Will Listed Companies Be Allowed to Buy Bitcoin? Legislation May Be Delayed Until Next Year [Crypto Briefing]

- Input

- 2025-12-14 14:23:44

- Updated

- 2025-12-14 14:23:44

[Financial News] The financial authorities’ plan to allow listed companies to invest in virtual assets by the second half of this year is now expected to be postponed until next year. This delay is attributed to financial soundness concerns at U.S. Digital Asset Holding (DAT) Companies and the stalled discussions with the National Assembly of the Republic of Korea regarding the second phase of the Act on the Protection of Virtual Asset Users, making implementation within this year physically impossible.

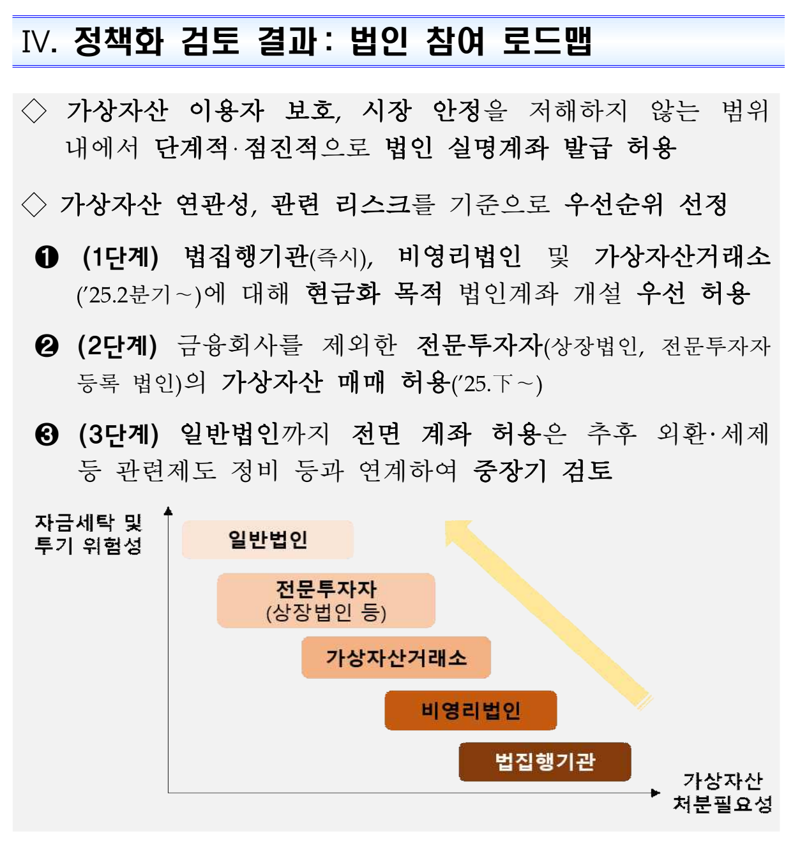

According to the National Assembly of the Republic of Korea and the virtual asset industry on the 14th, the Financial Services Commission (FSC) is reviewing the second phase of its 'roadmap for corporate participation in the virtual asset market,' announced in February. However, it appears unlikely that the measures will be implemented this year. The government had previously allowed nonprofit organizations to sell virtual assets for cash (phase one) in June, and planned to pilot investment transactions for listed companies and registered institutional investors in the second half. Approximately 2,500 listed companies and 1,000 registered institutional investors were expected to be eligible.

However, the virtual asset market environment has changed rapidly in the second half of the year, deepening the authorities’ concerns. The stock price volatility and financial vulnerabilities of Digital Asset Holding (DAT) Companies such as Strategy Inc and Bitmine Immersion Technologies Inc. have come under scrutiny. There is growing demand for sophisticated internal controls to mitigate the risks associated with company valuations being linked to virtual asset prices.

The delay in the second phase of legislation, which covers regulations on the business activities of virtual asset service providers and rules for stablecoins, has also played a role. According to the government’s roadmap, expanding corporate participation is contingent upon the completion of the second phase of legislation and the establishment of a comprehensive Anti-Money Laundering (AML) framework.

The virtual asset industry, which had anticipated the opening of the corporate market in the second half of this year, has expressed frustration. An official from a virtual asset exchange remarked, “We have completed preparations for B2B services, but the approval for listed companies to trade Bitcoin (BTC) has been postponed, which is disappointing. The opening of the corporate market is essential for increasing overall trading volume and revitalizing small and mid-sized KRW Markets.”

Some in the industry are concerned that the delay in corporate capital inflows is intensifying the 'Galapagos effect' in the domestic market. Unlike overseas markets such as the U.S., where institutional investors play a significant role, the Korean virtual asset market is dominated by retail investors. Without institutional participation, it is difficult to reduce market volatility and achieve healthy growth.

Nonetheless, behind-the-scenes discussions between the financial authorities and the industry are ongoing. A representative of a virtual asset service provider stated, “At a recent meeting chaired by the FSC, there was a focused discussion on internal controls, such as split trading to mitigate market shocks from large-scale corporate trades, and measures to prevent price manipulation. Although the introduction is being delayed, practical coordination is in its final stages.”

Within and outside the National Assembly of the Republic of Korea, it is believed that the timing for allowing corporate accounts will coincide with the legislative schedule early next year. With members of the Democratic Party of Korea (DPK) on the National Policy Committee pushing for the second phase of legislation, there is a strong possibility that detailed guidelines for corporate participation will be finalized as early as late January or early February next year.

In the securities industry, there are expectations that the regulatory framework for the virtual asset market will be completed next year. Sung-wook Hong, a researcher at NH Investment & Securities, predicted, “Starting with the government’s announcement on stablecoins, a series of regulatory events—including the proposal of the Act on the Protection of Virtual Asset Users, the passage of Security Token Offering (STO) legislation, and discussions on a Spot Bitcoin ETF—will unfold in early 2024.”

elikim@fnnews.com Kim Mi-hee Reporter