110 Billion Won Loan Secured with ‘Performance Bond’—38 Arrested for Fraudulent Supply Contracts

- Input

- 2025-11-07 12:13:22

- Updated

- 2025-11-07 12:13:22

[Financial News] A group that exploited guarantee products from SGI by drafting fake contracts and collecting insurance payouts has been apprehended by the police. The Metropolitan Investigation Unit Detective Mobile Team of the Seoul Metropolitan Police Agency (SMPA) announced on the 7th that it had arrested Mr. A (in his 50s), the CEO of a borrowing company, on charges including violations of the Special Act on Prevention of Insurance Fraud. In total, 38 individuals were apprehended, including 23 employees from borrowing companies, 10 from lending companies, and 5 loan brokers. The estimated damages amount to approximately 8 billion won.

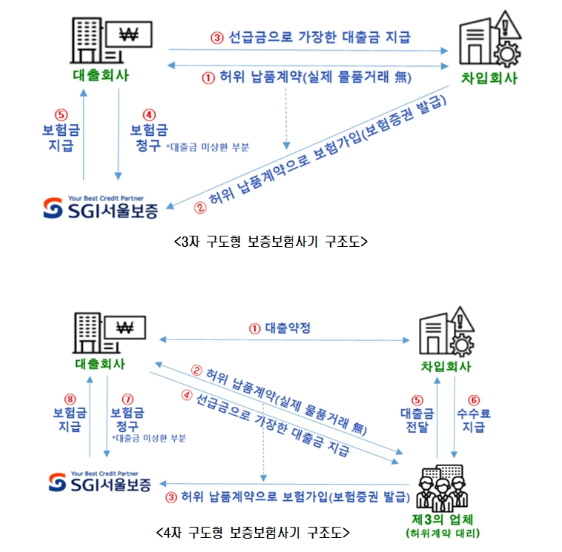

The suspects wrote fake supply contracts without any real exchange of goods, enrolled in SGI’s Performance Bond, and used the insurance policy as collateral for loans. The amounts listed as ‘payment for goods’ in the contracts were, in reality, simple loan transactions.

According to police investigations, the borrowing companies exploited the fact that it was difficult to secure loans from institutional lenders, using insurance products as a form of collateral. By enrolling in the insurance, lending companies were guaranteed principal recovery and could earn annual interest rates of 10–12% without risk, while borrowing companies obtained funds without additional collateral.

The Performance Bond they exploited is designed to compensate for losses if a client fails to receive goods after making an advance payment. It is a system premised on commercial transactions and does not apply to monetary loan agreements. However, the suspects disguised loan transactions as supply contracts, deceiving the insurer into issuing guarantee certificates.

From December 2021 to December 2022, Mr. A secured loans totaling 11 billion won from multiple lending companies across 67 transactions, enrolling in corresponding insurance policies. When he failed to repay 4.5 billion won, the lending companies claimed insurance payouts to cover their losses. Police believe Mr. A colluded with the lenders in advance to draft fake contracts and have booked them as accomplices.

Another company CEO, Mr. B (in his 50s), unable to obtain guarantee insurance due to low credit, enlisted 15 third-party firms to sign fake contracts on his behalf, paying them a 10% commission on the contract amount. From 2020 to 2023, Mr. B borrowed 4 billion won over 25 transactions, failing to repay 3.5 billion won.

The police explained that this case was not simply about borrowers committing fraud, but a structural crime involving collusion with lending companies and brokers. Although the lending companies ultimately received the insurance payouts, all parties were considered accomplices since the fake contracts were prearranged.

A police official stated, “Guarantee insurance is a system meant to ensure trust in commercial transactions, and abusing it as collateral for private loans is clearly illegal.” The official added, “We plan to expand investigations into new types of insurance fraud.” He further noted, “It is difficult to verify actual transactions with document-based reviews alone,” and stressed the need for an electronic system capable of verifying the substance of transactions.

425_sama@fnnews.com Choi Seung-han Reporter