Retirement Funds Shaken by Housing Prices... 2.7 Trillion Won Withdrawn Early from Retirement Pensions

- Input

- 2025-12-15 12:00:00

- Updated

- 2025-12-15 12:00:00

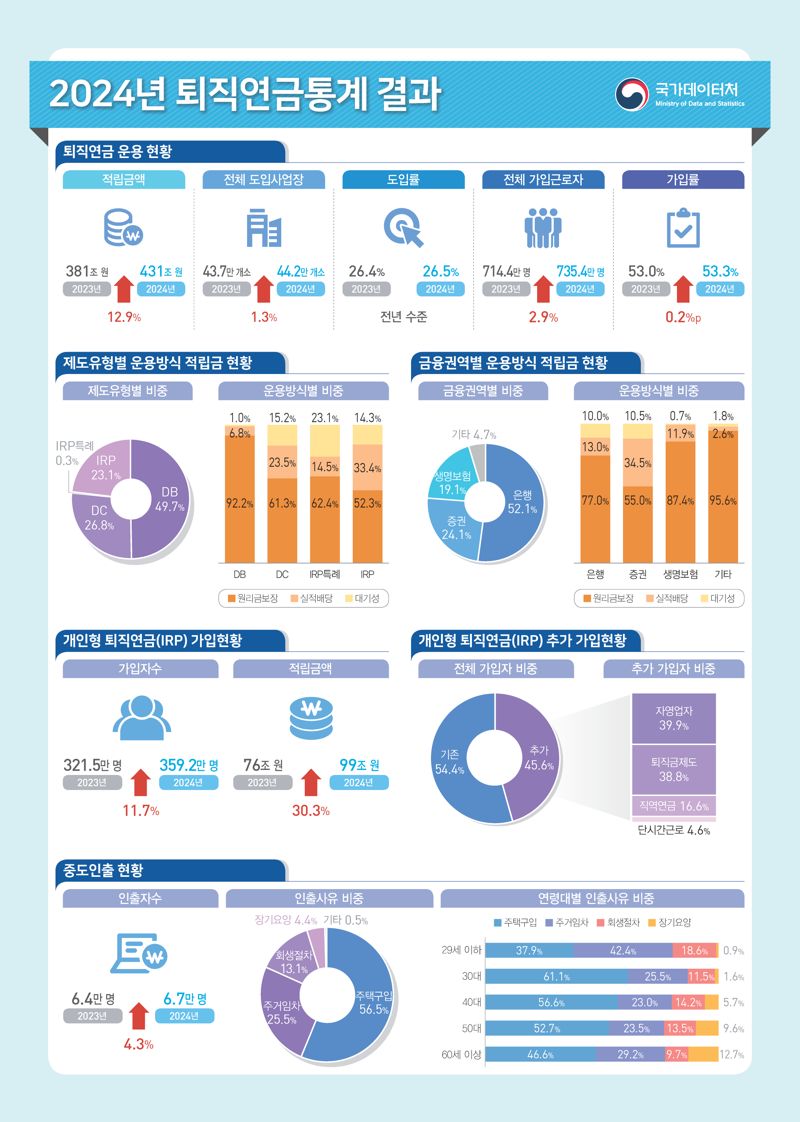

[The Financial News] Last year, early withdrawals from Retirement Pensions exceeded 2.7 trillion won. This increase is attributed to more people withdrawing their retirement funds to purchase homes. The total amount accumulated in Individual Retirement Pension Plans (IRP) also reached approximately 99 trillion won, up 23 trillion won from the previous year.

According to the '2024 Retirement Pension Statistics' released by the Ministry of Data and Statistics on the 15th, the number of people making early withdrawals from their retirement funds last year was 66,531, an increase of about 3,000 (4.3%) compared to the previous year. The highest number of early withdrawals was recorded in 2019 (72,830), and last year marked the fourth largest since statistics began in 2015. The total amount withdrawn early was 2.7 trillion won, a 12.1% increase from the previous year, making it the second highest after 2019 (2.776 trillion won).

The main reasons for early withdrawals were home purchases (56.5%), housing leases (25.5%), and rehabilitation procedures (13.1%). Compared to the previous year, the proportion for home purchases increased by 3.8 percentage points, while housing leases decreased by 2.0 percentage points. In terms of withdrawal amounts, home purchases accounted for 67.3%, followed by housing leases at 23.0%.

The share of withdrawals for home purchases also rose by 4.9 percentage points compared to the previous year, while housing leases dropped by 2.2 percentage points. Both the number of withdrawals and the total amount for home purchases reached the highest levels on record.

The number of subscribers to Individual Retirement Pension Plans (IRP) increased significantly. Last year, the number of IRP subscribers reached 3.592 million, up 11.7% from the previous year. IRP reserves totaled 99 trillion won, a 30.3% (23 trillion won) increase year-on-year.

A representative from the Ministry of Data and Statistics explained, “As the Retirement Pension system continues to improve, the number of subscribers is steadily increasing. Since 2017, eligibility has expanded so that anyone with income can participate, including the self-employed and occupational pension subscribers.” The official added, “Since 2022, it has become mandatory to transfer retirement funds to an IRP upon retirement, and the tax deduction limit was raised from 7 million won to 9 million won last year, which also contributed to the increase.”

Meanwhile, the total reserves in the Retirement Pension system reached 431 trillion won last year, up 12.9% (49 trillion won) from the previous year. By type, Defined Benefit Pension Plans (DB) accounted for 49.7% (214 trillion won), Defined Contribution Retirement Pension (DC) made up 26.8% (116 trillion won), and IRP represented 23.1% (99 trillion won). Compared to the previous year, the proportion of DB decreased by 4.0 percentage points, while IRP and DC increased by 3.1 and 0.9 percentage points, respectively. The total number of businesses implementing Retirement Pension plans was 442,000, a 1.3% increase from the previous year.

junjun@fnnews.com Choi Yong-jun Reporter