[Editorial] OECD Ranks Korea 9th in Corporate Tax Rate; Further Increases Will Discourage Investment

- Input

- 2025-11-24 18:26:44

- Updated

- 2025-11-24 18:26:44

Business circles argue that, especially amid tighter labor regulations and rising overseas investment, the government should refrain from raising corporate taxes to prevent a decline in domestic investment.

The effective corporate tax rate reflects not only the nominal rate but also various macroeconomic indicators such as deductions, inflation, and interest rates, representing the actual tax level faced by companies. Because it more closely influences management decisions than a simple comparison of nominal rates, it is considered a crucial indicator of corporate competitiveness.

The recent increase in Korea’s effective corporate tax rate is attributed to a reduction in tax relief measures, which has limited companies’ ability to cut costs. In fact, since 2013, the R&D tax credit rate for large corporations has been steadily declining.

Additionally, the government’s strengthened tax audits have increased the taxable income base for companies, further adding to the burden. While it is necessary to streamline special tax regimes and broaden the tax base, excessive measures could dampen companies’ willingness to invest.

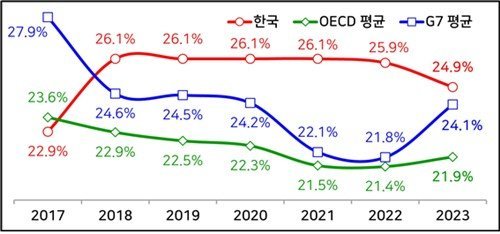

Korea’s ranking for effective corporate tax rate rose from 19th in 2017 to 12th in 2018, 10th in 2020, and has remained at 9th since 2021. Countries with higher rates than Korea—such as Colombia, Australia, Portugal, Republic of Costa Rica, Mexico, and Germany—are not in direct competition with Korean companies.

In contrast, China, Korea’s fiercest rival in export markets, has an effective corporate tax rate 1.9 percentage points lower than Korea. This tax burden gap inevitably translates into differences in price competitiveness in the global market.

Nevertheless, the government continues to discuss raising the nominal corporate tax rate. Since the administration’s launch, the Democratic Party of Korea (DPK) and economic ministries have debated the ineffectiveness of tax cuts and considered restoring corporate tax rates to previous levels. Recently, proposals have included a 1 percentage point increase by bracket and higher rates for large corporations. While other countries are lowering rates and expanding investment tax credits to attract corporate investment, Korea appears to be moving in the opposite direction.

Currently, global companies are enhancing their competitiveness in advanced industries such as artificial intelligence and semiconductors with government support. In contrast, as Korean companies grow, they face structural limitations due to overlapping regulations and additional obligations. According to an analysis by the Korea Chamber of Commerce and Industry (KCCI), Korean companies are subject to 342 stepwise regulations under 12 different laws. If the corporate tax burden increases further under these circumstances, Korean companies will face multiple layers of pressure—regulation at home and intensified price competition abroad.

Recently, President Lee Jae-myung remarked at a joint public-private meeting, "If you have to cut taxes just to do business, there is a problem with international competitiveness," and, "Fiscal demands must also be met." This is interpreted as meaning that, considering fiscal conditions, companies should contribute through taxes to some extent. However, companies are already squeezing every possible cost-saving measure.

If corporate taxes are raised under these circumstances, companies will inevitably have less capacity for new investment and job creation. The government must exercise caution with corporate tax policies that affect national competitiveness.