KOSPI Surpasses 4,200 for the First Time Ever: Samsung Electronics and SK hynix Reach Milestones

- Input

- 2025-11-03 14:30:12

- Updated

- 2025-11-03 14:30:12

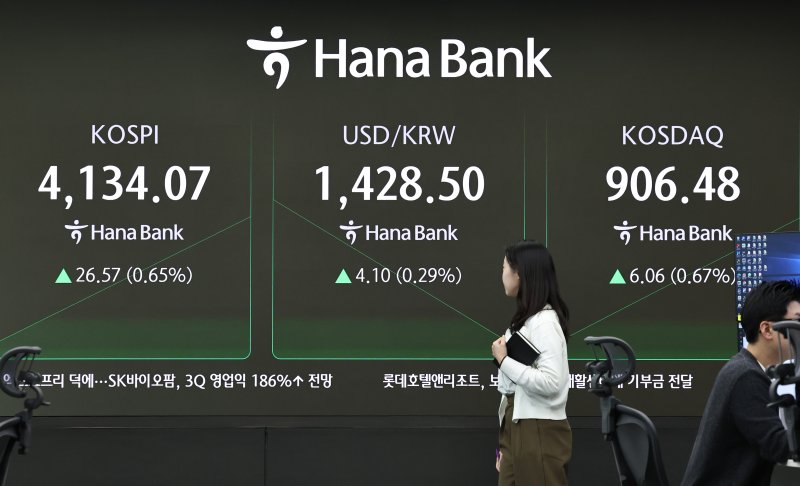

The Korea Composite Stock Price Index (KOSPI) has surpassed the 4,200 mark for the first time in history. The index was lifted by Samsung Electronics Co., Ltd. and SK hynix, the two largest companies by market capitalization in Korea, both reaching record highs of 110,000 won and 610,000 won, respectively.

As of 2:25 p.m. on the 3rd, the KOSPI was trading at 4,207.56, up 100.06 points (2.44%) from the previous session. The index opened at 4,123.36, a 0.39% increase from the previous close, and continued to climb throughout the afternoon, reaching an intraday high of 4,216.93.

In the main stock market, individual investors purchased 906.5 billion won worth of shares, further boosting the index. Foreign investors and institutions sold 761.9 billion won and 137.9 billion won, respectively. In the KOSPI futures market, foreign investors recorded a net purchase of 931.1 billion won.

By sector, electronics (up 5.13%), electric and gas (up 3.92%), and manufacturing (up 3.22%) showed strong gains, while transportation and storage (down 2.98%), construction (down 2.92%), and textiles and apparel (down 1.99%) declined.

Among the top market cap stocks, Samsung Electronics Co., Ltd. and SK hynix both hit new highs, trading at 110,800 won (up 3.07%) and 618,000 won (up 10.55%) from the previous session.

Other gainers included Doosan Enerbility (up 0.23%), Hanwha Aerospace (up 6.33%), and HD Hyundai Heavy Industries Co., Ltd. (up 0.67%). In contrast, Hyundai Motor (down 0.17%) and Kia Corporation (down 1.67%) declined.

The KOSPI surpassed the 4,200 mark for the first time ever as domestic and international securities firms continued to raise their target prices for Korean semiconductor stocks. Key sectors such as semiconductors, electrical equipment, shipbuilding, and defense are all showing strength.

On this day, SK Securities Co., Ltd. set a target price of 1 million won for SK hynix. The firm explained that with the advent of the AI era, the semiconductor industry paradigm is shifting from 'build first, receive orders later' to 'receive orders first, build later,' and that company valuations should be assessed using the price-to-earnings ratio (PER).

Lee Jae-won, a researcher at Shinhan Securities Co., Ltd., stated, "Jensen Huang, CEO, provided upward momentum to the domestic stock market in November, and large-cap stocks such as SK hynix, power equipment, and shipbuilding continue to perform strongly. As many industrial sector earnings announcements are scheduled for today, attention should be paid to whether positive earnings estimate revisions will continue alongside IT."

At the same time, the Korean Securities Dealers Automated Quotations (KOSDAQ) index was trading at 911.98, up 11.56 points (1.28%) from the previous session. The index opened at 906.19, a 0.64% increase from the previous close.

In the KOSDAQ market, individuals and institutions recorded net sales of 229.2 billion won and 10.3 billion won, respectively, while foreign investors purchased 278.6 billion won worth of shares.

nodelay@fnnews.com Ji-yeon Park Reporter