POSCO Future M Targets 'Double-Kill' in ESS with LFP and High-Nickel Cathode Materials [Battery Industry Seeking Breakthroughs]

- Input

- 2025-12-16 14:51:57

- Updated

- 2025-12-16 14:51:57

■ New LFP Cathode Material Plant in Pohang to Respond to ESS Demand

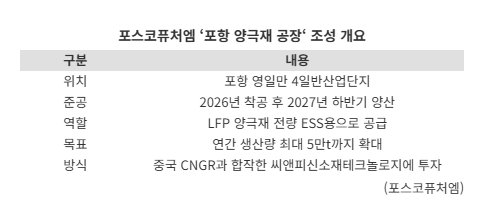

With this investment, POSCO Future M plans to expand production capacity to a maximum of 50,000 tons. The company also intends to push forward with the construction of the LFP cathode material plant by making additional investments in CNP Advanced Material Technology, a joint venture established in 2023 with CNGR Advanced Material Co., Ltd., a Chinese secondary battery materials company.

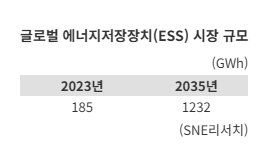

LFP batteries are gaining attention as the ESS market expands. While their output is lower than that of Ternary batteries such as nickel-cobalt-manganese (NCM) and nickel-cobalt-aluminum (NCA), LFP batteries are more affordable and have a longer lifespan, making them ideal for power storage in ESS. This is why 90% of global ESS facilities have adopted LFP batteries.

In particular, as demand for ESS-specific LFP batteries surges in the North American market, major battery manufacturers are converting their existing Ternary battery production lines to LFP battery lines to adapt to market changes. POSCO Future M, which has primarily produced Ternary cathode materials, aims to diversify its cathode material portfolio and strengthen its competitiveness in global tenders by approving this LFP plant investment.

A POSCO Future M official stated, "In addition to the dedicated LFP cathode material plant, we plan to convert some of the NCM Ternary cathode material production lines at the existing Pohang Cathode Materials Plant to LFP cathode material lines, with supply starting at the end of 2026 to ensure early entry into the LFP market."

■ Increasing Profitability with 'High-Nickel Cathode Materials'... Establishing a Dedicated ESS Organization

Another key asset for POSCO Future M is its high-nickel cathode material. By increasing the nickel content, these cathode materials maximize energy density, allowing more power to be stored in the same space. As ESS installation space is limited, the competitiveness of these 'high-efficiency materials' directly translates into profitability.Most notably, POSCO Future M is recognized for its stable supply of raw materials such as lithium and nickel through group companies including POSCO, POSCO HY CLEAN METAL, Posco Pilbara Lithium Solution, and POSCO Lithium Solution. The company has established a self-sufficient system that handles everything from raw material refining to precursor production and final cathode material manufacturing domestically, giving it a distinct supply chain advantage in the industry.

POSCO Future M aims to begin supplying ESS materials as early as next year and is actively marketing its flagship high-nickel cathode materials to major battery manufacturers, introducing samples and seeking evaluation and certification.

Furthermore, POSCO Future M anticipates that demand for graphite-based anode materials will also rise as the ESS market grows, and is building an 'all-in-one' raw material supply chain. In June, the company signed an investment agreement with the Saemangeum Development and Investment Agency (SDIA), Jeonbuk Special Self-Governing Province, Gunsan-si, and Korea Rural Community Corporation to produce Spherical Graphite domestically. Its subsidiary, FutureGraph, plans to build a Spherical Graphite plant in the Saemangeum National Industrial Complex, with annual production of 37,000 tons starting in 2027.

In July, POSCO Future M established the 'ESS Section,' a dedicated organization for ESS materials. This move is aimed at enhancing its capacity to respond to the ESS market, going beyond its traditional focus on battery materials for electric vehicles. An industry official noted, "POSCO Future M is building the most diverse product portfolio among domestic material companies, leveraging group-level raw material internalization and cathode material technology. In particular, the new Pohang plant is expected to significantly strengthen its mid- to long-term competitiveness as the ESS market expands."

eastcold@fnnews.com Kim Dong-chan Reporter