Korea-China Reversal Within 5 Years... "All 10 Key Industries Expected to Lose to China"

- Input

- 2025-11-17 06:00:00

- Updated

- 2025-11-17 06:00:00

[The Financial News] Following steel and display, it is now projected that by 2030, all of Korea’s top 10 export industries—including semiconductors, electrical and electronics, and shipbuilding—will be overtaken by China. The phrase 'China’s pursuit' may become obsolete within just five years. The seriousness of the situation is underscored by the fact that these are the actual forecasts from leading Korean exporters. It is now a critical moment that calls for extraordinary measures to secure the competitiveness of Korea’s core industries.

On the 17th, The Federation of Korean Industries (FKI) released a report titled 'Competitiveness Status and Outlook of Korea, USA, Japan, and China.' The survey targeted the top 1,000 companies by sales in the 10 major export industries, with responses from 200 firms. Korea’s 10 key export sectors are semiconductors, displays, electrical and electronics, automobiles and automotive parts, general machinery, ships, rechargeable batteries, ships, petrochemicals and petroleum products, and biohealth.

■ China Has Already Surpassed Korea in Steel, Batteries, and AutomobilesWhen asked which country is Korea’s biggest export competitor this year, 62.5% of companies named China. The USA followed at 22.5%, with Japan at 9.5%. Looking ahead to 2030, 68.5% of respondents still identified China as the main competitor, followed by the USA (22.0%) and Japan (5.0%). The proportion naming China rose by 6 percentage points, indicating expectations of even fiercer export competition with China in the years to come.

When Korean corporate competitiveness was set at 100, companies rated the USA at 107.2, China at 102.2, and Japan at 93.5. By 2030, these figures are projected to rise to 112.9 for the USA, 112.3 for China, and 95.0 for Japan. This suggests the gap with US and Chinese companies will continue to widen. FKI stated, "Korean companies believe our corporate competitiveness has already fallen behind the USA and China, and that the gap will only grow over the next five years." Notably, China’s corporate competitiveness is expected to reach parity with the USA within five years.

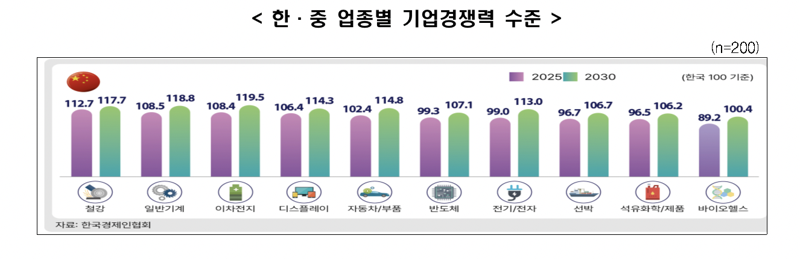

Comparing Korea’s industry-specific competitiveness (set at 100) to China’s, the results show that China already leads in five sectors: steel (112.7), general machinery (108.5), rechargeable batteries (108.4), display (106.4), and automobiles and automotive parts (102.4). China’s battery industry is already number one in the world by sales, and its electric vehicle (EV) sector is competing with Tesla, Inc. for the top spot.

■ In Five Years, Semiconductors and Shipbuilding Will Also Be OvertakenCurrently, Korea is still considered more competitive than China in five sectors: semiconductors (99.3), electrical and electronics (99.0), ships (96.7), petrochemicals and petroleum products (96.5), and biohealth (89.2). However, by 2030, China is expected to surpass Korea in all 10 major industries.

When comparing with the USA, Korea is currently ahead in only three sectors: steel (98.8), ships (90.8), and rechargeable batteries (89.5). In the other seven sectors, including semiconductors (118.2) and biohealth (115.4), the USA leads. By 2030, companies expect the USA to overtake Korea even in steel (100.8), leaving ships (90.0) and rechargeable batteries (93.4) as the only sectors where Korea will remain ahead.

Companies cited weakening domestic product competitiveness (21.9%) and increasing external risks (20.4%) as the main obstacles to improving competitiveness. Other challenges included sluggish domestic demand due to population decline (19.6%), a shortage of core technology talent such as artificial intelligence (AI) experts (18.5%), and outdated labor markets and corporate regulations compared to competitors (11.3%).

Industry leaders emphasize that, as Korea’s industrial sector faces a structural transition critical to its survival, there is a need for intensive government support for future technologies, focusing on companies with core competitiveness such as Samsung Group, Hyundai Motor, SK Group, and LG Group.

one1@fnnews.com Jung Won-il Reporter