Tripled in Six Months... DRAM Shortage Brings Smiles to Samsung and SK hynix

- Input

- 2025-11-09 09:08:05

- Updated

- 2025-11-09 09:08:05

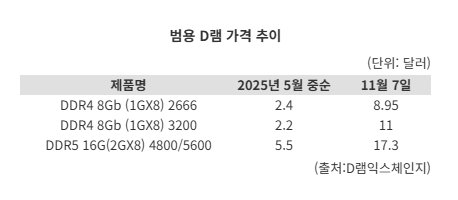

According to DRAMeXchange, a market research firm, the price of general-purpose DRAM has been rising sharply since mid-May.

For example, the price of Double Data Rate 4 Synchronous Dynamic Random-Access Memory (DDR4) 8Gb (1GX8) 2666, which was $2.4 on May 21, soared to $8.95 by the 5th. This is a 3.7-fold increase in just six months. During the same period, the price of DDR4 8Gb (1GX8) 3200 jumped from $2.2 to $11, marking a fivefold surge. The price of Double Data Rate 5 Synchronous Dynamic Random-Access Memory (DDR5) is also climbing rapidly. DDR5 16G (2GX8) 4800/5600 rose significantly from $5.5 on May 16 to $17.3 on the 5th, and surpassed $20 on the 7th.

The main reason for this sharp increase in DRAM prices is that demand far outpaces supply. The 'AI boom' has led memory manufacturers to significantly expand production of High Bandwidth Memory (HBM), naturally reducing the supply of general-purpose DRAM. An industry insider noted, "Even though HBM demand has grown dramatically, in terms of volume, general-purpose DRAM still dominates. Existing manufacturers are likely considering how to balance the two segments."

As a result, profitability for Samsung Electronics Co., Ltd. and SK hynix is expected to improve in the fourth quarter. In particular, analysts believe Samsung Electronics Co., Ltd., with its relatively higher production capacity, will be more significantly affected. An industry official explained, "For Samsung Electronics Co., Ltd., which must keep its factories running to produce general-purpose products, the price increase is a welcome development. The operating margin, which was in the 14% range in the third quarter, is likely to rise further."

This is also good news for SK hynix, which holds a high market share in the HBM sector. According to the semiconductor industry, SK hynix is seeking the optimal production ratio between general-purpose DRAM and HBM to maximize profitability. During its third-quarter earnings call at the end of last month, SK hynix stated, "Server demand continues to drive the general-purpose DRAM market," emphasizing its focus on both HBM and existing product lines.

Financial information provider FnGuide Inc. projects that Samsung Electronics Co., Ltd.'s operating profit in the fourth quarter will approach 15 trillion won. This represents an increase of more than 23% compared to 12.1661 trillion won in the third quarter. SK hynix is expected to surpass 13.8 trillion won.

Some believe that the shortage of general-purpose DRAM could continue into next year. If this trend persists, the profitability of both companies is expected to rise further. An industry source remarked, "If DRAM demand continues to grow, both companies could notify clients of price increases, which would likely lead to improved profitability."

kjh0109@fnnews.com Kwon Jun-ho Reporter