[fn Editorial] France’s Fiscal Crisis and Credit Downgrade: A Warning That Hits Close to Home

- Input

- 2025-10-20 18:05:25

- Updated

- 2025-10-20 18:05:25

This comes just a month after Fitch Ratings, Inc. also lowered France’s credit rating. The French government’s austerity budget, intended to reduce one of the highest fiscal deficits in the European Union (EU), was blocked by political opposition and public backlash, fueling concerns over a growing fiscal crisis.

The fact that credit rating agencies are issuing consecutive negative assessments of France, the world’s seventh-largest economy, indicates that the fiscal crisis is becoming increasingly unmanageable. France accumulated a welfare burden in the 1980s and 1990s by expanding pension and social security benefits, while politicians, mindful of elections, repeatedly postponed necessary reforms. As a result, public debt has reached 113% of GDP and the fiscal deficit stands at a critical 5.8%.

In contrast to France, the Kingdom of Sweden achieved sustainable welfare by improving government spending efficiency through bipartisan reforms. Although Sweden once faced a national default crisis due to banking failures and a real estate bubble, it overcame these challenges with proactive reforms based on social consensus. The reason such Swedish-style reforms are rare among advanced European nations is that it is inherently difficult to reduce welfare benefits once they have been expanded.

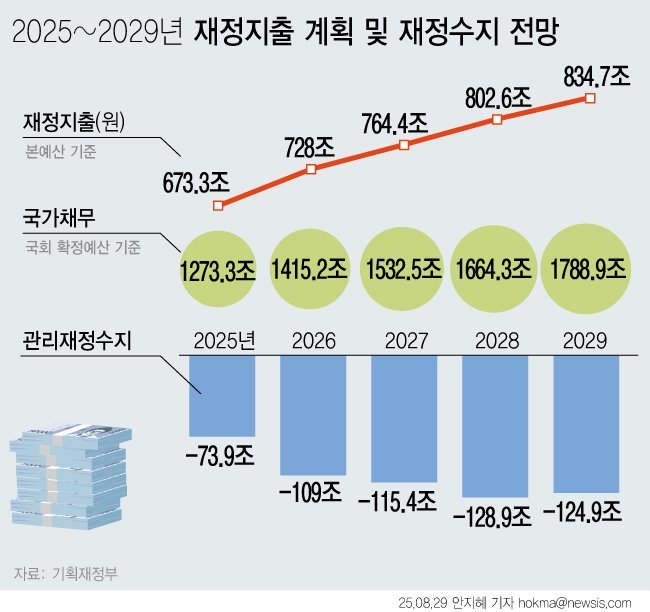

The Republic of Korea (ROK)’s national debt, including the liabilities of non-profit public institutions, stands at 53% of GDP—about half of France’s level. However, this figure alone is no cause for complacency. ROK’s total public debt ratio is the third highest among 11 advanced economies without reserve currencies, and its growth rate is the fastest among non-reserve currency countries. Unlike the United States of America (USA), the Eurozone, or Japan, ROK does not issue a reserve currency, making it harder to secure foreign exchange liquidity. Neglecting debt management and postponing reforms under these circumstances is tantamount to ignoring an imminent 'Gray Rhino' crisis.

In reality, while the government continues to ramp up fiscal spending, it seems to be turning a deaf ear to calls for fiscal reform. At the Council of Economic Ministers meeting on the 20th, Deputy Prime Minister for Economic Affairs Koo Yun-cheol merely highlighted the positive effects of fiscal policy, stating, "Consumption is recovering, aided by policy measures such as consumer coupons for revitalizing livelihoods." While it is important to use fiscal stimulus to boost growth, it is equally crucial to develop a new medium- to long-term plan to moderate spending so as not to excessively burden future generations.

Crises often sound warnings in advance, but once a certain threshold is crossed, they can strike like a tsunami. Even now, the government must set aside political calculations and pursue fundamental reforms such as restructuring welfare and the public sector, improving spending efficiency, and strengthening fiscal rules.

Building a sustainable growth model through structural reform, rather than relying on temporary stimulus driven by debt, is the true path to enhancing national competitiveness.