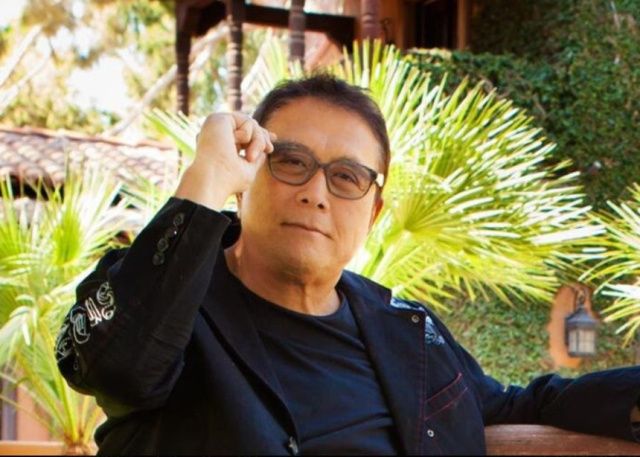

"Rich Dad" Robert Kiyosaki Once Predicted Bitcoin Would Hit $1.4 Million—Here’s What He Said as Prices Fell

- Input

- 2025-11-17 08:49:53

- Updated

- 2025-11-17 08:49:53

[Financial News] As Bitcoin (BTC), the leading cryptocurrency, continued its downward trend and fell below $95,000 for the first time since early May, Robert Kiyosaki, author of the bestseller "Rich Dad Poor Dad," reaffirmed his commitment to holding for the long term and stated he has no intention to sell. He cited 'liquidity shortage' as a key factor behind market instability and predicted that the value of Gold, Silver, Bitcoin (BTC), and Ethereum would become even more prominent in the upcoming phase of monetary expansion.

According to Cointelegraph on the 15th (local time), Kiyosaki recently posted on his social media, analyzing that the global liquidity crunch is affecting all asset classes.

He stated, "I agree with those who believe that governments around the world will eventually implement large-scale money printing, so-called 'big print,' to resolve the mounting debt burden," adding that this process will likely drive up the value of real assets and major cryptocurrencies.

Kiyosaki continued, "Investors with short-term cash needs may consider liquidating some assets," but clarified, "This is not a value judgment, but rather a move to secure liquidity."

He emphasized, "The supply of BTC is limited to 21 million units. If you wait until the bear market ends, you may end up buying at a higher price than now."

He also pointed out, "Only those who need cash due to fear in the market are selling," and mentioned that he has no reason to liquidate his holdings since his cash flow is sufficient.

Kiyosaki declared, "I will continue to hold Bitcoin (BTC), Gold, Silver, and Ethereum," adding, "The current downturn is only temporary, and in the long term, scarcity and inflation-hedging will enhance their value."

He criticized inflation, excessive government spending, and debt issues, explaining, "Governments will print more money to cover these debts." He further noted, "As a result, the value of fiat currencies will inevitably decline." In this context, he has consistently maintained that scarce assets like BTC are attractive as a means of asset protection.

Regarding this, Kiyosaki commented, "Personally, rather than trying to buy at a lower price after a crash, I look at the long-term market cycle when deciding when to buy," and stated, "Once the BTC crash is over, I will buy more."

Previously, in April, Kiyosaki predicted that BTC would eventually reach $1 million. He remarked, "These assets will undergo price corrections in the short term," and indicated his plan to make additional purchases during downturns.

He further asserted, "In the long run, by 2030, BTC will surpass $1 million, and Gold will exceed $30,000 per ounce," adding, "Silver is also highly likely to surge due to industrial demand and changes in the global monetary system."

hsg@fnnews.com Han Seung-gon Reporter