629,000 People Subject to Comprehensive Real Estate Holding Tax This Year, Totaling 5.3 Trillion Won—Over 80% Reside in the Seoul Metropolitan Area

- Input

- 2025-11-26 16:00:00

- Updated

- 2025-11-26 16:00:00

[Financial News] This year, 629,000 people are subject to the Comprehensive Real Estate Holding Tax. Of these, 540,000 are liable for the residential portion, with an average tax of 1.606 million won per person. Six out of ten taxpayers are located in Seoul.

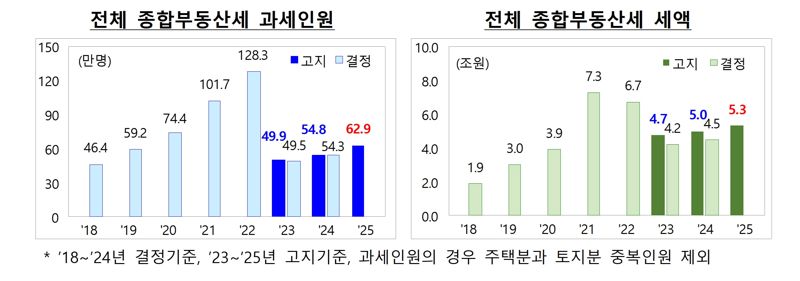

According to the Ministry of Economy and Finance and the National Tax Service (NTS) on the 26th, the total number of people subject to the Comprehensive Real Estate Holding Tax on both residential and land properties increased by 14.8% (81,000 people) from last year, reaching 629,000. The total amount of tax assessed rose by 6.1% (300 billion won) to 5.3 trillion won.

Given that there were no major changes to the Comprehensive Real Estate Holding Tax system, the increase is attributed to new housing supply, a 3.65% rise in the official prices of apartment complexes nationwide, and a 2.93% increase in the officially assessed land values.

The growth in the tax was mainly driven by the residential portion. The number of people taxed for residential properties rose by 17.3% (80,000 people) to 540,000 compared to last year. The total tax for this segment amounted to 1.7 trillion won, up 6.3% (100 billion won) year-on-year.

Among individuals, 481,000 people are liable for the residential portion of the Comprehensive Real Estate Holding Tax, with a total tax of 771.8 billion won. These figures represent increases of 19.9% and 32.5%, respectively, from last year. Of these, 151,000 single-homeowners saw a 17.8% (23,000 people) increase, with their total tax rising by 43.8% (51.1 billion won) to 167.9 billion won.

The number of multi-homeowners subject to the tax reached 330,000, up 20.9% (57,000 people) from last year, and their total tax liability increased by 29.7% (138.4 billion won) to 603.9 billion won. For corporations, 59,000 entities were taxed for residential properties, a slight decrease of 0.2% (146 entities) from last year, and their total tax fell by 8.6% (88.3 billion won) to 900 billion won.

The average Comprehensive Real Estate Holding Tax per individual rose by 10.5% (153,000 won) from last year, reaching 1.606 million won. All 17 regions saw an increase in the number of people taxed. Seoul, which had the highest increase in the officially assessed price of apartment complexes at 7.86% in 2025, recorded a 21% rise in the number of taxpayers. Incheon and Gyeonggi Province followed with increases of 19% and 15.7%, respectively.

The National Tax Service began mailing Comprehensive Real Estate Holding Tax notices on the 24th. The payment deadline is December 15. Certain eligible senior citizens who own a single home may defer payment.

An official from the Ministry of Economy and Finance explained, "Although the final tax amount is usually lower than the assessed amount due to many taxpayers applying for special provisions after receiving their notices, both the number of taxpayers and the total tax amount are expected to rise slightly compared to last year."

syj@fnnews.com Seo Young-jun Reporter