"I Receive 680,000 Won, but Someone Gets 3.18 Million Every Month?" The Secret to Maximizing National Pension Benefits

- Input

- 2025-11-28 11:20:01

- Updated

- 2025-11-28 11:20:01

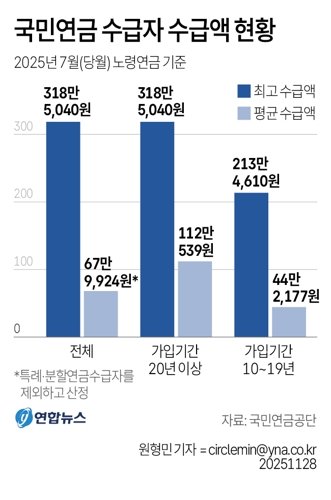

[Financial News] A case has emerged of an old-age pension recipient receiving more than 3 million won per month from the National Pension Service (NPS), drawing attention. Given that the average monthly benefit for all old-age pension recipients is about 680,000 won, this highlights the significant gap in payouts based on contribution periods.

According to the 'National Pension Statistics as of July 2025' released by the National Pension Service (NPS) on the 28th, the highest monthly benefit currently received by an NPS recipient is 3,185,040 won. This amount, which essentially serves as living expenses in retirement, is the result of increasing the pension amount through options such as applying for Deferred Pension or maintaining a long contribution history.

NPS: Average Benefits Vary by Contribution Period...

Overall Average: 680,000 Won; Over 1.12 Million Won for Those with 20+ Years of Contributions

Overall Average: 680,000 Won; Over 1.12 Million Won for Those with 20+ Years of Contributions

A key point is the difference in average benefits depending on the contribution period. The average monthly benefit for all old-age pension recipients is 679,924 won. Since this is lower than the maximum Livelihood Benefit for a single-person household (770,000 won), some question the effectiveness of the pension.

However, the NPS determines benefits proportionally to the length and amount of contributions. In fact, recipients of the Full Old-age Pension—those with more than 20 years of contributions—receive an average of 1,120,539 won per month, far exceeding the overall average.

On the other hand, those who contributed for 10 to 19 years receive an average of just 442,177 won per month. Ultimately, maintaining employment or regional contributions for over 20 years allows recipients to secure a pension that goes beyond basic subsistence.

A breakdown by benefit amount provides a clearer picture of the current state of the NPS. The largest group—about 2.17 million recipients—receives between 200,000 and 400,000 won per month, but the number of high-benefit recipients is steadily increasing. Notably, around 850,000 people receive more than 1 million won monthly, and 82,484 people receive over 2 million won.

The total number of pension recipients is also steadily rising. As of the end of July 2025, the cumulative number of NPS recipients (including lump-sum payments) reached 7,544,930, with 7,338,371 receiving monthly benefits. By type, old-age pension recipients make up the majority at about 6.2 million, followed by 1.07 million receiving the Survivor's Pension and 68,000 receiving the disability pension.

To Receive More from the NPS, 'Long-Term Contributions' Are Essential

These figures indicate that the NPS has become a major pillar of retirement income compared to the past. As the National Pension System, introduced in 1988, matures, the quality of retirement security increasingly depends on how long and consistently one pays into the system.

The latest statistics show that 'long-term contributions' are essential for the NPS to function as a reliable retirement safety net. Experts advise that the NPS should be viewed as an investment in the future rather than a simple tax. They recommend actively utilizing the Credit System and the Lump-sum Payment System for Missed National Pension Contributions to increase benefits—a strategy referred to as 'pension financial planning.'

bng@fnnews.com Kim Hee-sun Reporter