KDI: 'Reliance on Foreign Capital Investment and Declining Productivity Mirror Japan’s Path'

- Input

- 2025-11-04 12:00:00

- Updated

- 2025-11-04 12:00:00

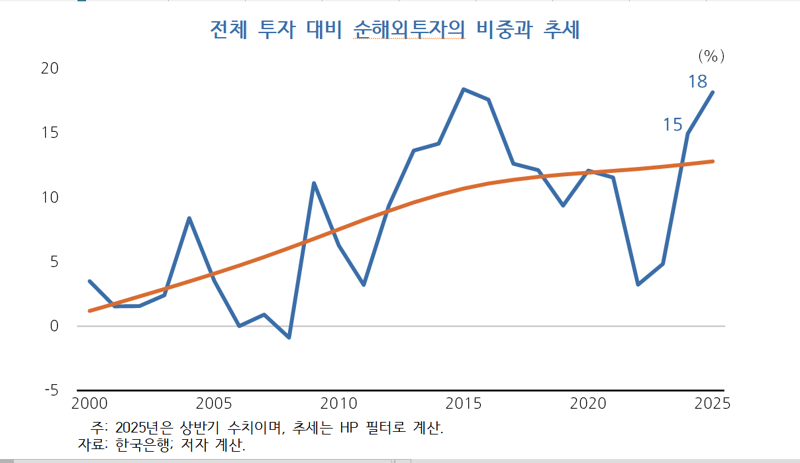

[Financial News] The Korea Development Institute (KDI) has pointed out that, due to rapidly aging demographics and slowing productivity, there is an increasing reliance on returns from overseas investments rather than domestic ones, which could have a greater long-term negative impact on the domestic economy. The institute noted that a significant portion of national income is shifting to overseas investment returns, a pattern similar to Japan, which has experienced prolonged low growth. KDI recommends that economic structural reforms must continue.

In its report released on the 4th regarding the macroeconomic background and implications of increasing overseas investment, KDI stated, "A slowdown in productivity directly reduces Gross Domestic Product (GDP) and also diminishes domestic capital accumulation," adding, "The negative impact on GDP is amplified by about 1.5 times."

KDI estimates that a 0.1 percentage point slowdown in productivity and a 0.05 percentage point reduction in domestic capital will together reduce GDP by 0.15%. As of last year, the domestic capital stock decreased by 0.7% of GDP, or about 18 trillion won, while net external assets increased by a similar amount.

The current trend of overseas investment closely resembles the pattern seen in Japan about 20 years ago. In Japan, the growth rate of the working age population (ages 15–64) fell from around 2% in 1965 to about 0.5% in 2004, and productivity growth dropped from 3% to nearly zero over the same period. Korea has shown a similar trajectory from 1985 to 2024.

Jun Hyung Kim, a research fellow at KDI, noted, "In Japan, where productivity and demographic structures are similar to Korea, a decline in productivity has significantly dampened economic vitality, and a larger share of national income now depends on returns from overseas investments."

Since the 2010s, Japan’s net exports have turned negative, but the country has maintained a current account surplus by relying on an income account balance equivalent to about 6% of GDP.

Since the mid-2000s, Korea’s Net Overseas Investment has expanded, coinciding with a period of declining domestic investment and productivity. As net external assets have grown and returns on overseas investments have outpaced those on domestic investments, the income account balance turned positive in the 2010s. The income account balance shifted from -0.7% in 2000 to 1.2% in 2024, while the share of GDP decreased by 1.9 percentage points.

KDI projects that the trend of increasing overseas investment will continue. A decline in the domestic working age population is expected to slow labor input, reducing the profitability of domestic capital and prompting further expansion of Net Overseas Investment.

While it is not possible to restrict overseas investments that help offset declines in national income, KDI emphasizes the need to boost domestic economic productivity. The institute calls for ongoing economic structural reforms, such as creating an environment where promising innovative firms can enter the market and marginal companies can exit.

Kyucheol Jung, a research fellow at KDI, stated, "If capital continues to flow overseas and domestic productivity remains low, economic vitality will be significantly undermined." He added, "To improve overall productivity, it is necessary to reform seniority-based and discriminatory wage systems between regular and non-regular workers, and to make the labor market more flexible, rather than focusing solely on individual capabilities."

skjung@fnnews.com Jung Sang-geun Reporter