Tax Audit Launched into Corporations Linked to 'Cambodia Scam'... "Strict Response to Tax Evasion"

- Input

- 2025-11-03 11:00:00

- Updated

- 2025-11-03 11:00:00

[Financial News] The National Tax Service (NTS) has launched a full-scale tax investigation into domestic corporations implicated in the Cambodia scam. The probe will cover not only the local bases of Cambodian corporations but also domestic individuals who gained illicit profits through these operations, with a focus on tax evasion.

On the 3rd, the NTS stated, "We will closely cooperate with relevant agencies to ensure the recovery of criminal proceeds," and added, "We will take strict action against those suspected of tax evasion related to scam crimes."

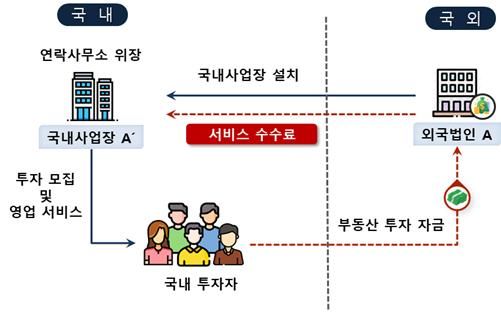

According to the NTS, Foreign Corporation A established an overseas real estate investment consulting firm in a commercial district of central Seoul, hiring sales staff and executives to conduct business domestically. However, it disguised itself as a simple liaison office and failed to report business income and withhold taxes on employee salaries.

Company A solicited investments ranging from tens of millions to hundreds of millions of won per person from domestic investors and remitted these funds overseas. As there was no evidence of actual real estate acquisitions, authorities suspect the funds were illicitly transferred abroad under the pretense of overseas real estate investment.

Through its tax investigation into Foreign Corporation A and its employees, the NTS plans to collect unpaid taxes and, if criminal connections are confirmed, will cooperate with relevant agencies to recover criminal proceeds sent overseas.

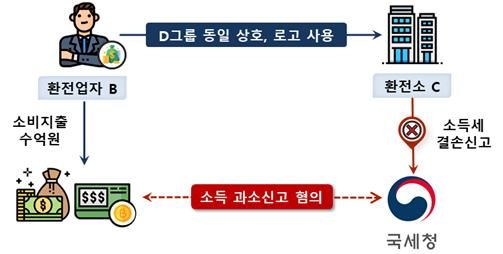

The NTS has also initiated an investigation into Operator B, who is believed to have ties to Huiyuan Group, a foreign financial group suspected of illegal money laundering. B is accused of underreporting income by minimizing the reported performance of the exchange office.

The NTS will focus on verifying whether exchange commission income was concealed during this investigation and will thoroughly track exchange transactions to scrutinize any links to illegal money laundering and related crimes.

At a briefing, Ahn Deok-su, Director of Investigation at the NTS, stated, "We have launched tax audits into domestic branches of Cambodian criminal organizations, money laundering financial firms, and currency exchange offices." He added, "We will rigorously verify the nature and legitimacy of overseas remittances and investigate tax evasion by tracking exchange transactions."

Director Ahn emphasized, "If criminal connections are confirmed, we will recover criminal proceeds through prosecution and, if necessary, escalate to criminal tax investigations. Income derived from international scam crimes will be thoroughly traced and collected as taxes."

imne@fnnews.com Hong Ye-ji Reporter