‘AI Bubble’ Concerns Ease... KOSPI Recovers 4,000 Mark on Institutional and Individual Buying [Financial News Morning Market Brief]

- Input

- 2025-12-17 11:38:21

- Updated

- 2025-12-17 11:38:21

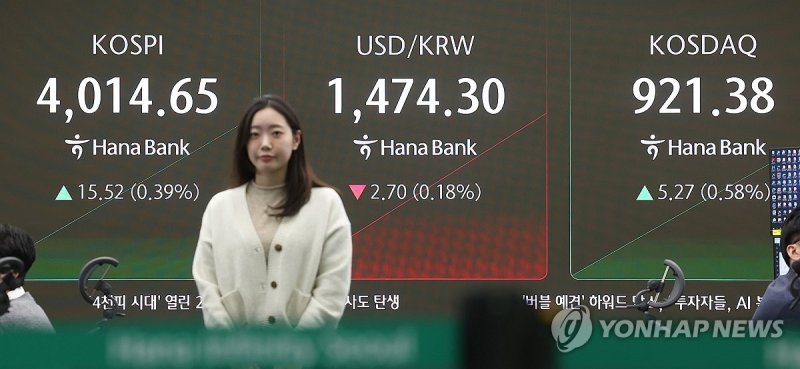

[Financial News] The Korea Composite Stock Price Index (KOSPI) regained the 4,000 level, driven by buying from institutional and individual investors. As concerns over an Artificial Intelligence (AI) bubble subsided, investor sentiment showed signs of recovery.

As of 10:55 a.m. on the 17th, the KOSPI was trading at 4,019.94, up 20.81 points (0.52%) from the previous session. The index opened at 4,019.43, a 0.51% increase from the previous close.

In the KOSPI Market, institutional investors and individual investors recorded net purchases of 135.2 billion won and 126.7 billion won, respectively. Meanwhile, foreign investors sold off 268.8 billion won worth of shares.

By sector, electricity & gas (2.45%), textiles & apparel (2.24%), electrical & electronics (1.54%), construction (1.20%), and non-metallic minerals (1.15%) showed strength. In contrast, pharmaceuticals (-1.32%), machinery & equipment (-1.20%), securities (-0.88%), and food, beverages & tobacco (-0.52%) declined.

Among major large-cap stocks, Samsung Electronics (2.82%), SK hynix (0.75%), Hyundai Motor Company (0.17%), KB Financial Group (0.32%), Kia Corporation (0.25%), and Hanwha Aerospace (1.14%) posted gains. On the other hand, LG Energy Solution (-0.36%), Samsung Biologics (-2.29%), HD Hyundai Heavy Industries (-1.15%), and Doosan Enerbility (-1.81%) fell.

Recently, the market saw renewed concerns about an 'AI bubble' after global AI-related companies such as Oracle Corporation and Broadcom Inc. reported earnings that fell short of expectations. However, on the 16th (local time), U.S. markets saw Broadcom Inc. (0.44%), Oracle Corporation (2.02%), and Nvidia Corporation (0.81%) close higher, easing the sharp declines to some extent.

Han Ji-young, a researcher at KIWOOM Securities, stated, "Today, the KOSPI is expected to rebound, helped by the stabilization of U.S. AI stocks. However, with upcoming earnings from Micron Technology, Inc. and U.S. economic indicators, the domestic market will likely see both caution and anticipation around U.S.-driven events, resulting in a limited rebound and a shift toward sector differentiation."

At the same time, the KOSDAQ Index was trading at 913.82, down 2.29 points (0.25%) from the previous session. The index opened at 922.03, up 0.65% from the previous close.

In the KOSDAQ market, only individual investors were net buyers, purchasing 299.4 billion won worth of shares, while foreign investors and institutional investors posted net sales of 217.7 billion won and 45.5 billion won, respectively.

yimsh0214@fnnews.com Im Sang-hyuk Reporter