Over 30,000 Youth Tomorrow Savings Account Members Receive Their First Lump-Sum Payout

- Input

- 2025-10-21 12:00:00

- Updated

- 2025-10-21 12:00:00

The Ministry of Health and Welfare and the Korea Development Institute for Self-Sufficiency and Welfare announced on the 21st that, beginning on the 22nd, they will provide maturity support payments to approximately 33,000 individuals whose Youth Tomorrow Savings Account has reached its first three-year maturity.

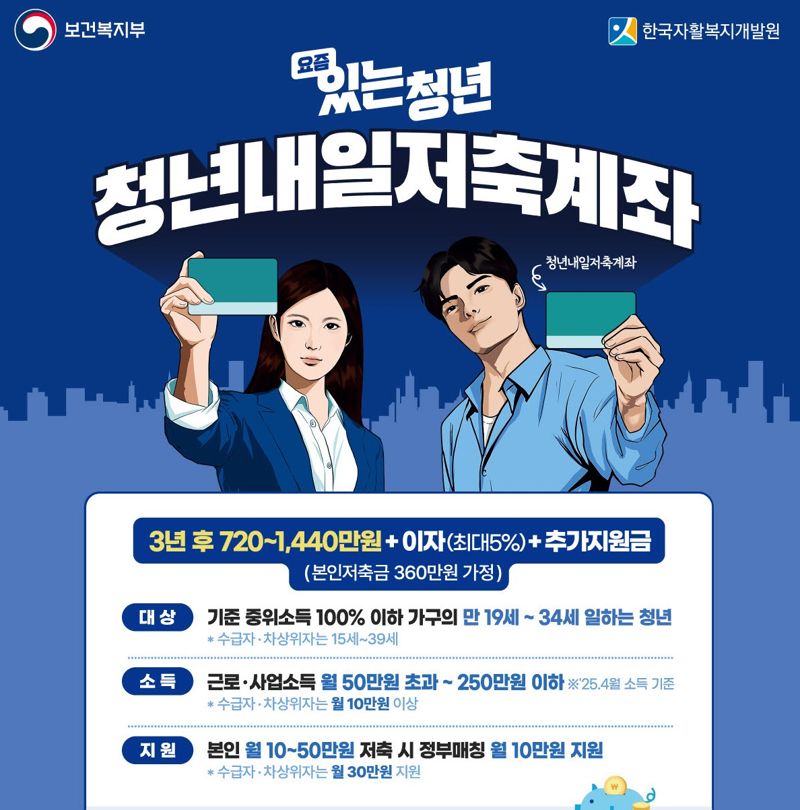

The Youth Tomorrow Savings Account is a flagship government initiative to help young people build assets, launched in 2022. The program aims to support steady saving and the establishment of a stable financial foundation for working low-income youth.

Eligible youth—those with earned or business income and at or below 100% of the median income—can save between 100,000 and 500,000 won per month, with the government matching up to 300,000 won monthly.

After three years, participants can receive their own savings, accrued interest (with an annual interest rate of up to 5%), and government support totaling up to 10.8 million won.

Tailored financial education is also provided for those closing their accounts at maturity.

Since April this year, basic asset management education and one-on-one financial counseling services have been offered at Metropolitan Self-Sufficiency Centers nationwide.

The Ministry of Health and Welfare believes the Youth Tomorrow Savings Account program plays a positive role in helping low-income youth build assets and achieve independence, and plans to expand support.

Bae Gyeong-taek, Welfare Policy Director at the Ministry of Health and Welfare, stated, "The maturity support payment for the Youth Tomorrow Savings Account is the result of young people's consistent efforts combined with government support. We will continue to provide backing so that youth can use this payout as a stepping stone to plan for a better future and realize their potential."

A Ministry of Health and Welfare survey on the program's outcomes revealed that youth experienced positive changes in areas such as household finances, employment, and housing.

Participants increased their total income, enabling them to pay off debts. They also improved their financial literacy by managing income and expenses independently.

The program's impact was especially notable in employment. The proportion of regular and full-time workers and the rate of enrollment in the four major insurance programs increased, leading to greater job stability. Earned income also rose steadily.

In terms of housing, the proportion of participants living in owned or long-term lease housing also increased steadily.

Kim Sou-hwan, Director of Self-Sufficiency Policy at the Ministry of Health and Welfare, commented, "Based on the results of the panel survey, we will analyze the program's outcomes and strengthen asset-building support systems and tailored financial education to meet the diverse needs of youth."

Since the 13th, the Ministry of Health and Welfare has been accepting maturity closure applications online via the Bokjiro Portal and at Eup, Myeon, Dong Administrative Welfare Centers. Participants can receive their savings, interest, and government support. Detailed application procedures and required documents are available on the Korea Development Institute for Self-Sufficiency and Welfare website and the Bokjiro Portal.

skjung@fnnews.com Jung Sang-geun Reporter