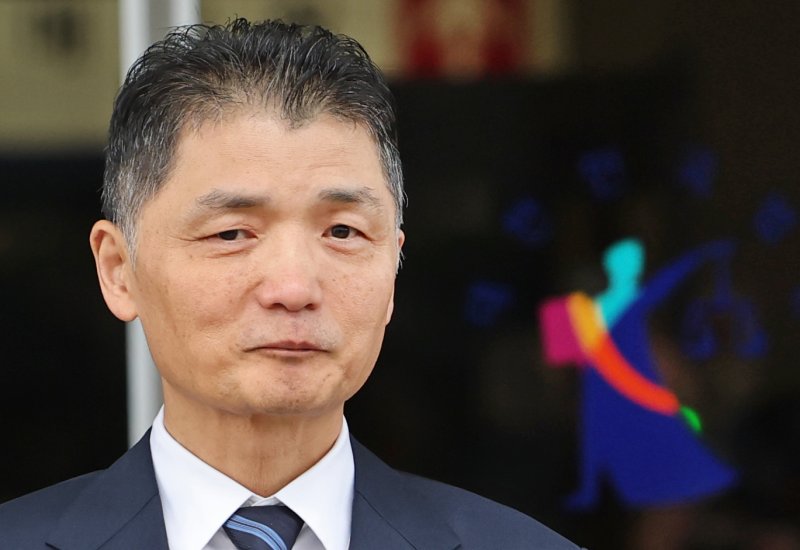

Background to Kim Beom-soo’s Acquittal? "No Intent to Manipulate Stock Prices"... Prosecution Expected to Appeal

- Input

- 2025-10-21 15:20:05

- Updated

- 2025-10-21 15:20:05

[Financial News] On the 21st, the Seoul Southern District Court acquitted Kim Beom-soo, head of the Future Initiative Center at Kakao Corporation, of charges related to manipulating the stock price of SM Entertainment. The court found it difficult to conclude that there was an intent to manipulate prices during the stock transactions and determined that there was no absolute necessity for Kakao to acquire SM at the time. The court also took the unusual step of sharply criticizing the prosecution’s investigation, describing it as "pressure." However, as the court’s decision diverged significantly from the prosecution’s arguments and sentencing request, a legal battle is likely to continue in the appeals process.

The 15th Criminal Division of the Seoul Southern District Court, presided over by Judge Yang Hwan-seung, stated at the sentencing hearing for Kim, who was charged with violating the FSCMA, "Kakao’s large-scale on-market purchases of SM shares during Hybe’s public tender offer period cannot be deemed price manipulation solely because they affected the stock price."

The court noted that the timing and intervals of Kakao’s purchase orders differed from those typically associated with manipulative trading. It concluded that there was insufficient evidence to prove an intent to artificially fix the price above the normal market level.

The court also pointed out that, even after Hybe’s tender offer period ended, there were market expectations that SM’s share price would continue to rise. The judges found the defendants’ statements credible, asserting that Kakao’s stock purchases were aimed at securing shares, not manipulating prices.

The court explained, "When examining the order ratios, timing, and purchase points, there are significant differences from typical manipulative trades." It added, "Even after reviewing specific high-priced purchase orders and those aimed at securing shares, the prosecution’s evidence is insufficient to establish price manipulation."

The court further determined that Kakao was not in a position where it absolutely had to acquire SM. "While it is true that Kakao considered acquiring management control of SM, it is difficult to conclude that the situation necessitated such an acquisition," the court stated. "The prosecution’s claim of a covert takeover is not convincing."

Regarding the prosecution’s assertion that Kim Beom-soo instructed his team to "acquire management control peacefully," the court noted, "No one present at the investment meeting on that day recalls hearing such a statement." The court added, "Given Kim’s passive stance on acquiring SM’s management rights at the February meeting, even if such a remark was made, it likely meant to negotiate peacefully with Hybe."

The court also found the testimony of Lee Jun-ho, former head of investment strategy at Kakao Entertainment, who was considered a key prosecution witness, to be unreliable. Lee had claimed that Kakao and One Asia Partners conspired to manipulate SM’s stock price.

The court pointed out, "After a separate search and seizure, Lee changed his previous statements during prosecution questioning to support the charges." The court emphasized, "It is notable that he claimed Kakao Entertainment was not involved in price manipulation, while asserting that Kakao was, which is contradictory." The court further noted, "His motivation to testify in line with the investigators’ expectations to avoid prosecution is clear."

The court also criticized the prosecution’s investigative methods. It is rare for a court to openly address the prosecution’s conduct after a verdict. The court stated, "Investigative tactics that pressure suspects or related parties, as seen in this case, can distort the truth and lead to unjust outcomes." The court added, "Regardless of who conducts the investigation, such methods should be avoided in the future."

On the other hand, considering that prosecutors had requested a 15-year prison sentence and a fine of 500 million won for Kim Beom-soo at the sentencing hearing in August, an appeal is highly likely.

During the trial, prosecutors argued, "When defendants collectively accumulate large amounts of shares to artificially raise and fix the price, it unfairly impacts the market and undermines trust in the capital markets." They added, "Strict punishment is necessary to prevent future market disruptions and protect ordinary investors, thereby maintaining a healthy market order."

Kim Beom-soo was indicted on charges of manipulating the price of SM Entertainment shares in February 2023, allegedly to hinder Hybe’s tender offer by keeping the stock price above 120,000 won.

welcome@fnnews.com Jang Yoo-ha Reporter