US-Driven AI Bubble Concerns Grow... KOSPI Drops Over 1% [fn Morning Market Briefing]

- Input

- 2025-12-15 10:47:12

- Updated

- 2025-12-15 10:47:12

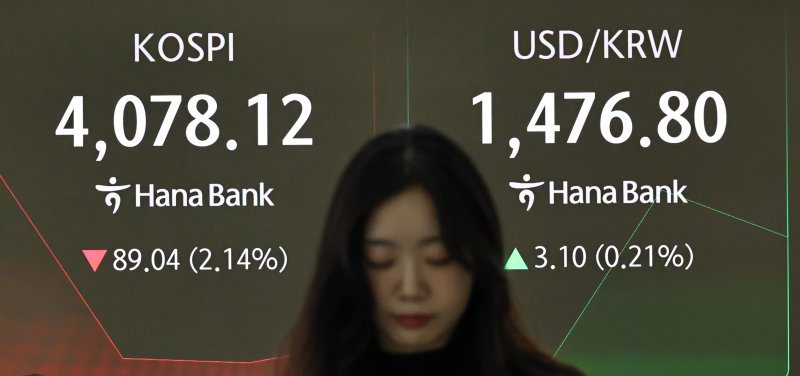

[Financial News] Renewed concerns over an artificial intelligence (AI) bubble originating in the US have caused the Korea Composite Stock Price Index (KOSPI) to stumble. Although the index fell by more than 2% in early trading, it pared losses and attempted to recover the 4,100 level. As of 10:40 a.m. on the 15th, the KOSPI was trading at 4,104.88, down 62.28 points (1.49%) from the previous session. The index opened at 4,053.74, a 2.72% drop from the previous close, but then trimmed its losses and aimed to reclaim the 4,100 mark.

In the main stock market, individual investors are solely net buyers, purchasing 913.5 billion won worth of shares. Foreign investors and institutions are net sellers, offloading 586.1 billion won and 343.3 billion won worth of stocks, respectively.

By sector, metals (up 3.46%), pharmaceuticals (up 2.15%), and paper & wood (up 0.62%) saw gains, while construction (down 4.66%), electrical and electronics (down 2.77%), and medical precision equipment (down 2.54%) declined.

Among the top market cap stocks, Samsung Electronics (down 3.31%), SK hynix (down 3.50%), LG Energy Solution (down 0.56%), and Hyundai Motor Company (down 1.82%) weakened, while only bio stocks such as Samsung Biologics (up 4.55%) and Celltrion (up 0.70%) posted gains.

Over the weekend, renewed AI bubble concerns in the US stock market led to sharp declines, particularly among major large-cap stocks in Korea. On the 12th (US Eastern Time), the New York Stock Exchange (NYSE) closed lower as skepticism about the AI industry emerged, with all three major indices ending in negative territory. The NASDAQ Composite Index (NASDAQ Composite), which is tech-heavy, dropped 398.69 points (1.69%) to close at 23,195.17. The Philadelphia Semiconductor Index (SOX) also plunged by 5.10%.

Market sentiment has cooled as skepticism about the AI industry has intensified. Hock Tan, CEO of Broadcom, explained during an earnings call on the 11th that 'the outlook for non-AI revenue in the first quarter is unchanged from the same period last year,' and added, 'Rapidly growing AI revenue has a lower gross margin than non-AI revenue.'

Meanwhile, at the same time, the KOSDAQ Index was trading at 934.95, down 2.39 points (0.25%) from the previous session. The index opened at 925.60, a 1.25% decrease from the previous close.

In the KOSDAQ market, only individual investors are net buyers, purchasing 130.4 billion won worth of shares, while foreign investors and institutions are net sellers by 16.6 billion won and 80.2 billion won, respectively.

nodelay@fnnews.com Ji-yeon Park Reporter