While the US Pursues ‘Integration,’ Korea Sticks to ‘Separation’ of Finance and Virtual Assets... “Urgent Need for Second Phase Legislation” [Crypto Briefing]

- Input

- 2025-12-15 13:18:21

- Updated

- 2025-12-15 13:18:21

[Financial News] The virtual asset industry is closely monitoring whether the financial authorities' principle of ‘Separation of Finance and Virtual Assets’ will see any visible changes. The previously announced Second Phase Legislation on Virtual Assets, initially expected on the 10th, has been delayed, turning anticipation into uncertainty. While the US is breaking down the boundaries between traditional finance and virtual assets, Korea’s progress remains slow. With Dunamu and NAVER Financial pursuing a merger, calls for relaxing the separation are growing louder.

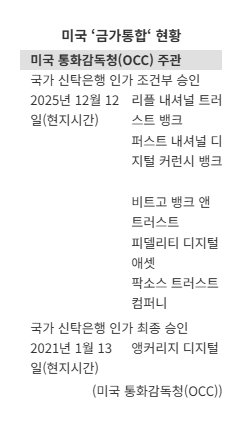

According to the virtual asset industry on the 15th, the Office of the Comptroller of the Currency (OCC) announced on the 12th (local time) that it had conditionally approved national trust bank charters for five virtual asset companies, including Ripple National Trust Bank and First National Digital Currency Bank. The OCC not only supervises banks nationwide but also has the final authority to grant bank charters.

Ripple National Trust Bank, which received conditional approval, is a corporation established by Ripple, while First National Digital Currency Bank is a new entity founded by Circle, the issuer of the dollar stablecoin. Even if these companies receive final approval, they will not be allowed to accept cash deposits or make loans, but they will be able to provide custody and management services for client assets.

Jonathan Gould, head of the OCC, commented on the approval, stating, “The entry of new participants into the federal banking system is positive for consumers, the banking industry, and the overall economy.”

This is not the first time a virtual asset company has received a national trust bank charter in the US. Anchorage Digital was the first to obtain such approval in January 2021 and continues to operate today.

In the US, not only do virtual asset companies enter traditional finance as seen in this case, but traditional financial institutions are also expanding into virtual asset services. The Bank of New York Mellon (BNY Mellon), the oldest bank in the US, began providing custody services for Ripple’s stablecoin RLUSD in July. Citigroup plans to launch a virtual asset custody platform next year.

In contrast, Korean financial authorities maintain a strict ‘Separation of Finance and Virtual Assets’ principle, clearly dividing the business domains of finance and virtual assets. Although there is no specific legal provision, regulatory interpretations effectively prohibit such business activities.

Industry insiders believe this stance is hindering market development. With the emergence of stablecoins and the blurring of boundaries between finance and virtual assets, there are concerns that excessive regulation in Korea prevents even attempts at new business.

Recently, Dunamu, the operator of the Upbit exchange, and NAVER Financial, which operates the fintech service Naver Pay, have been pursuing a merger. However, the regulatory hurdles set by the financial authorities remain high. Lee Chanjin, Governor of the Financial Supervisory Service (FSS), remarked on the 1st regarding the merger, “Given the current separation, we will closely examine institutional safeguards to assess the impact on the existing financial industry and prepare accordingly.”

As a result, discussions on the Second Phase Legislation on Virtual Assets, which would ease the separation, are considered urgent. However, the government’s draft proposal has been delayed, stalling progress. The Democratic Party of Korea Digital Asset Task Force (TF), which is pushing for the legislation, had set the 10th as the deadline for the government’s proposal. With the deadline missed, the TF plans to hold a meeting on the 22nd to pursue party-led legislation.

A virtual asset industry official commented, “We expected to see some clarity by the end of this year, but the continued delays have slowed our business strategy preparations. Even if full approval is not granted, discussions on partial regulatory easing are necessary.”

yimsh0214@fnnews.com Im Sang-hyuk Reporter