Despite Land Transaction Permit Restrictions, Home Prices Rise...Regulated Areas See Greater Increases Than Non-Regulated Areas

- Input

- 2025-11-14 10:22:52

- Updated

- 2025-11-14 10:22:52

[Financial News] One month after the announcement of the October 15 Real Estate Policy, apartment sale prices in newly designated Land Transaction Permit Zones in Seoul and Gyeonggi Province have increased compared to just before the policy.

On the 14th, Ziptoss, a real estate agency, analyzed transaction data from the Ministry of Land, Infrastructure and Transport (MOLIT) before and after the implementation of the October 15 Real Estate Policy. The results showed that the average apartment sales price in the newly regulated areas of Seoul and Gyeonggi Province rose by 1.2% each.

This analysis focused on apartments where at least one transaction occurred in the same complex and for the same unit size during both October 1–19 and October 20–November 12, with October 20 marking the expansion of the Land Transaction Permit Zone.

The findings revealed that high-end apartments led the upward trend. Of the 66 record-high transactions in newly regulated areas of Seoul (excluding the Gangnam 3 Districts), 40 cases (61%) involved apartments priced over 1.5 billion won.

In the Gangnam 3 Districts, which had already been under Land Transaction Permit restrictions before the policy, the average sales price rose by 2.2% in just one month. These districts accounted for 288 record-high transactions, representing 81% of all such deals in Seoul.

Notably, the October 15 Real Estate Policy’s strengthened requirements for owner-occupancy have further fueled the preference for newly built apartments. In Seoul, apartments less than 10 years old saw the highest average price increase at 3.4%, nearly double that of apartments over 30 years old (2.0%) or those aged 11–29 years (1.4%).

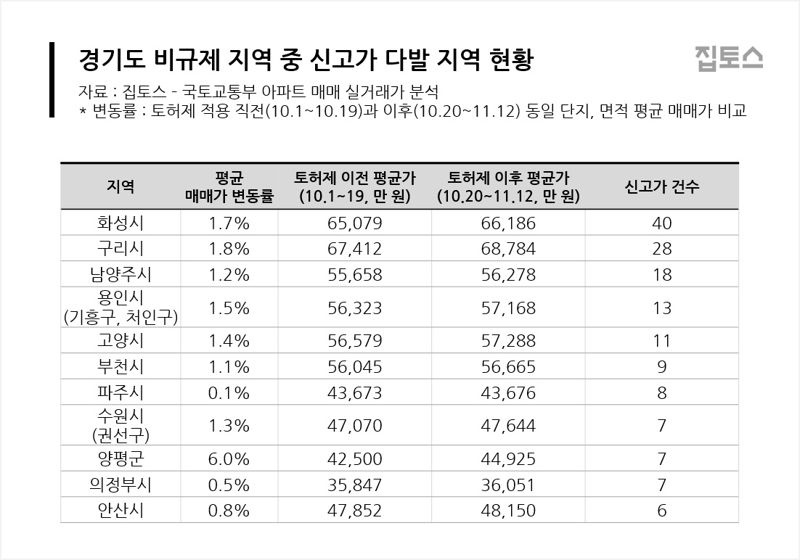

Additionally, a 'balloon effect' was observed as demand shifted to non-regulated areas adjacent to Gyeonggi Province. After the policy, the average sales price in non-regulated areas of Gyeonggi Province rose by 1.1%. There were 182 record-high transactions, which is 61 times more than the three in regulated areas of Gyeonggi Province and 2.8 times more than the 66 in newly regulated areas of Seoul during the same period.

The surge in prices and record-high transactions was concentrated in areas with good access to Seoul. In Guri-si, the average sales price increased by 1.8%, with 28 record-high transactions. Hwaseong City also saw a 1.7% rise and led with 41 record-high deals.

Other notable areas included Yongin City (+1.5%, 13 record-high transactions), Goyang (+1.4%, 11 record-high transactions), and Namyangju-si (+1.2%, 18 record-high transactions). These five cities accounted for about 60% (110 cases) of the 182 record-high transactions in all non-regulated areas of Gyeonggi Province.

Jaeyoon Lee, CEO of Ziptoss, commented, "This policy has further accelerated the concentration of demand on a single, high-quality property. While transaction volume in regulated areas has sharply declined, making the rise in home prices appear to slow, the buying trend for high-end apartments continues, and the polarization of asset values is expected to intensify."

act@fnnews.com Choi Ah-young Reporter