Bitcoin Volatility Shakes DAT Companies... Strategy Inc Facing Bankruptcy? [Crypto Briefing]

- Input

- 2025-12-04 16:34:18

- Updated

- 2025-12-04 16:34:18

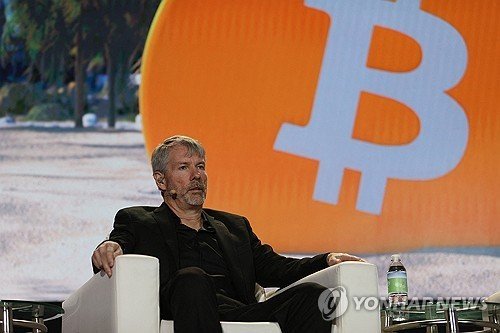

[Financial News] Recent price swings in Bitcoin (BTC) have sent shares of Digital Asset Treasury (DAT) companies like Strategy Inc into turmoil, shaking even institutional investors’ indirect crypto investment channels. With the possibility of removal from the Morgan Stanley Capital International (MSCI) index being raised, market anxiety is mounting. DAT companies are publicly listed firms that directly hold and manage crypto assets, serving as a vehicle for institutions to gain indirect exposure to assets like Bitcoin.

According to global financial information platform Investing.com, Bitcoin (BTC) has dropped more than 12% over the past month, hovering around $93,000. During the same period, shares of Strategy Inc, a leading DAT company, plunged nearly 30%. On the 1st, when BTC fell to $83,000, Strategy Inc’s stock fluctuated between $155.61 and $172.18 during the session, showing volatility exceeding 10%.

Analysts note that because Strategy Inc has increased its Bitcoin holdings to boost corporate value, it is directly exposed to BTC’s volatility. According to Bitcoin Treasury, Strategy Inc currently holds approximately 650,000 BTC, accounting for about 80% of its total assets.

The simultaneous instability in both Bitcoin and Strategy Inc is attributed to ongoing discussions about MSCI index rebalancing. MSCI will collect opinions until the 31st and announce in mid-January next year whether companies with large crypto holdings will be excluded. J.P. Morgan estimates that if MSCI removes Strategy Inc from the index, up to $2.8 billion in passive funds could flow out, which would be seen as a structural negative for the crypto market.

However, some argue that fears of Strategy Inc’s bankruptcy are exaggerated. Xangle Research emphasized, “While we cannot completely rule out the possibility of Bitcoin sales by Strategy Inc in extreme scenarios, its current capital structure is robust enough to be considered safe from external shocks.” According to Xangle’s analysis, Strategy Inc has secured a collateral ratio of 6.6 times for its convertible bonds (CBs) maturing between 2028 and 2032, totaling about $8.2 billion. This means the value of BTC held by Strategy Inc is more than six times its debt, so even if BTC prices plunge over 80% from current levels, a default would not occur.

Nevertheless, the premium for DAT companies is expected to gradually decline in the long term. Hong Jin-hyun, a researcher at Samsung Securities, predicted, “While the number and types of DAT companies will increase next year, unlike this year, the DAT premium will decrease significantly.” He added, “The success of DAT companies will depend on their management capabilities. The key will be how much cash flow they can generate through operations such as staking, decentralized finance (DeFi), and prime brokerage.” However, Ethereum-based DAT companies are expected to maintain their competitiveness. Hong assessed, “Compared to Bitcoin DAT strategies, Ethereum DAT companies have advantages in regulation, security, and operational efficiency.”

elikim@fnnews.com Kim Mi-hee Reporter