"SK hynix Average Purchase Price at 610,000 Won, 500 Million Won Bet"—Public Servant’s Debt-Fueled Investment Post Sparks Stir Online

- Input

- 2025-11-26 14:49:24

- Updated

- 2025-11-26 14:49:24

[Financial News] As the scale of so-called 'leveraged investments'—borrowing heavily to invest at market highs—reaches record levels, concerns about investor losses are mounting. It is increasingly common to see individuals sharing their leveraged investment situations and anxieties online.

"Invested my entire fortune with a loan"... Post by a public servant

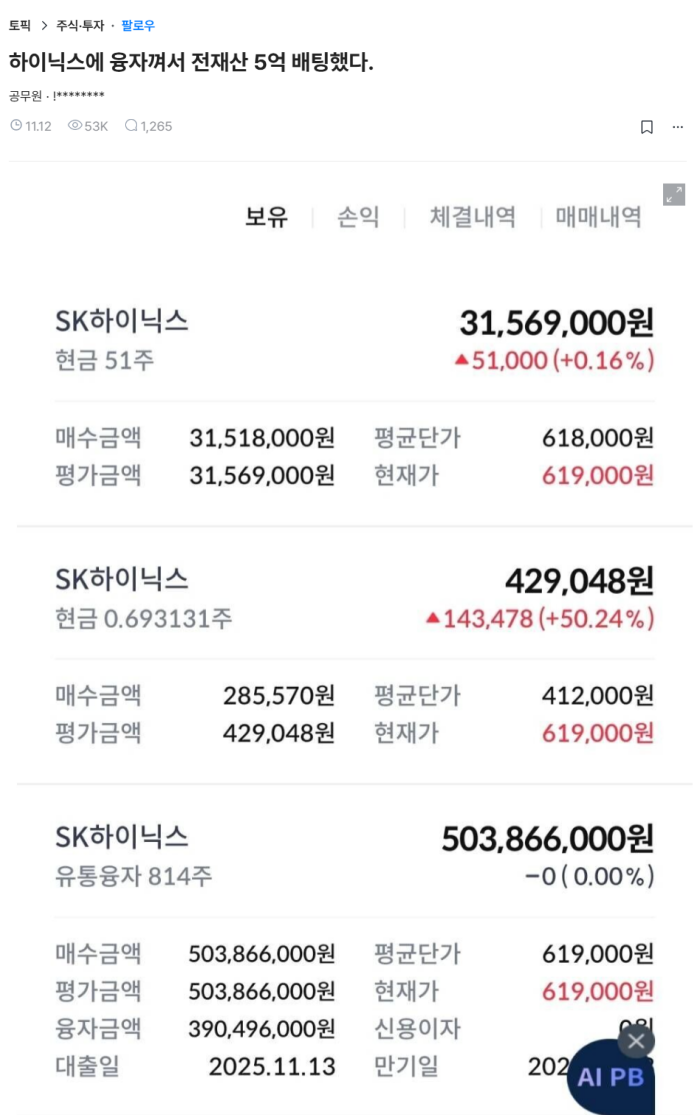

A notable example is a post by a public servant, identified as Mr. A, on the workplace community Blind on the 12th. Mr. A shared his investment details under the title, "Betting my entire fortune of 500 million won on SK hynix with a loan."

According to the investment details verified by Mr. A, he invested approximately 535 million won in SK hynix. The issue is that his average purchase price per share was around 619,000 won, which corresponds to a recent market peak. Mr. A’s story of taking out a loan to invest at the top quickly spread online, drawing widespread concern. Over 1,200 comments poured in, ranging from ridicule—"Caught at the peak with borrowed money"—to encouragement such as "You’ll recover soon enough."

Retail investors with leveraged positions face risk of forced liquidation... Warnings intensify

This is not an isolated case. Recently, SK hynix shares have experienced significant volatility, with daily drops exceeding 10%. As a result, retail investors who entered at the peak with borrowed funds are now at risk of margin calls and forced liquidation.

According to data from the Korea Financial Investment Association (KOFIA), the margin loan balance for SK hynix has recently approached or even surpassed 1 trillion won, reaching an all-time high. Despite ongoing debate about whether the stock is at its peak as it fluctuates in the 500,000 won range, individual investors continue to join the buying spree, viewing market corrections as opportunities and taking on more debt.

The main risk is forced liquidation if the stock price declines. If an investor’s collateral ratio for margin loans falls below a certain threshold (typically 140%), securities companies may forcibly sell the shares at the start of the next trading day to recover the loan. Experts warn that excessive leverage in a volatile market can easily lead to margin calls, urging investors to exercise caution.

bng@fnnews.com Kim Hee-sun Reporter