Dunamu Inc. Faces Key Regulatory Review for Merger... Challenge Remains in Interpreting ‘FIU Sanctions’ [Crypto Briefing]

- Input

- 2025-12-08 14:03:48

- Updated

- 2025-12-08 14:03:48

[Financial News] Dunamu Inc. is making every effort to adjust the level of sanctions imposed by the Financial Intelligence Unit (FIU). Previously, the Financial Intelligence Unit (FIU) under the Financial Services Commission (FSC) imposed business suspension and fines on Dunamu Inc., prompting the company to actively respond through administrative litigation. This is aimed at preventing any negative impact on the Financial Supervisory Service (FSS)’s review of the merger between NAVER and Dunamu Inc.

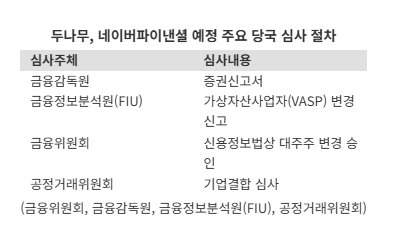

According to the virtual asset industry on the 8th, the main approval procedures that Dunamu Inc. and NAVER Financial Corporation must undergo for a comprehensive stock swap include: submission of a securities registration statement to the Financial Supervisory Service (FSS); review of the change report for virtual asset service provider (VASP) by the FIU; approval of major shareholder change by the FSC; and business combination review by the Korea Fair Trade Commission (KFTC).

First, both companies are expected to submit their securities registration statements and undergo review by the FSS. The FSS is reportedly examining not only formal requirements but also the level of shareholder rights protection, internal controls, and system stability.

The FSS is also expected to review the details of the sanctions imposed on Dunamu Inc. by the FIU. In February, the FIU found that Dunamu Inc. had transacted with unregistered overseas virtual asset service providers and violated customer due diligence (KYC) obligations, thereby breaching the Act on Reporting and Use of Specified Financial Transaction Information. As a result, a partial business suspension order was issued. On the 6th of last month, a fine of 35.2 billion KRW was also imposed in connection with this case.

Dunamu Inc. has initiated administrative litigation in response. At the administrative hearing with the FIU on the 4th, Dunamu Inc.’s legal representative argued, “The situation has been reported in the media mainly from the FIU’s unilateral perspective, and local authorities are inundating our overseas subsidiaries with requests for clarification.” He further emphasized, “There are significant de facto restrictions related to the recently reported major mergers and acquisitions (M&A).”

Currently, Dunamu Inc. is focusing its efforts on adjusting the level of the ‘business suspension order’ sanction. The sanctions imposed on Dunamu Inc. for violating the Act on Reporting and Use of Specified Financial Transaction Information include a business suspension order and a fine. While a fine can be imposed for a simple violation of Article 8 of the Act, a business suspension order requires proof of intent or gross negligence.

For Dunamu Inc., which needs to build trust to pass the merger review, whether there was intent or gross negligence is a sensitive matter. During the hearing, Dunamu Inc. stated, “The FIU concluded that there was intent or gross negligence and issued a business suspension order, but there is no evidence that Dunamu Inc. was aware of the possibility of transacting with unregistered service providers at the time.” They added, “We have faithfully cooperated with the FIU and submitted a written commitment to take the best possible measures, so labeling this as gross negligence is unjust.”

A recent hacking incident at Upbit involving 44.5 billion KRW has also emerged as an unexpected variable. Under current law, there are no direct provisions holding virtual asset service providers liable for sanctions or compensation in the event of a hacking incident. While direct sanctions may be difficult, concerns remain that the incident could negatively affect the merger review. On the 1st, Lee Chanjin, Governor of the FSS, commented on the Upbit hacking incident, stating, “This is not a matter that can simply be overlooked.” He added, “Since this incident threatens trust in the most critical aspect of virtual assets—system security—we will review whether additional measures are needed in the second phase of legislation.”

A Dunamu Inc. representative stated, “The ongoing administrative litigation and the newly imposed fine are separate matters. We have not yet determined our position regarding the fine.” He added, “Regarding the hacking incident, we are taking measures to prevent substantial damage to our members and are strengthening security.”

yimsh0214@fnnews.com Im Sang-hyuk Reporter