US-Korea Tariff Deal Makes 1% Growth Rate Visible This Year... Export and Exchange Rate Variables Remain

- Input

- 2025-11-02 15:16:29

- Updated

- 2025-11-02 15:16:29

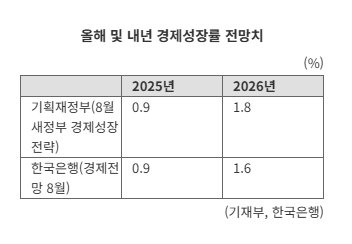

Expectations are rising that the conclusion of the United States–Korea Tariff Negotiations, which had been weighing on the economy, will have a positive impact on growth. Tariffs on automobile exports, which were relatively unfavorable compared to the European Union (EU) and Japan, have now been equalized, and the stock market is also expected to benefit, leading to a recovery in private consumption. As a result, some predict that this year's growth rate could reach 1%, and next year's could hit 2%. Previously, in August, the government forecasted 0.9% growth for this year and 1.8% for next year.

Tariff Negotiations, the Main Obstacle to Growth, Have Passed

On the 2nd, both the government and industry projected that the settlement of the United States–Korea Tariff Negotiations would lead to an upward revision of the economic growth rate. According to the Bank of Korea (BOK) and the Ministry of Economy and Finance, Korea's Gross Domestic Product (GDP) grew by 1.2% in the third quarter compared to the previous quarter. The growth rates for the first and second quarters were -0.2% and 0.7%, respectively. Therefore, if the fourth quarter records a quarter-on-quarter growth of -0.1% to 0.3%, the annual growth rate could reach 1%.Recently, Rhee Chang-yong, Governor of the BOK, stated during a parliamentary audit, "The likelihood of this year's economic growth rate exceeding 1% has increased." Koo Yun-cheol, Deputy Prime Minister and Minister of Economy and Finance, noted, "The easing of export uncertainty to the US will help Korean companies expand into the American market." Kim Jung-kwan, Minister of Trade, Industry and Energy, also explained, "The uncertainty that had constrained exports will be largely resolved as the targets and timing of tariff reductions become clearer." According to the BOK, the detailed settlement of this tariff negotiation is expected to prevent a 0.04 percentage point decrease in this year's growth rate.

There are also forecasts that next year's growth could reach 2%. Some securities firms and foreign investment banks have raised their growth projections for next year. Samsung Securities revised its forecast from 2.0% to 2.2%, while Korea Investment & Securities increased its estimate from 1.8% to 1.9%. Among foreign investment banks, Goldman Sachs raised its projection for next year's growth rate to 2.2%.

Juwon, Head of Economic Research at Hyundai Research Institute (HRI), commented, "The government's projection of 1.8% growth for next year is realistic, but considering the conclusion of the United States–Korea Tariff Negotiations and the recovery in private consumption, there is room for upward adjustment. This is also why foreign investment banks are forecasting growth in the 2% range."

Variables Remain: Exchange Rate and Export Impact Still Uncertain

Although the detailed settlement of the United States–Korea Tariff Negotiations has sent a positive signal for growth, exports and exchange rates are still expected to be variables. If the tariff deal, which had been a factor in the strong dollar, leads to a weaker won, the price competitiveness of exports may decline, potentially reducing demand in the US market.

Export conditions differ by product, as 50% tariffs on steel and aluminum remain in place, which limits export improvement. Fundamentally, the US base tariff of 15% and the restructuring of the global trade order continue to pose risks for exports.

According to export-import trends in October, exports to the US—which are directly affected by tariffs—fell 16.2% to $8.71 billion (about 12.46 trillion won) among the nine major export regions. Although monthly export growth has been positive for five consecutive months since June, the US remains an obstacle.

There are also concerns that investments in the US could become a fiscal burden for the government. Of Korea's $350 billion US investment package, $200 billion must be invested in cash in the US. The government plans to use foreign exchange reserves to cover these cash investment costs, but if returns on foreign assets are insufficient, issuing government-guaranteed bonds could increase the fiscal burden. This would constrain the government's fiscal resources, especially under its expansionary fiscal policy.

Sangha Yoon, a research fellow at the Korea Institute for International Economic Policy (KIEP), remarked, "Among the components of GDP, facility investment is the most volatile. The conclusion of this negotiation offers the greatest potential for increase in this area." He added, "For exports, rather than improved conditions for automobiles, the reduction of tariffs to 15% now allows Korea to compete on equal footing with Germany and Japan." He further noted, "If returns on foreign assets are poor, this could lead to a fiscal burden."

junjun@fnnews.com Choi Yong-jun, Hong Ye-ji Reporter