range at the start of the year, but fell to around $76,000 in April after United States of America (USA) President Donald Trump announced sweeping tariffs. As tariff concerns eased, BTC recovered to the $100,000 level, and in July, it surpassed $120,000 after the passage of the Guiding and Establishing National Innovation in the United States Act (GENIUS Act), which established a framework for Stablecoin issuance and oversight.

From August to early October, BTC traded between $110,000 and $120,000, supported by the Federal Reserve System (Fed)’s dovish stance on interest rates. However, on October 10 (local time), after Donald Trump hinted at renewed trade tensions with China, the price fell to around $104,000. In just three days, more than $20,000 evaporated compared to the all-time high of $126,000 set on October 7.

BTC has since trended downward, remaining stuck between $80,000 and $90,000 from last month through this month. Despite easing U.S.-China tensions, experts note that the Fed’s hawkish stance and the Bank of Japan (BOJ)’s decision to raise rates have led to a general risk-off sentiment in the market.

In its December report, Binance Research stated, “Risk assets, including BTC, are heavily influenced by the Fed’s monetary policy path and global liquidity conditions. The impact of Japan’s monetary policy could also spread to global risk assets, including cryptocurrencies.”

Some market observers predict a worst-case scenario in which BTC could plunge to the $10,000 level next year. Although BTC set new records this year and investor sentiment reached historic highs, some expect a sharp price correction as the market cools.

Mike McGlone, chief strategist at Bloomberg Intelligence, posted on his social media on the 18th (local time) an article titled “Signs That the Trend of the Great Depression in 1929 Is Similar to the Recent BTC Market.” He argued, “When speculative excess spreads and a reversal begins, the market exposes even greater risks. Next year, BTC could see increased volatility and fall to $10,000.”

However, most analysts expect BTC to show a more stable trend early next year. The passage of the CLARITY Act in the USA is fueling expectations that BTC and other digital assets will be incorporated into the institutional financial system. In addition, Kevin Hassett, a member of the White House National Economic Council (NEC) and a leading candidate for the next Fed chair, recently emphasized the need for rate cuts next year, which could further boost liquidity.

Hong Jin-hyun, a researcher at Samsung Securities, predicted, “The degree of correction next year is likely to be milder than in previous years. With stronger institutional integration, BTC will show trends more closely correlated with traditional finance. During correction phases, BTC has moved in tandem with Gold, while in bull markets, it has tracked the U.S. stock market. Next year, it is expected to follow a trend similar to Gold.”

yimsh0214@fnnews.com Im Sang-hyuk Reporter