Token Securities Bill Reviewed by National Assembly Policy Committee... Likely to Pass Plenary Session This Year [Crypto Briefing]

- Input

- 2025-11-24 15:40:22

- Updated

- 2025-11-24 15:40:22

[Financial News] The National Assembly of the Republic of Korea has begun reviewing legislation to institutionalize token securities (STO). With no significant disagreements between the ruling and opposition parties, the bill is highly likely to pass the plenary session within the year. Following the enactment of related enforcement ordinances, the market is expected to open in the first half of next year.

On the 24th, the National Policy Committee held its first subcommittee meeting to begin reviewing amendments to the 'Act on the Capital Market and Financial Investment Business' and the 'Act on Electronic Registration of Stocks, Bonds, etc.'—both related to the institutionalization of token securities.

A representative from the office of Kang Jun-hyeon, the ruling party's secretary of the National Policy Committee and chair of the first bill review subcommittee, stated, "We are working to process the bill today." He added, "If the review of the token securities bill is delayed due to the overall legislative schedule, we plan to hold an additional subcommittee next month to ensure its passage within the year." With bipartisan consensus, the prevailing view inside and outside the National Assembly is that the bill will likely pass the plenary session this year. Considering the timeline for preparing related enforcement ordinances, the market is expected to open in the first half of next year.

The reason the National Assembly and authorities are accelerating the institutionalization of token securities is the significant market potential. According to Boston Consulting Group (BCG), the domestic token securities market is expected to grow from 119 trillion KRW next year to 367 trillion KRW by 2030. Token securities serve as a means to simultaneously realize the government's policies of 'alleviating real estate concentration through stock market revitalization' and 'establishing a digital asset hub.' Assets such as real estate, artwork, and intellectual property rights can be issued in token form and, recognized as 'securities' under the Capital Markets Act, traded legally.

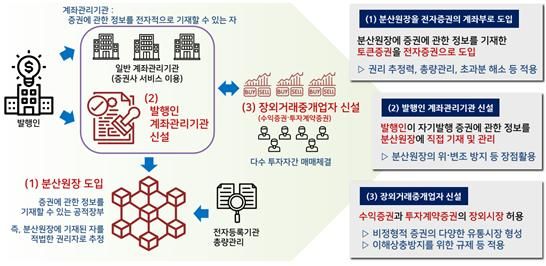

The token securities bills, proposed by Kang Jun-hyeon, Min Byung-duk, and Cho Seung-rae of the Democratic Party, as well as Kim Jae-seop of the People Power Party, establish a legal foundation for qualified issuers to use blockchain (distributed ledger) technology to issue new token securities and trade them on over-the-counter exchanges.

The Financial Services Commission (FSC) also plans to select up to two candidates for preliminary approval as fractional investment over-the-counter exchange (distribution platform) operators within the year, supporting the issuance and distribution of token securities. The FSC is currently reviewing the KDX, NXT, and Ownership Consortiums, led by Korea Exchange (KRX), Nextrade, and Lucentblock, respectively. Consortia that receive preliminary approval this year can apply for final approval after meeting human and physical requirements, and may begin operations upon receiving final approval from the FSC.

The financial investment industry has also completed preparations for market opening. Korea Securities Depository (KSD) has established a 'total volume management system' to monitor the issuance and distribution of token securities and is considering using stablecoins for token securities settlements. Securities firms are also developing their own platforms. Hana Securities participated in a testbed project led by KSD. Mirae Asset Securities, together with Hana Financial Group and SK Telecom, formed the Next Finance Initiative (NFI) to develop its own token securities issuance system (mainnet). Shinhan Securities, NH Investment & Securities, and KB Securities are also building collaborative models as they prepare to enter the market.

Beomjun Shin, chair of the Token Securities Council at the Korea Fintech Industry Association (KFIA), predicted, "With the institutional infrastructure for token securities already in place, the market can open immediately once the bill is passed." He added, "This will mark Korea's official entry into the global digital finance competition."

[email protected] Kim Mi-hee Reporter