"Mr. Kim left early yesterday"... Drinking less, but hangover remedies are in higher demand

- Input

- 2025-11-10 06:00:00

- Updated

- 2025-11-10 06:00:00

[Financial News] Despite a steady decline in domestic alcohol consumption due to the economic downturn and a decrease in company dinners, the hangover remedy market continues to grow. Recently, younger generations are drinking less and favoring their preferred beverages, while taking hangover remedies to manage their condition, rather than drinking to excess as in the past.

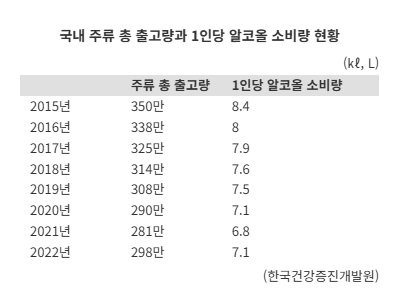

According to recent statistics and the alcoholic beverage industry, both total domestic alcohol shipments and per capita consumption have been on a continuous downward trend since around 2015.

The '2024 Alcohol Statistics Yearbook' published by the Korea Health Promotion Institute (KHPI), under the Ministry of Health and Welfare, shows that total domestic alcohol shipments fell from 3.5 million kiloliters in 2015 to 2.81 million kiloliters in 2021, a decrease of nearly 20% over six years. During the same period, per capita alcohol consumption for those aged 15 and older dropped from 8.4 liters to 6.8 liters, a 19% reduction. Although there was a slight increase in shipments and consumption in 2022, there are no signs of a rebound in domestic alcohol consumption in recent times.

While there are no official statistics on per capita alcohol consumption from 2023 to the present, industry performance and sentiment indicate that the downward trend continues. According to WiseReport, HiteJinro’s sales and operating profit for the third and fourth quarters of this year are projected to decline by 0.04% and 6.62%, respectively, compared to the same period last year. For Oriental Brewery (OB), which is not listed on the domestic market, its parent company Anheuser-Busch InBev (AB InBev) announced that sales in the first half of this year would decrease by a high single-digit percentage. The shift in drinking culture following COVID-19, along with the growth of the low-sugar beverage market, has changed consumption trends. In fact, HiteJinro, anticipating a decline in the domestic market, has been increasing soju exports to emerging markets in Southeast Asia since 2016 as part of its 'globalization of soju' strategy.

Paradoxically, while domestic alcohol consumption is declining, the hangover remedy market is expanding. According to NielsenIQ Korea, the hangover remedy market in Korea reached approximately 350 billion won last year, up 10% from the previous year. Leading products in the domestic market include CONDITION (HK inno.N), Easy Tomorrow (Samyang Corporation), and Ready Q (HANDOK). Sales of Samyang Corporation’s Easy Tomorrow Booster Zero surged to 4.36 million units as of September this year, a 70% increase from 2.57 million units a year earlier.

Recently, the hangover remedy market has seen a variety of products tailored to consumer preferences and drinking habits, including liquid, jelly, and pill forms. Notably, the Ministry of Food and Drug Safety has strengthened efficacy verification by allowing the term 'hangover relief' in advertising only for products that have passed its efficacy tests.

A representative from the hangover remedy industry commented, "Recently, even zero-calorie hangover remedies have been launched, offering more variety. In the past, people took hangover remedies after excessive drinking, but now it has become common to take them in advance, even when drinking less, to ensure a better condition the next day."

A wine industry insider also noted, "Unlike in the past, it has become common for men to prepare and take hangover remedies with their companions before drinking wine."

hwlee@fnnews.com Lee Hwan-joo Reporter